Embed presentation

Download as PDF, PPTX

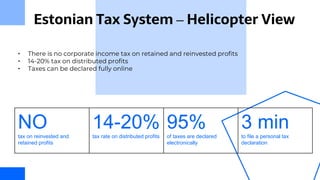

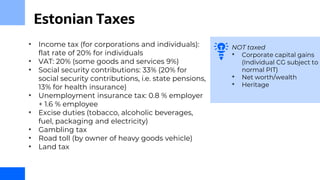

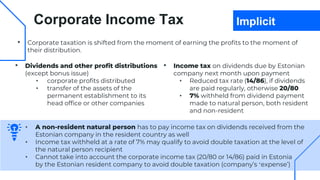

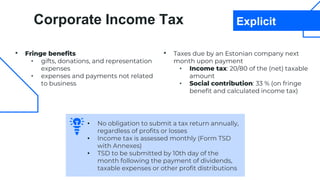

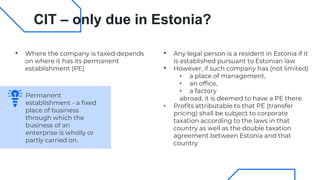

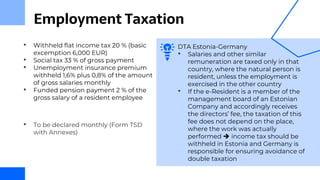

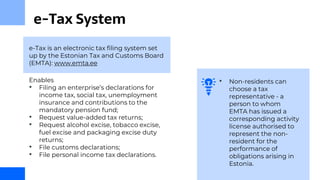

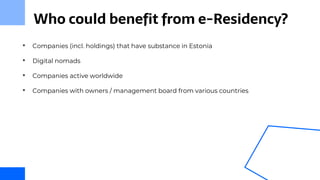

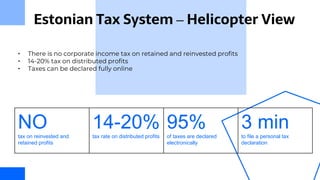

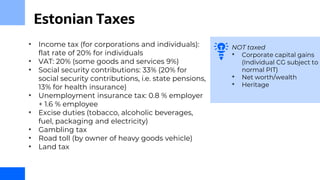

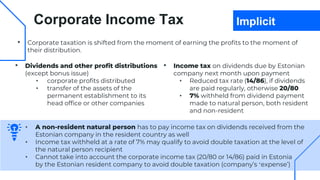

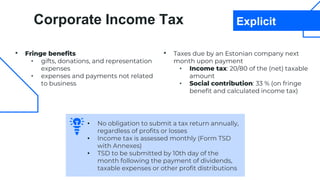

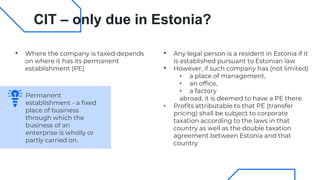

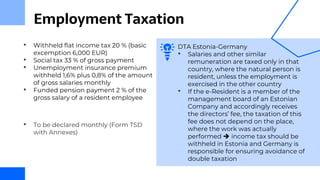

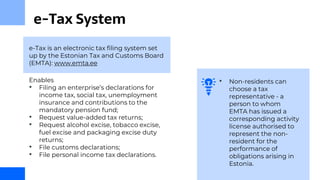

The document outlines the key aspects of Estonia's tax system, including no corporate income tax on retained profits, a 14-20% tax rate on distributed profits, and most taxes being declared electronically. It also discusses Estonia's taxes on income, VAT, social security contributions, and employment, as well as how the tax system applies to e-residents and digital nomads. E-residency allows foreign companies and digital nomads to benefit from Estonia's business-friendly tax system and conduct business online through the e-Tax electronic filing system.