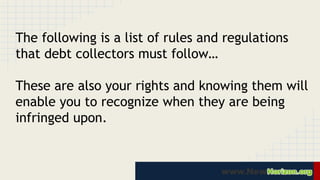

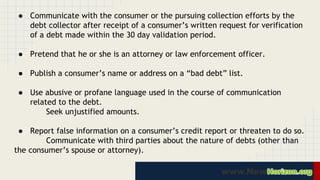

The document outlines consumer rights under the Fair Debt Collection Practices Act, which aims to protect individuals from aggressive debt collection tactics. It lists specific actions that debt collectors are prohibited from taking, such as contacting consumers after they've requested no further communication and using abusive language. Consumers are encouraged to understand and assert their rights to combat potential violations effectively.