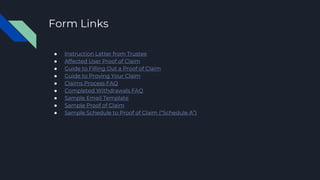

The document outlines the claims process for affected users of the QuadrigaCX cryptocurrency exchange following its bankruptcy, detailing the appointment of Miller Thomson and Ernst & Young as representative counsel. Users were required to submit proof of claims by August 31, 2019, although claims can still be filed afterward without a bar date, with specific instructions provided for submission methods. It also includes guidance on tax responsibilities related to cryptocurrency transactions and information about ongoing communications with representative counsel.