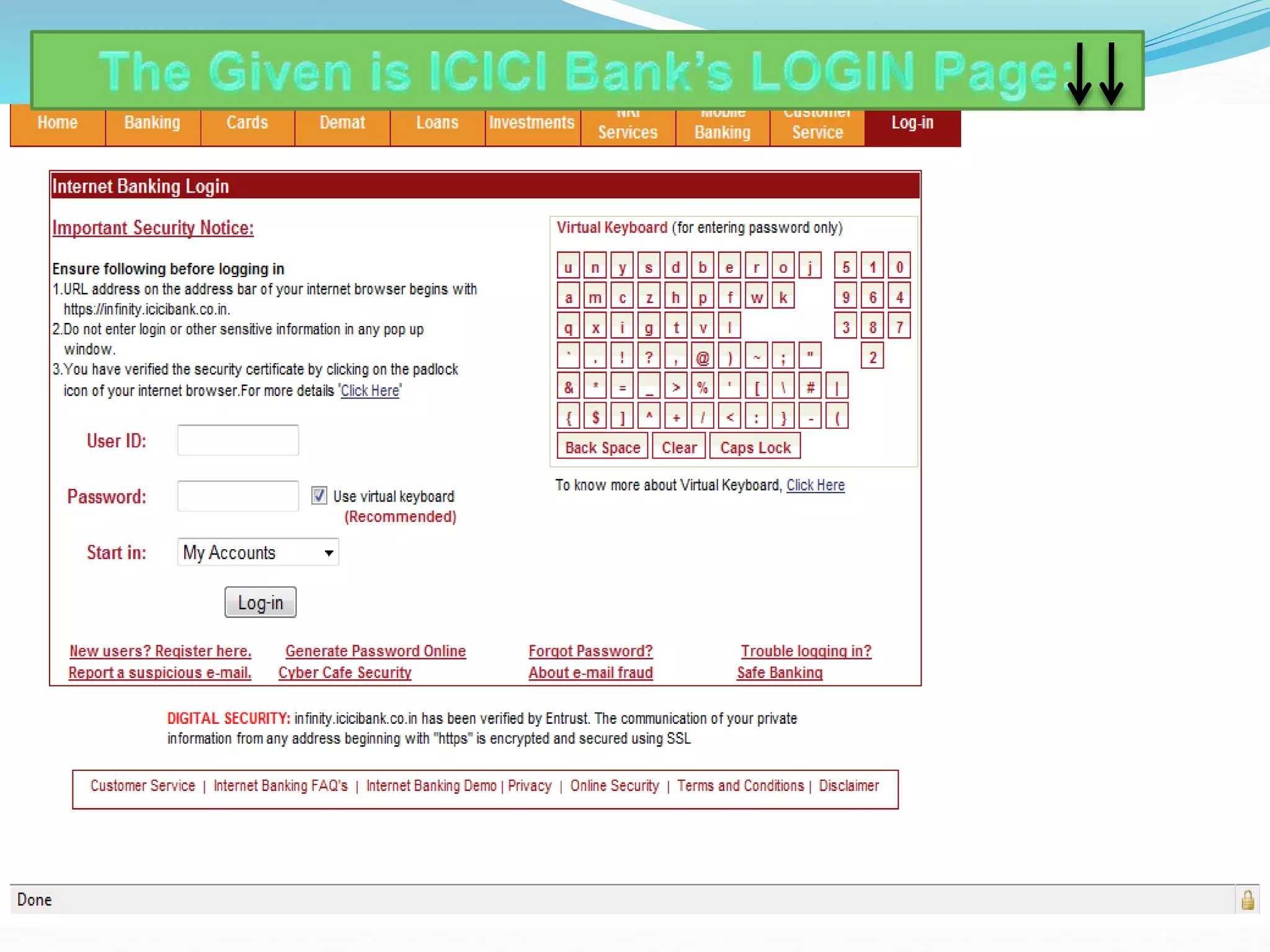

The document outlines various emerging online services, focusing on online banking, insurance, tax services, and utility bill payments. It includes details on how these services work, the types of transactions possible, and step-by-step procedures for using them. Key online banking functions include account management, fund transfers, and security tips for safe online practices.