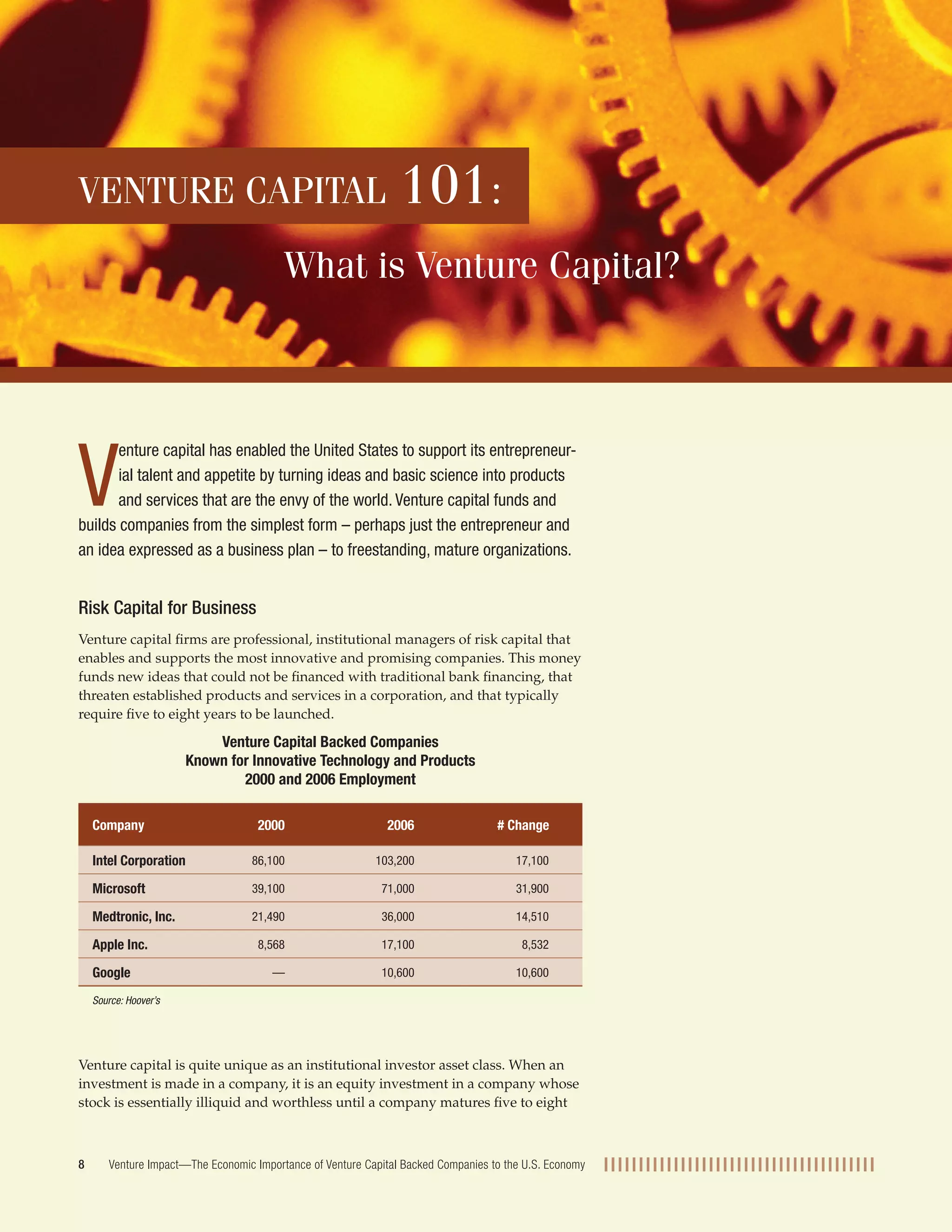

Venture capital funds innovative companies by providing risk capital. It enables entrepreneurs to turn ideas and research into new products and services. Venture capital firms actively support companies over 5-8 years, through multiple funding rounds, as they grow from ideas into mature organizations. While most venture capital investments fail, successes like Intel, Microsoft, and Google that receive venture funding go on to create thousands of jobs and drive innovation. Venture capital has been critical to supporting entrepreneurship in the US and enabling the creation of many innovative technology companies.