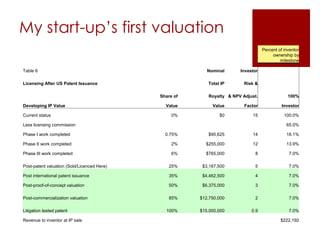

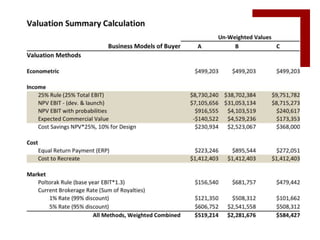

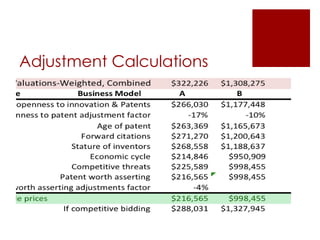

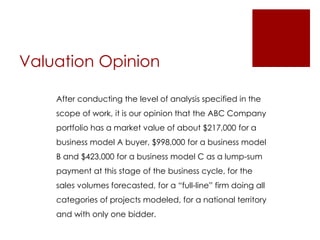

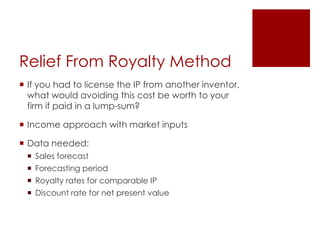

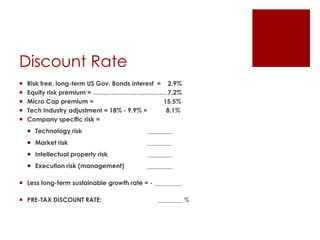

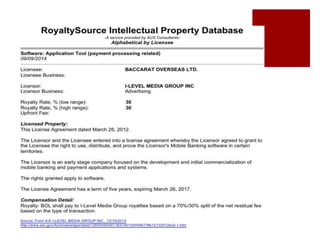

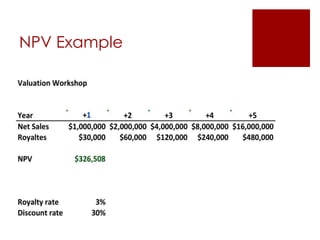

The document outlines a valuation workshop led by Clyde Hanson, focusing on valuing intangible assets, particularly a patented drug product. It discusses methodologies for valuing intellectual property, including licensing, revenue potential, and discount rates, alongside detailed valuation examples for various business models. The document emphasizes the importance of understanding product markets, expected revenues, and potential risks in evaluating a start-up's intangible assets.