This document provides an overview of acquiring the Barbasol brand from its parent company Perio Inc. Key points include:

- Barbasol is well-positioned to capitalize on consumers continuing to buy lower-priced products post-recession.

- Acquiring Perio would obtain Barbasol, which generates 89% of Perio's revenue, as well as other personal care brands.

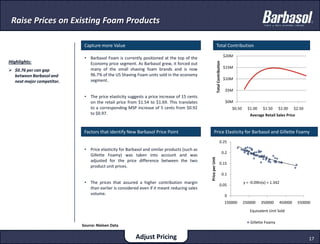

- Recommendations include raising Barbasol foam prices and launching an economy gel product to enter a profitable market segment.

- Valuing Perio at $52.7M currently, the acquisition price range is estimated at $45-68.8M, with an expected 13.6

![Family-oriented operations“The Perio company reflects the values and attitudes that we so cherish here in Ohio.”- U.S. Rep. John BoccieriConsumer Perception of the Company“I was impressed with the fact that the president began the groundbreaking ceremony with prayer. That's an indication of the type of company they are and will be.”“[The speech given by the CEO o Perio at the grounding of the new Ohio factory was] impressive and I hope is a true indication of how the company is run.”New Barbasol Factory"This is a family-oriented operation and a great place to work." Source: Ashville Times Gazette. Barbasol press release: May 25, 2010Organizational StructureSenior management team is vertically-oriented](https://image.slidesharecdn.com/finalpitchbookteamc2-13058451271132-phpapp02-110519174745-phpapp02/85/Integrated-Project-Pitch-Book-18-320.jpg)

![“It [Original Barbasol] is effective and priced the way a daily use product should be priced: reasonably.”](https://image.slidesharecdn.com/finalpitchbookteamc2-13058451271132-phpapp02-110519174745-phpapp02/85/Integrated-Project-Pitch-Book-30-320.jpg)