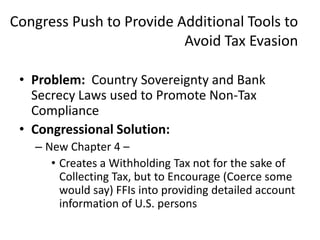

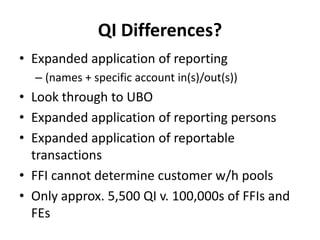

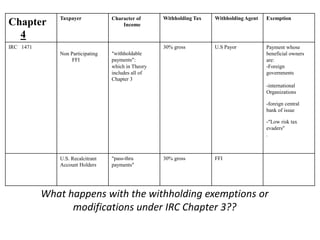

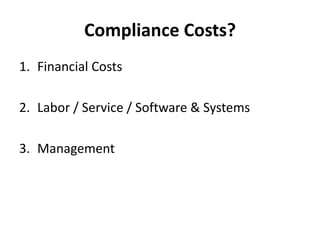

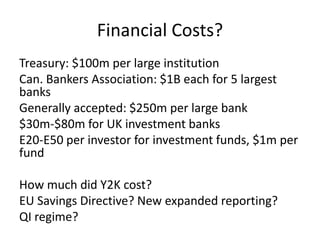

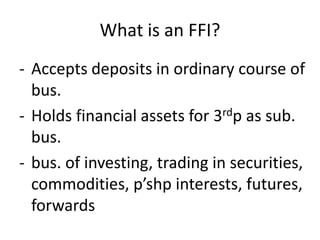

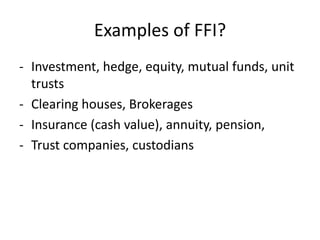

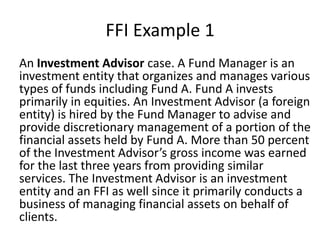

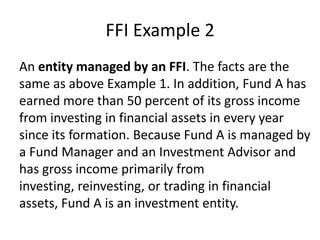

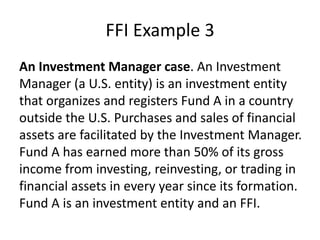

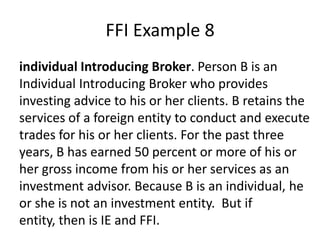

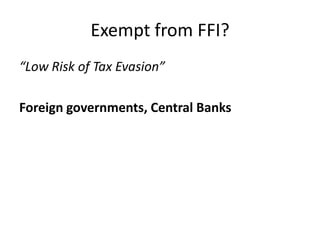

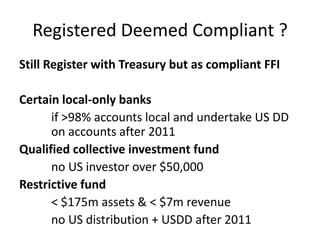

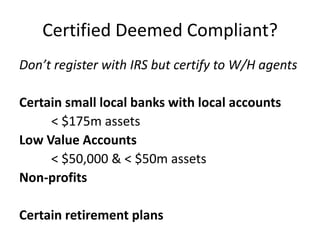

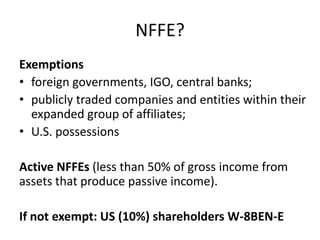

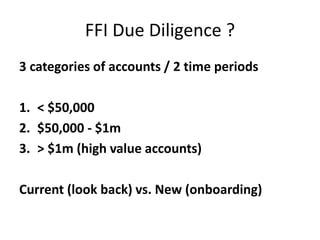

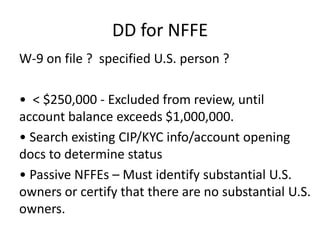

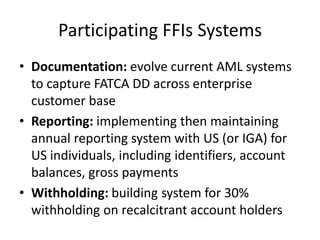

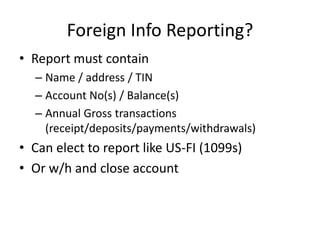

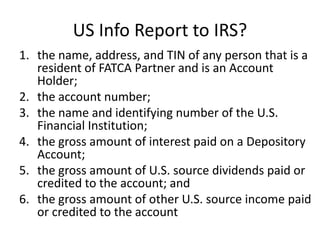

This document discusses the requirements and challenges of FATCA compliance for foreign financial institutions and entities. It provides examples of different types of entities that would be considered FFIs, such as investment funds, insurance companies, and trusts managed by financial institutions. It also discusses exemptions from FFI status, such as foreign governments and registered deemed compliant entities. Implementation of FATCA poses significant financial and operational challenges for covered entities in modifying systems and processes to comply with new reporting and withholding requirements.

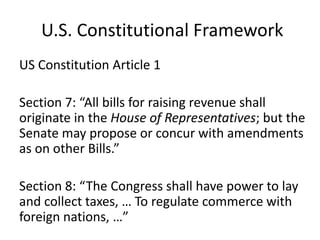

![Art 26 expansion

[1] Information for Non-Tax Purposes

[2] Groups of Taxpayers

[3] Reasonable Possibility of Relevancy](https://image.slidesharecdn.com/uvawinter2014fatcaandeoi-140122152921-phpapp02/85/Uv-a-winter-2014-fatca-and-eoi-6-320.jpg)

![U.S. Constitutional Framework

• Constitution Article 2 , Section 2

He [President] shall have power, by and with

the advice and consent of the Senate, to

make treaties, provided two-thirds [66%] of

the Senators present concur](https://image.slidesharecdn.com/uvawinter2014fatcaandeoi-140122152921-phpapp02/85/Uv-a-winter-2014-fatca-and-eoi-57-320.jpg)