This document provides an overview of key concepts in Indian income tax law, including:

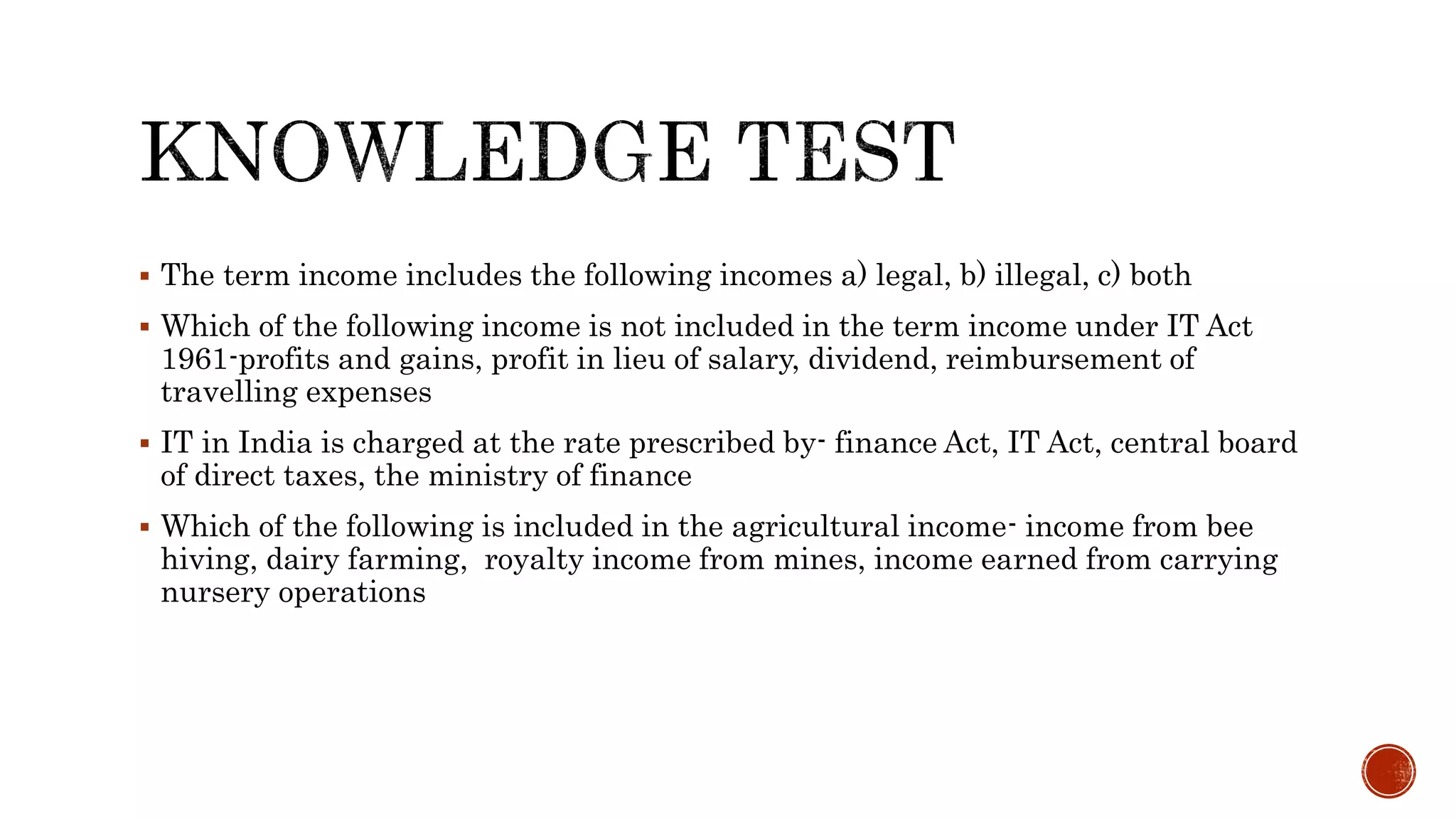

- The main sources of tax law in India such as the Income Tax Act of 1961.

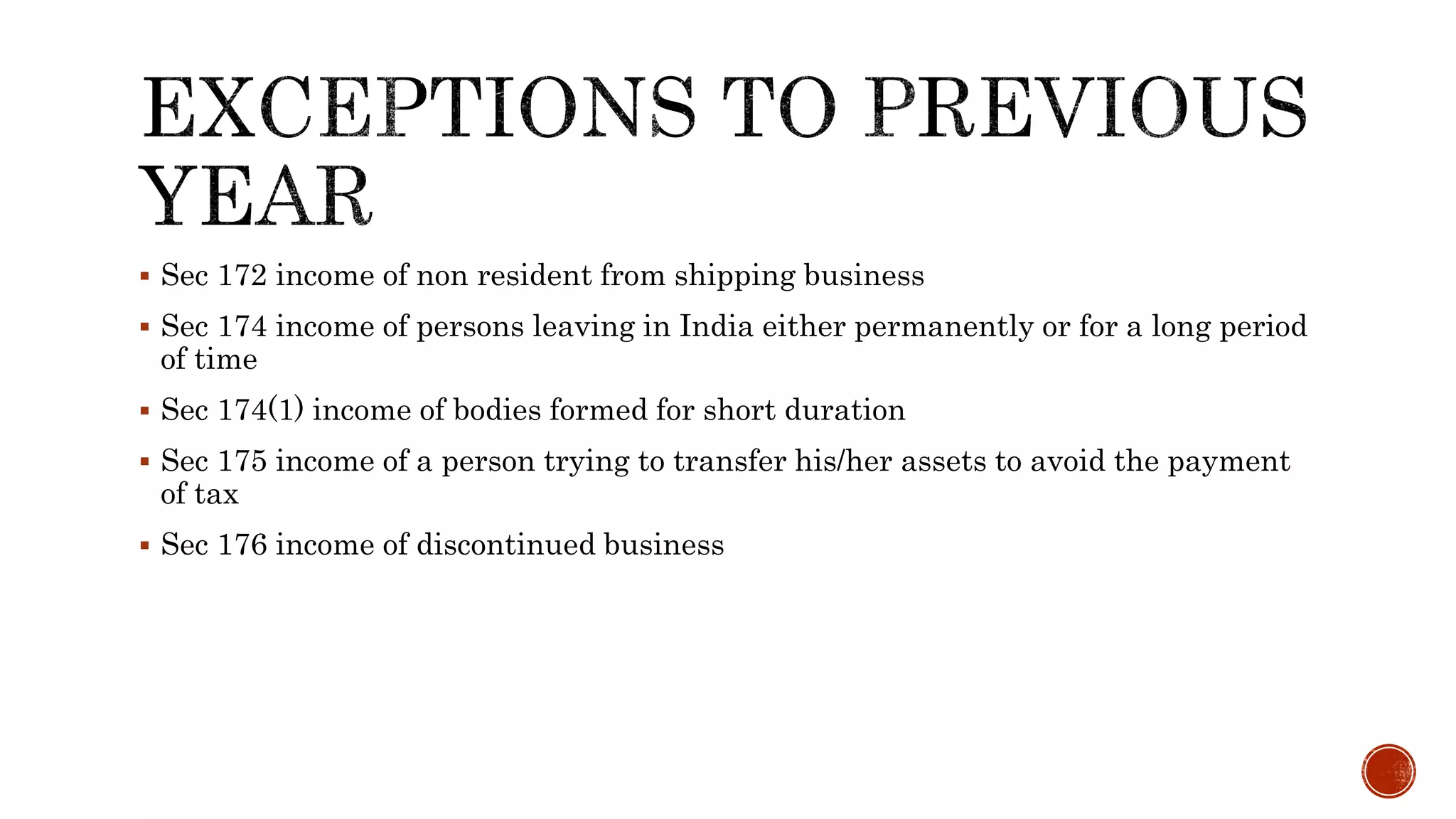

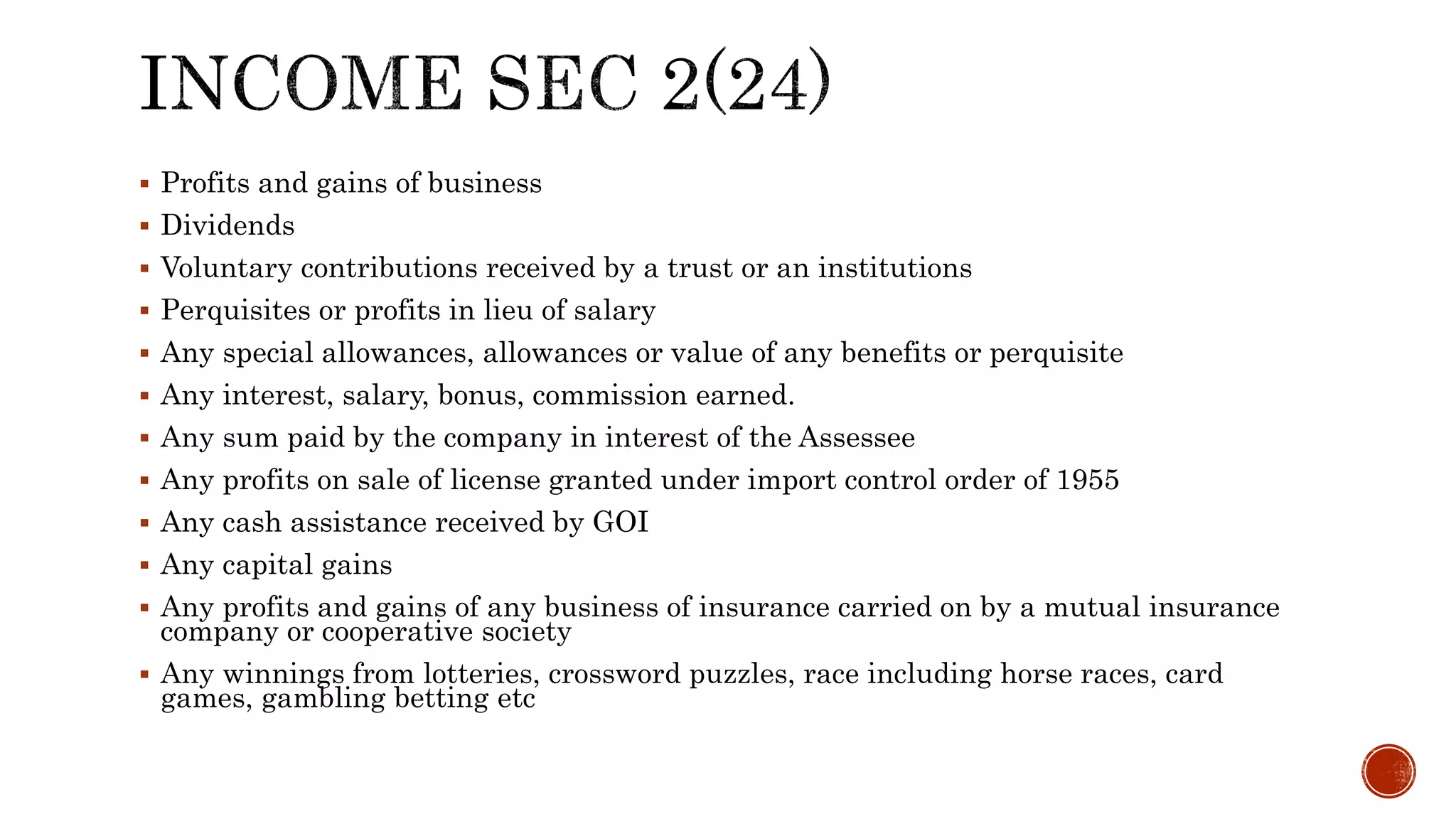

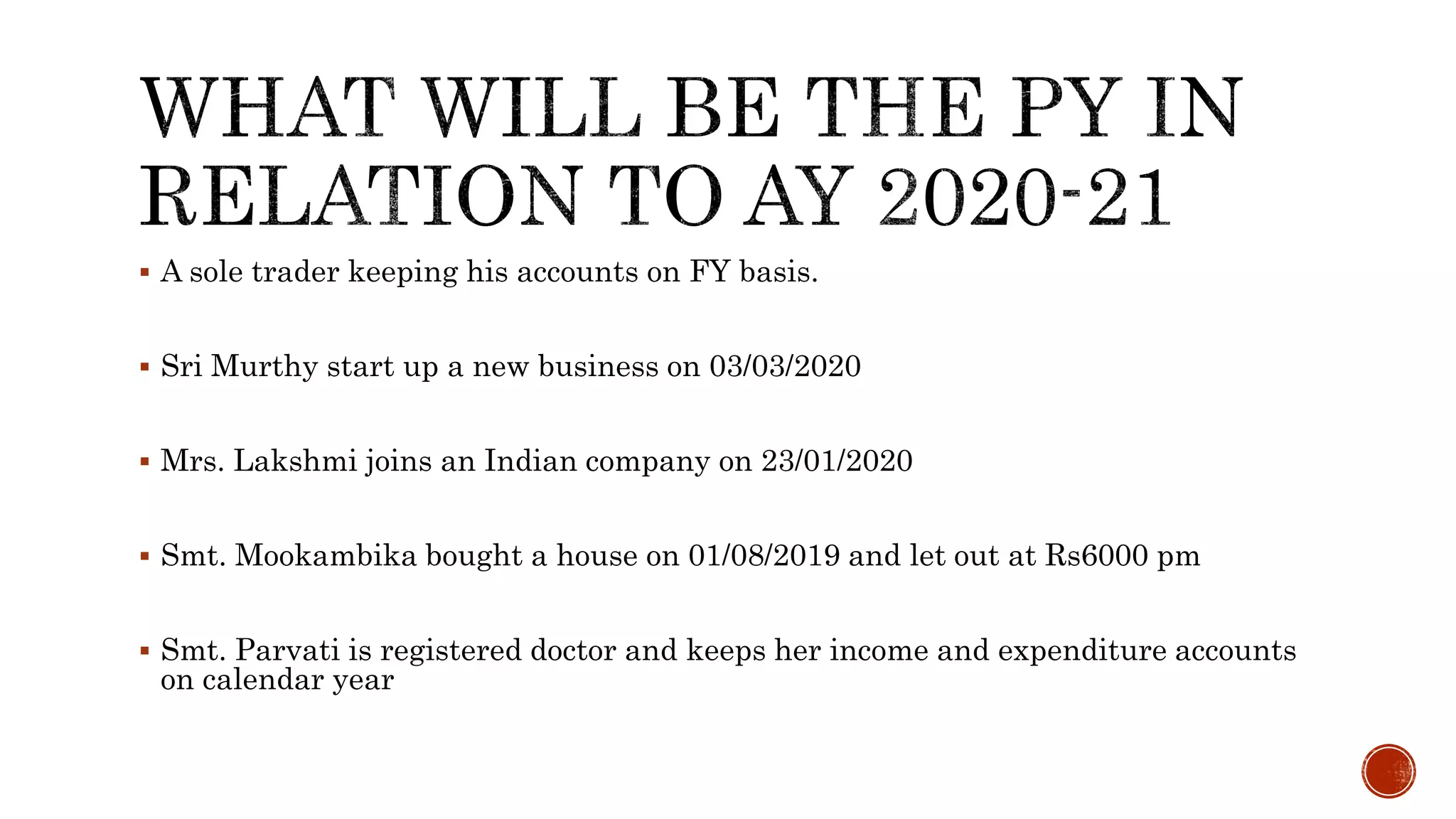

- Definitions of terms like assessee, person, previous year, gross total income.

- The different types of assessees such as individuals, HUFs, companies, etc.

- What constitutes agricultural income and exclusions from total income calculations.

- The different heads of income and process for calculating total income.

- Examples of income that would fall under different sources like salary, business, capital gains.