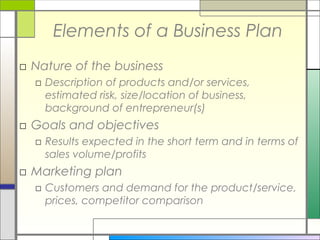

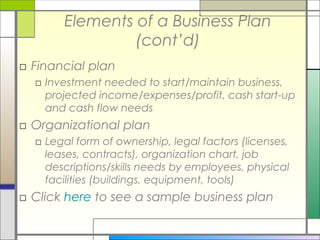

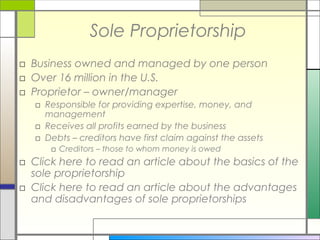

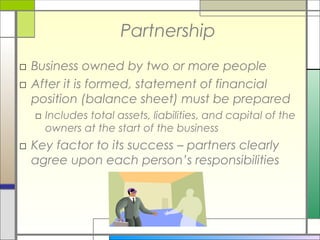

This document discusses sole proprietorships and partnerships as forms of business ownership. It describes key characteristics of entrepreneurs like assuming risk and enjoying independence. It emphasizes the importance of preparing a thorough business plan before starting a venture to lay out goals, risks, and responsibilities. The plan should include details about the business concept, marketing, finances, organization, and facilities. Sole proprietorships are owned and managed by one individual who receives all profits but also assumes all debts. Partnerships involve two or more owners who must agree on responsibilities for the business to succeed.