Embed presentation

Download to read offline

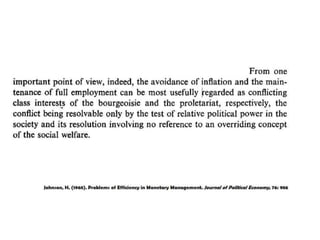

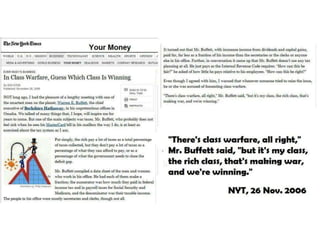

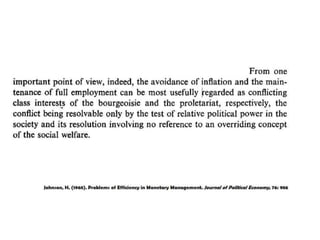

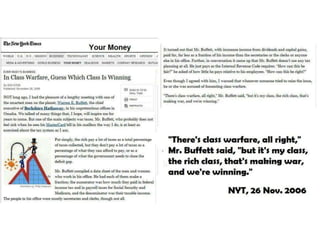

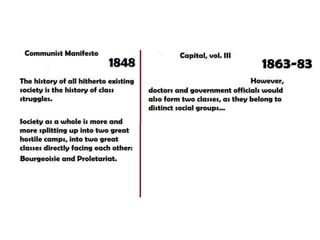

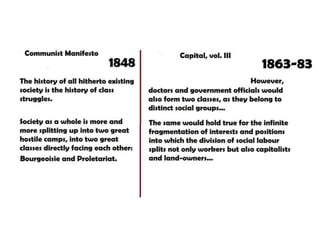

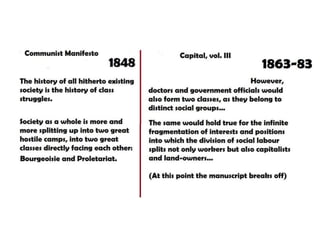

![“What [the wealthy], businesses and

banks share is a common interest in

supporting asset prices, a lack of

interest in seeking full employment

unless it is a prerequisite for

supporting asset prices, and an

aversion to any policies that can

trigger wage inflation.”

Ashwin Parameswares (2011)](https://image.slidesharecdn.com/5-140305095533-phpapp02/85/Irish-Political-Economy-Class-5-Austerity-Tax-Avoidance-and-Privatization-32-320.jpg)

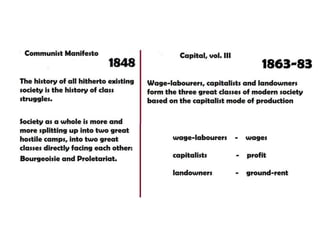

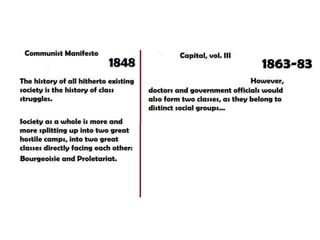

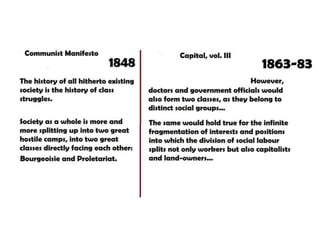

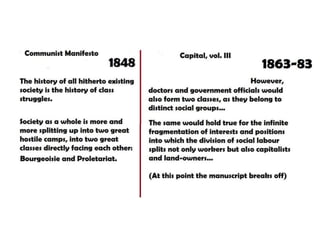

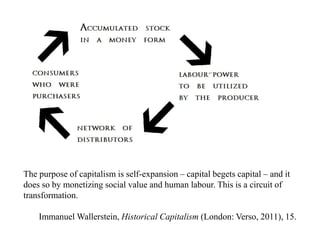

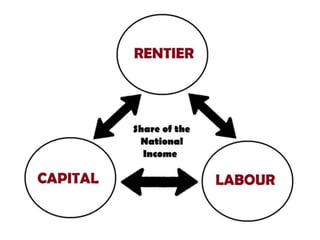

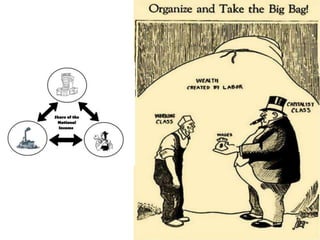

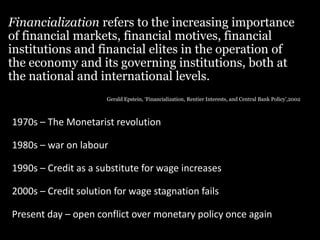

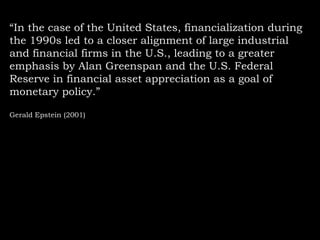

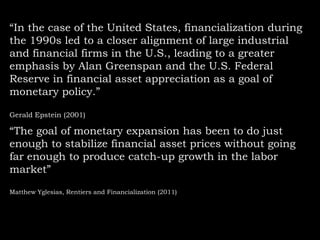

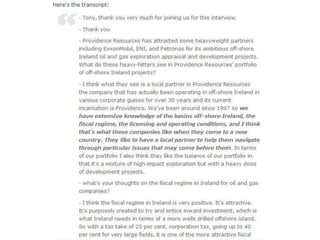

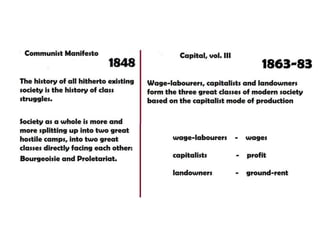

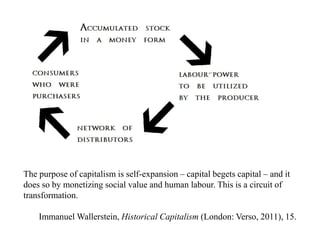

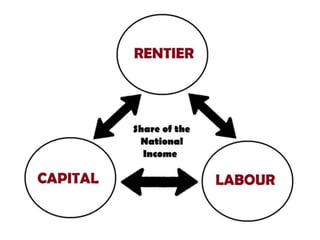

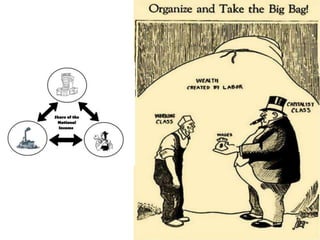

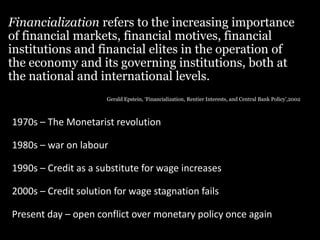

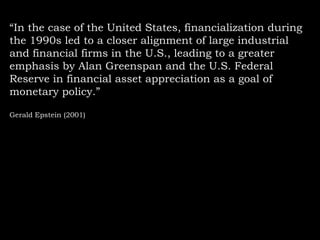

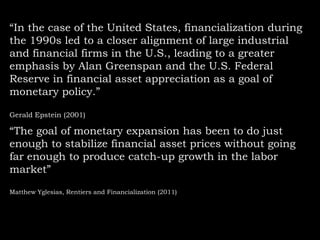

Over the last few decades, capitalism has increasingly prioritized financialization and the mobility of capital over labor. This has led governments and central banks, particularly in the US, to pursue monetary policies aimed at stabilizing financial markets and asset prices rather than achieving full employment or wage growth for workers. The interests of large financial and industrial firms, wealthy individuals, and rentiers have increasingly aligned in support of policies that benefit asset holders over wage earners.

![“What [the wealthy], businesses and

banks share is a common interest in

supporting asset prices, a lack of

interest in seeking full employment

unless it is a prerequisite for

supporting asset prices, and an

aversion to any policies that can

trigger wage inflation.”

Ashwin Parameswares (2011)](https://image.slidesharecdn.com/5-140305095533-phpapp02/85/Irish-Political-Economy-Class-5-Austerity-Tax-Avoidance-and-Privatization-32-320.jpg)