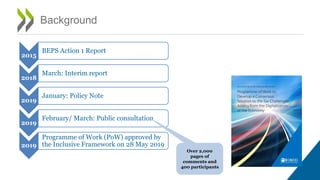

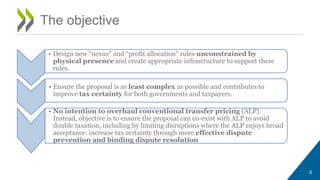

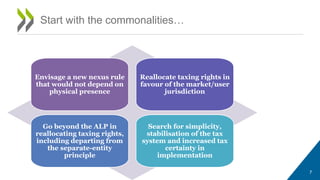

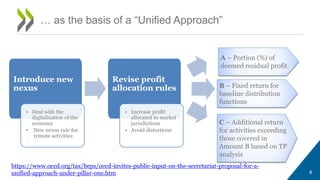

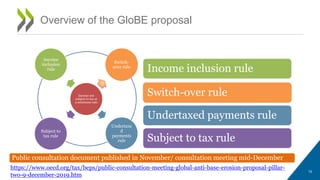

The document discusses the OECD's work on tax and digitalization under Pillars 1 and 2 of the BEPS project. For Pillar 1, the OECD proposes a "Unified Approach" with a new nexus rule not based on physical presence, and revised profit allocation rules that increase profits allocated to market jurisdictions. For Pillar 2, the OECD's "Global Anti-Base Erosion Proposal" includes an income inclusion rule, switch-over rule, undertaxed payments rule, and subject to tax rule to address situations where income is not subject to a minimum rate of tax. The OECD seeks public input on these proposals with the goal of reaching a consensus solution by the end of 2020.