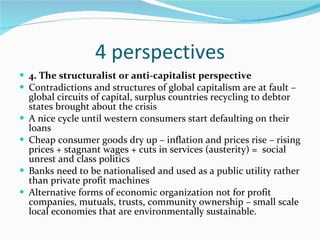

The document discusses different perspectives on the global financial crisis. It first asks where the money went, noting trillions of dollars disappeared from the global financial system. Low interest rates fueled a credit and housing boom until rates rose in 2004, causing defaults. This led to a downward spiral. It then defines a crisis as a critical turning point that leads to change and matters which explanation becomes dominant. Four perspectives are outlined: 1) market fundamentalism blaming government intervention, 2) social democratic regulation arguing neoliberalism went too far, 3) corruption stories of bad actors, and 4) structuralism seeing contradictions in global capitalism as the root cause.