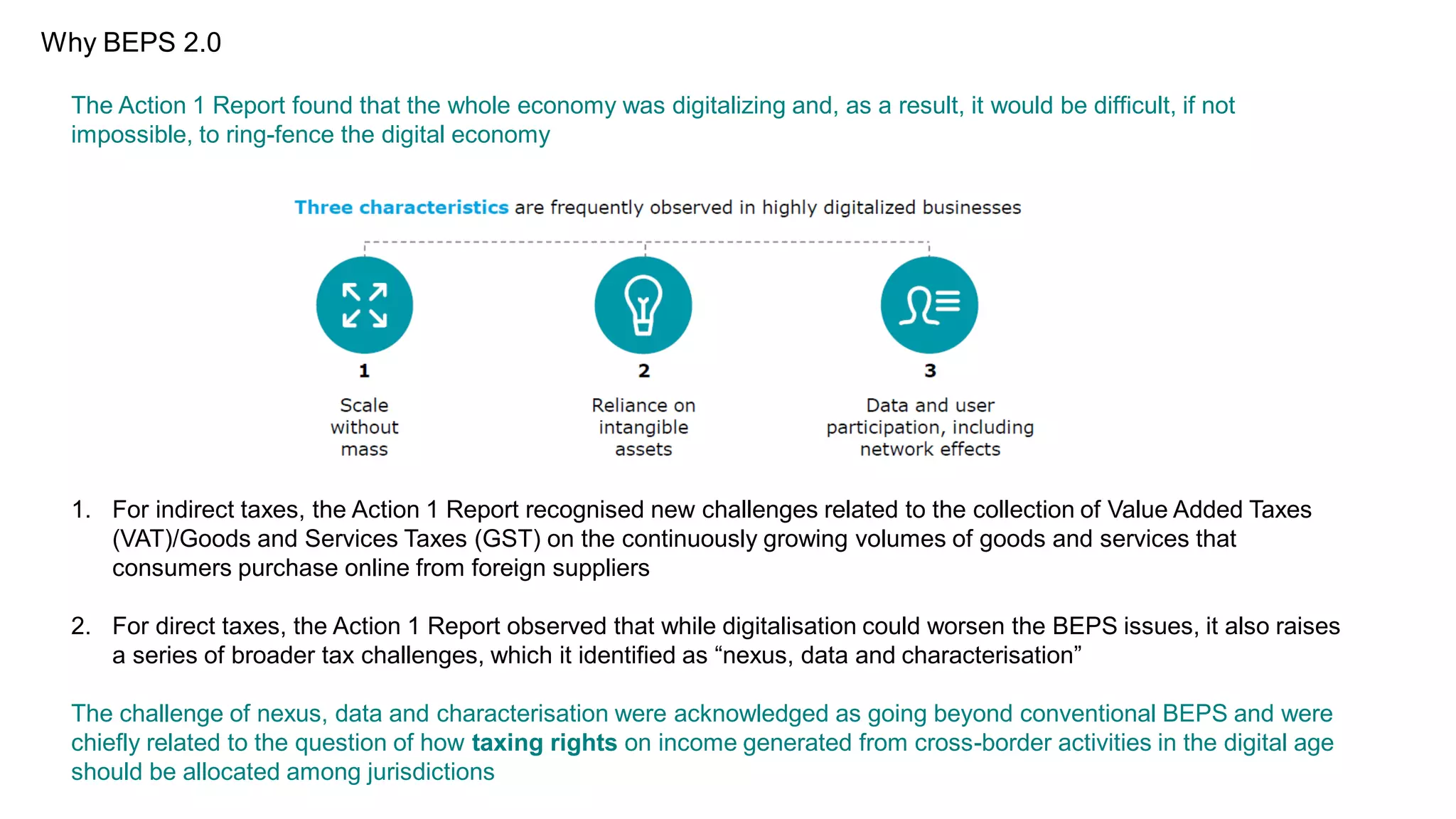

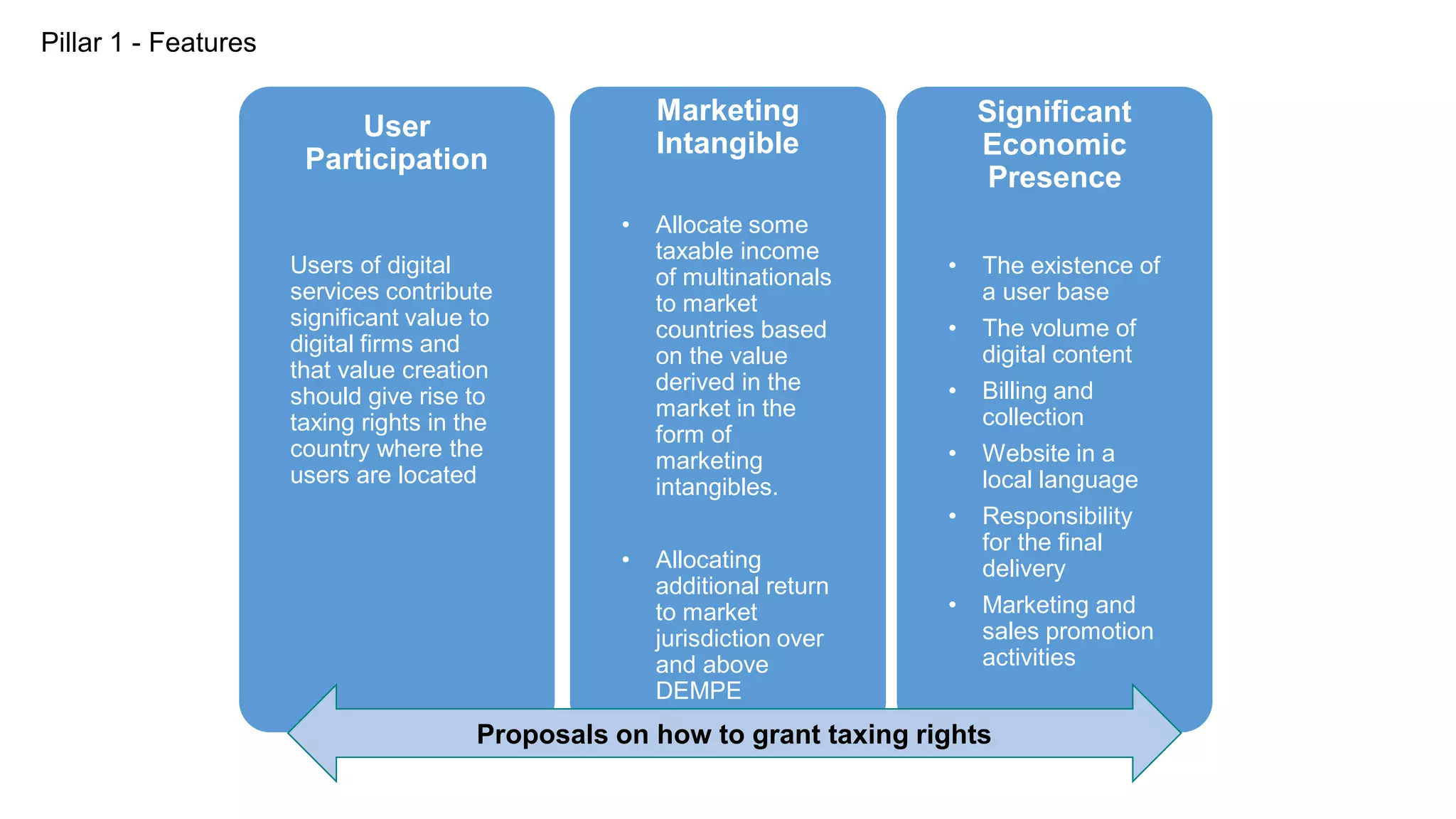

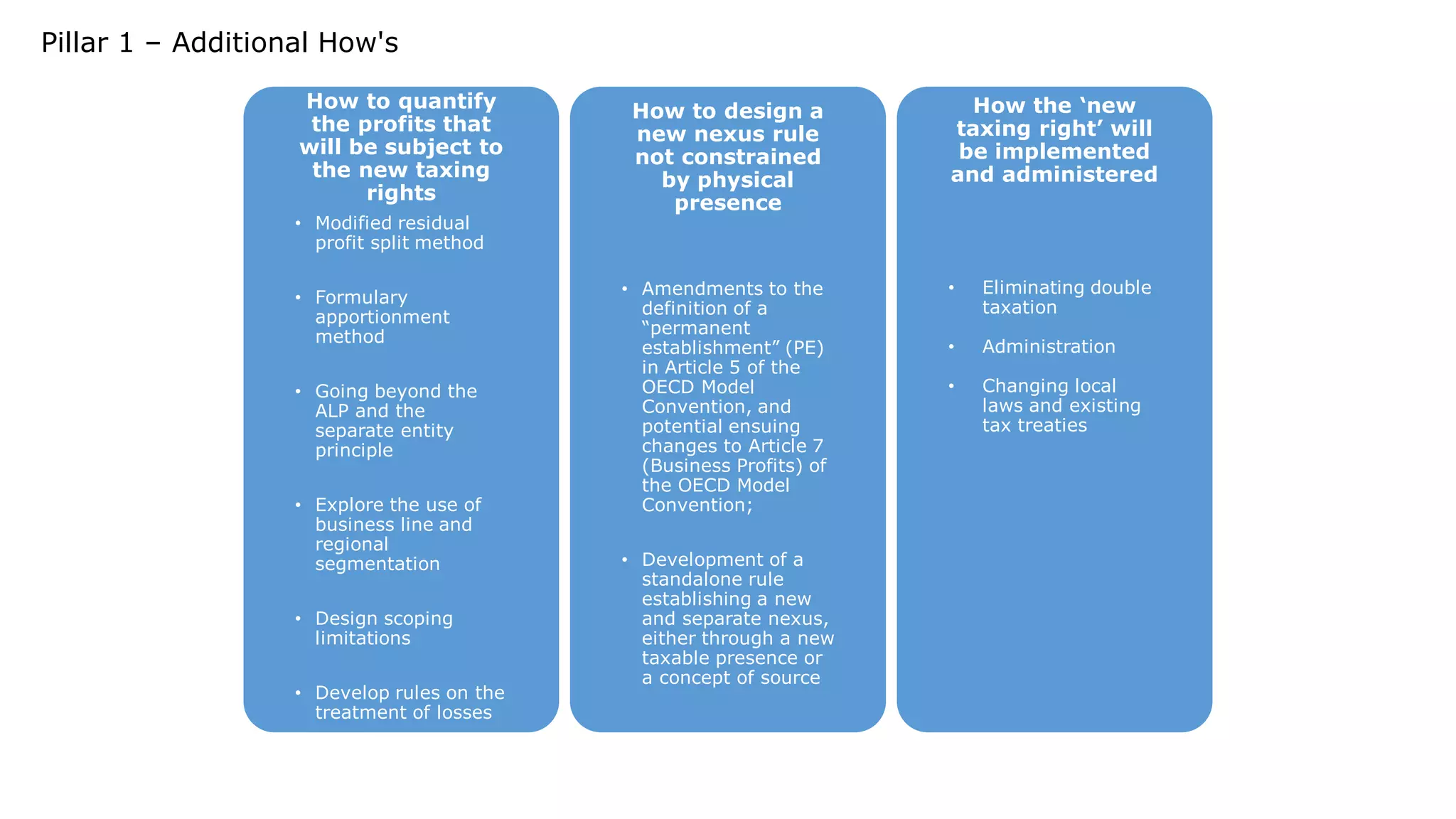

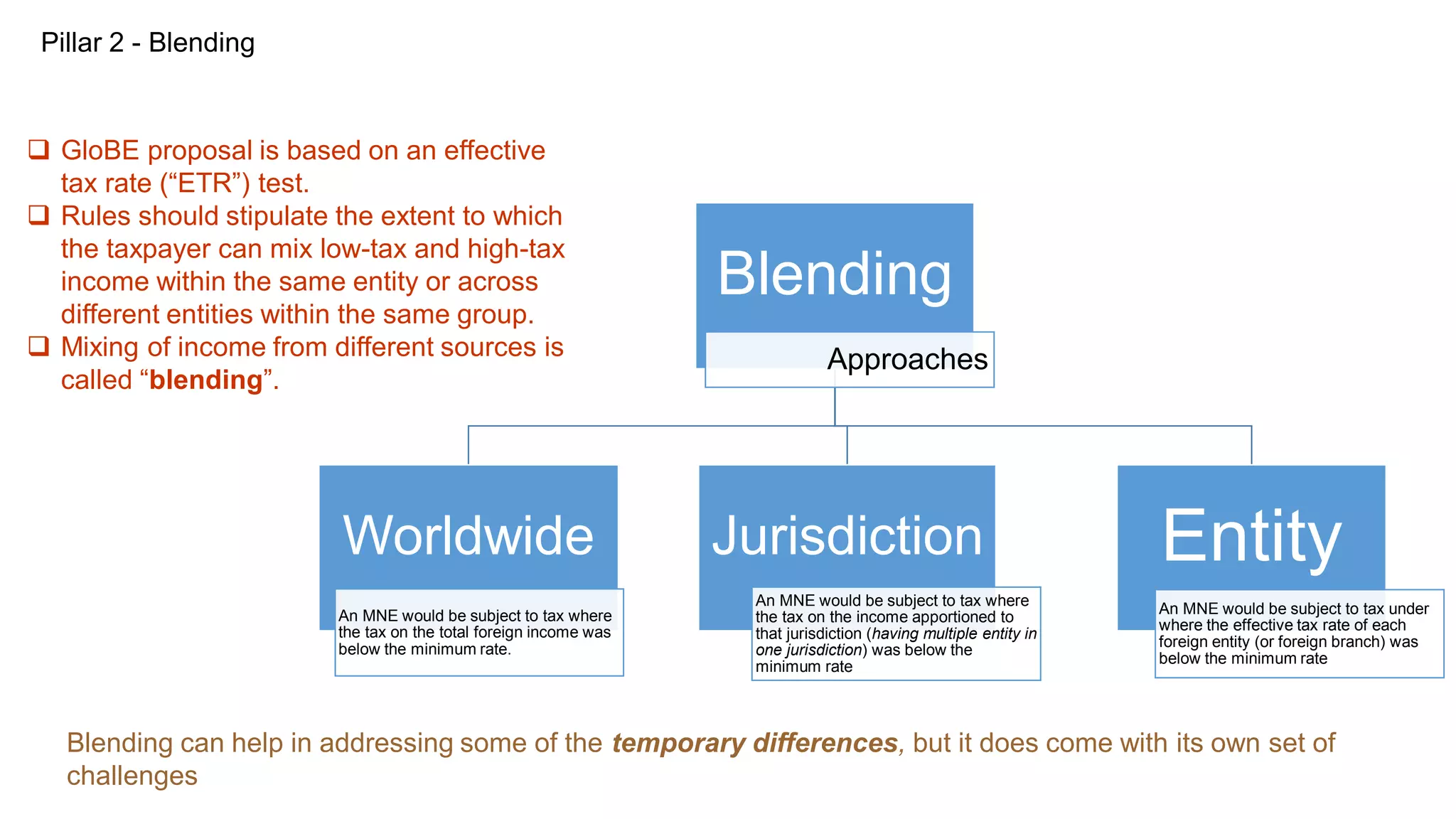

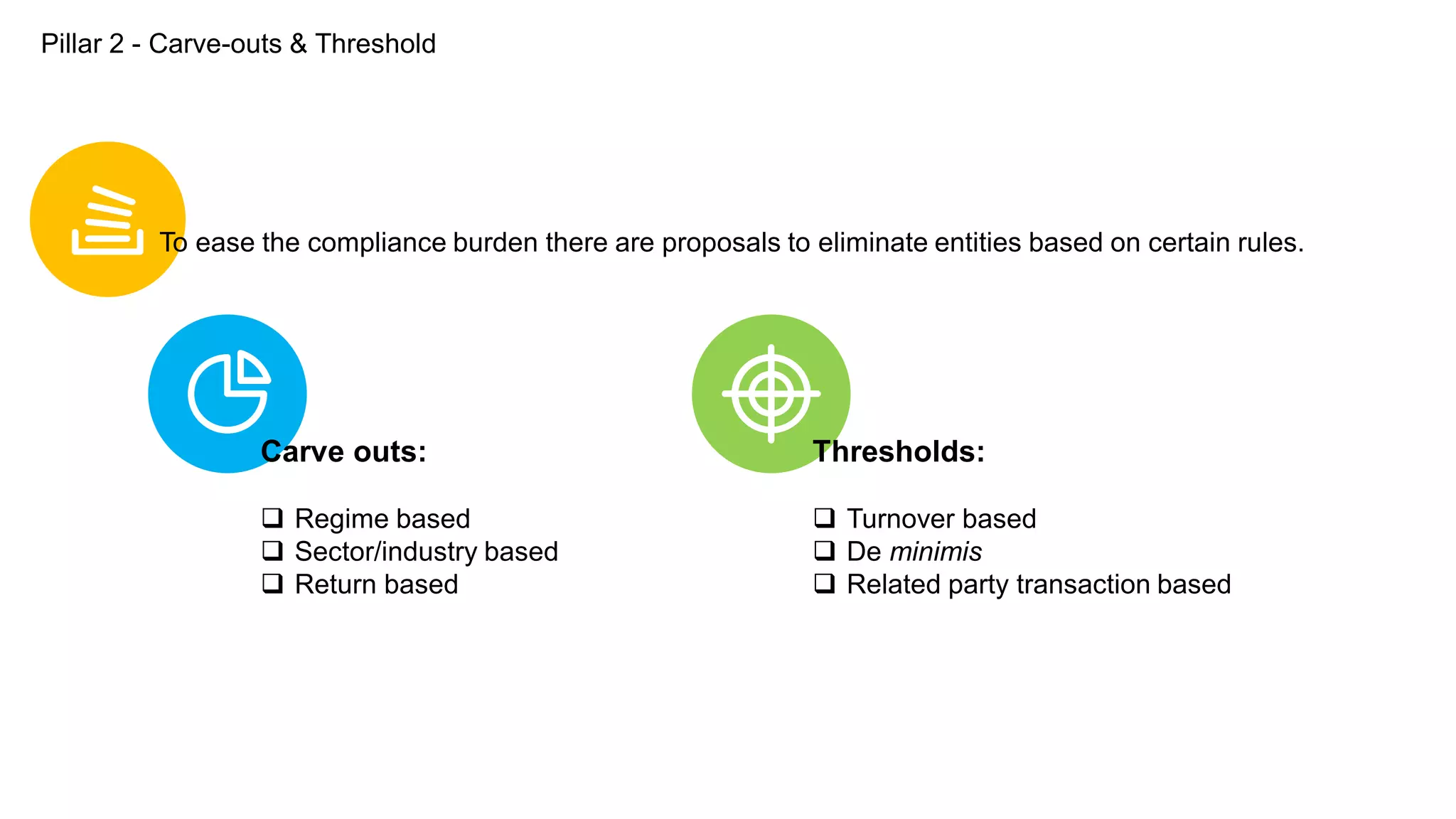

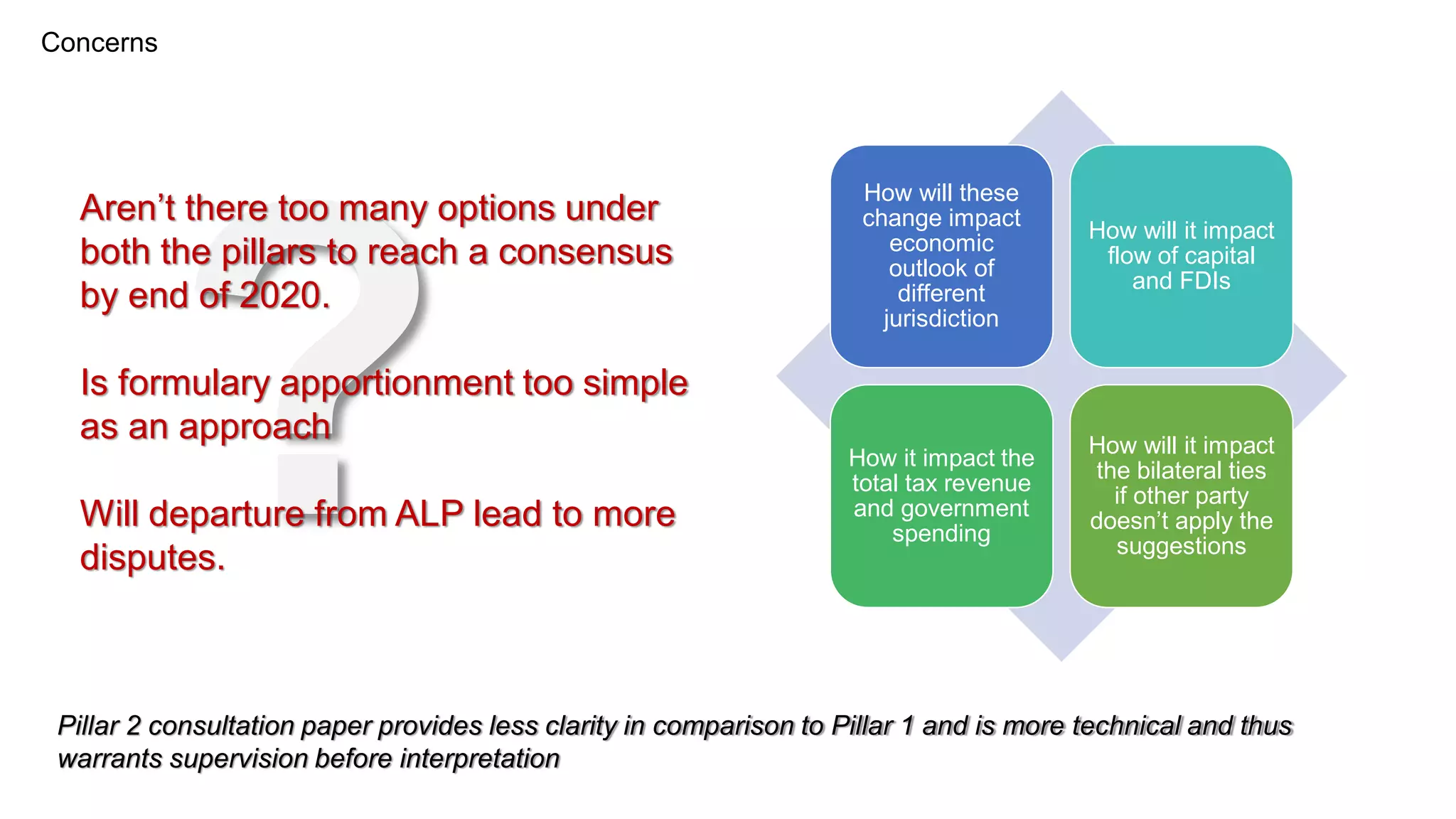

The document discusses the OECD's proposals under Pillars 1 and 2 of the BEPS 2.0 project. Pillar 1 aims to establish a new nexus rule and profit allocation framework to address tax challenges from the digitalization of the economy. It proposes allocating additional taxing rights to market jurisdictions based on factors like user participation and marketing intangibles. Pillar 2 introduces the Global anti-Base Erosion proposal consisting of an income inclusion rule and undertaxed payments rule to ensure a minimum level of taxation. It seeks to limit profit shifting, but countries have concerns around its economic and political impacts as well as challenges reaching consensus by the 2020 deadline.