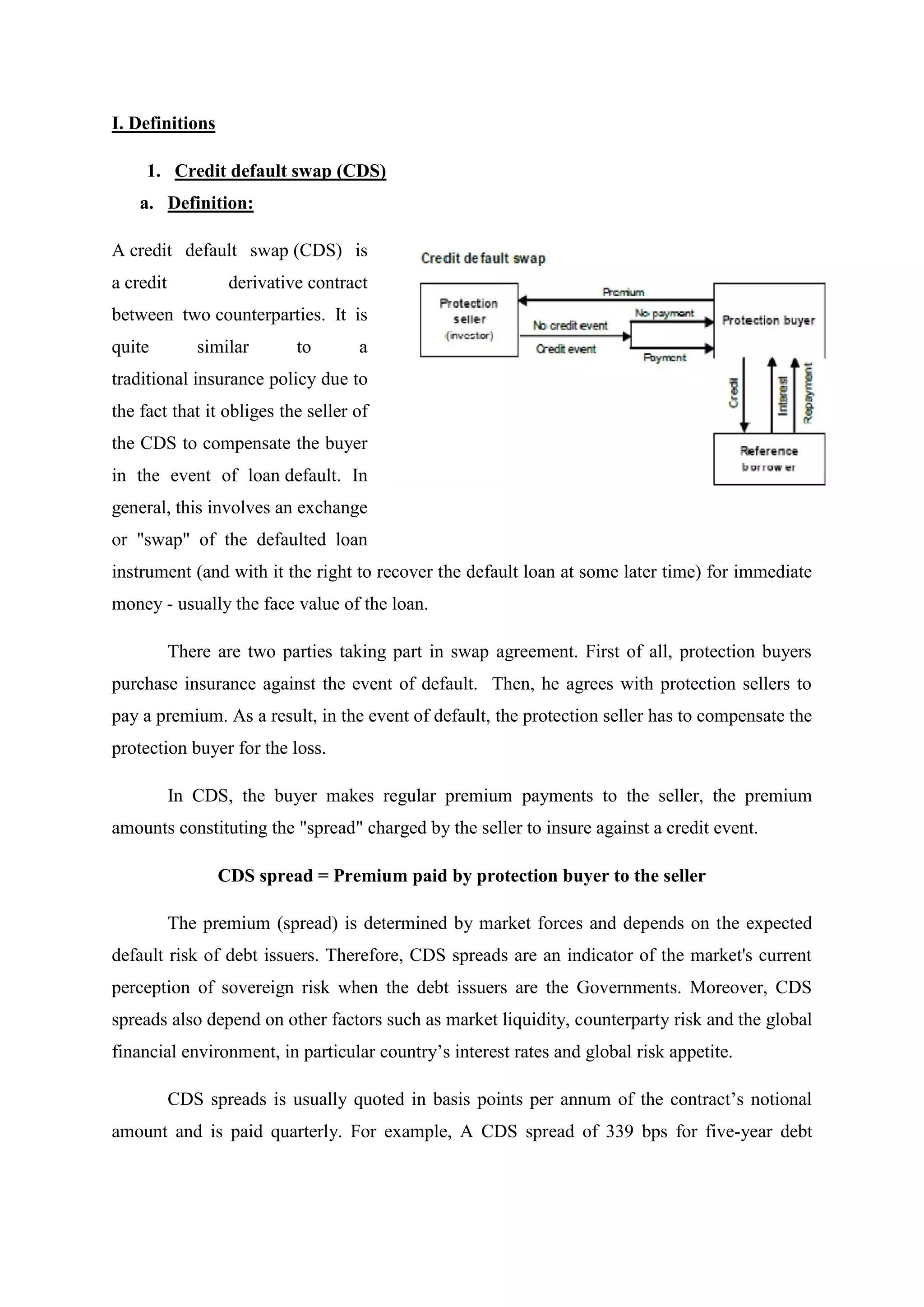

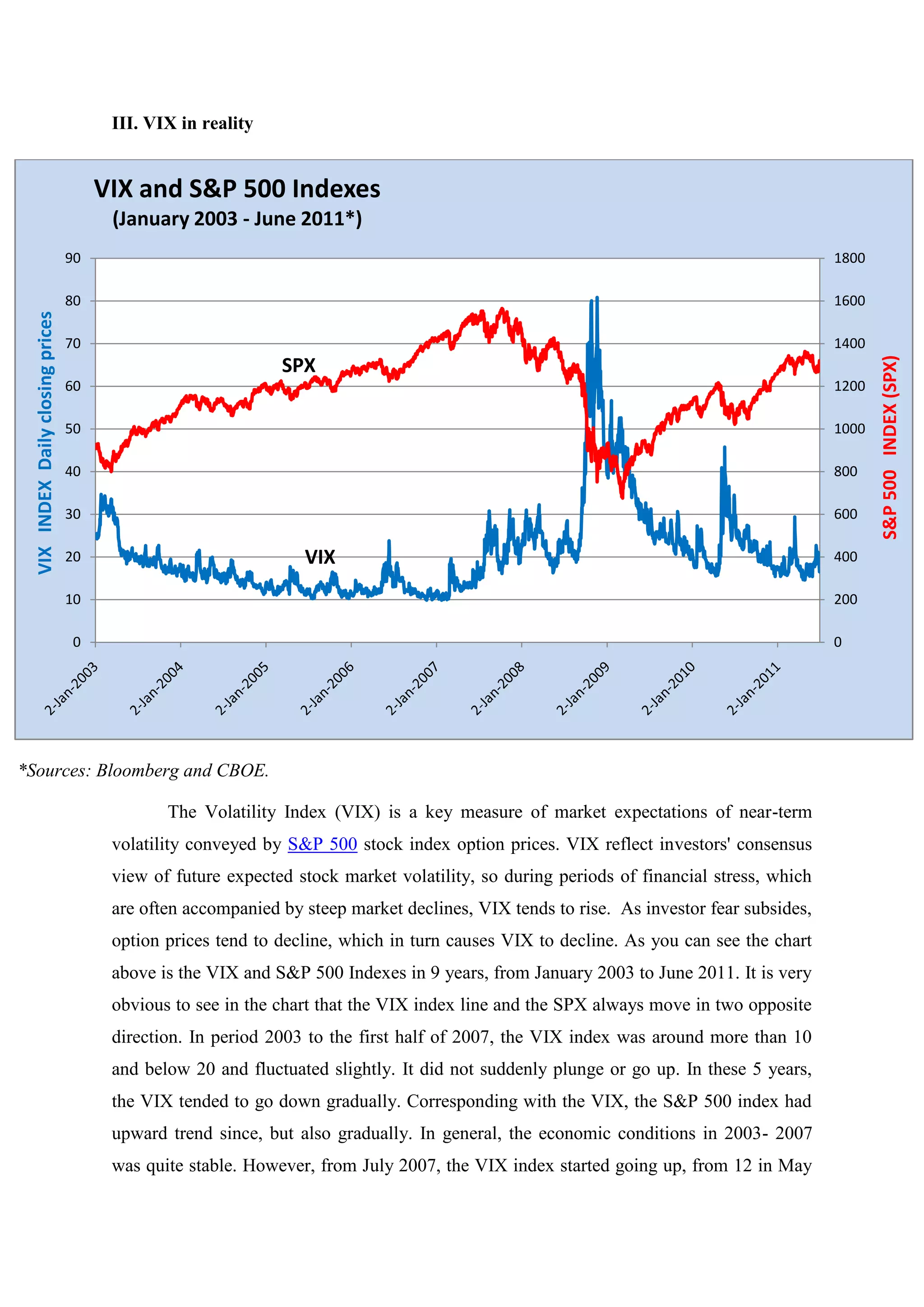

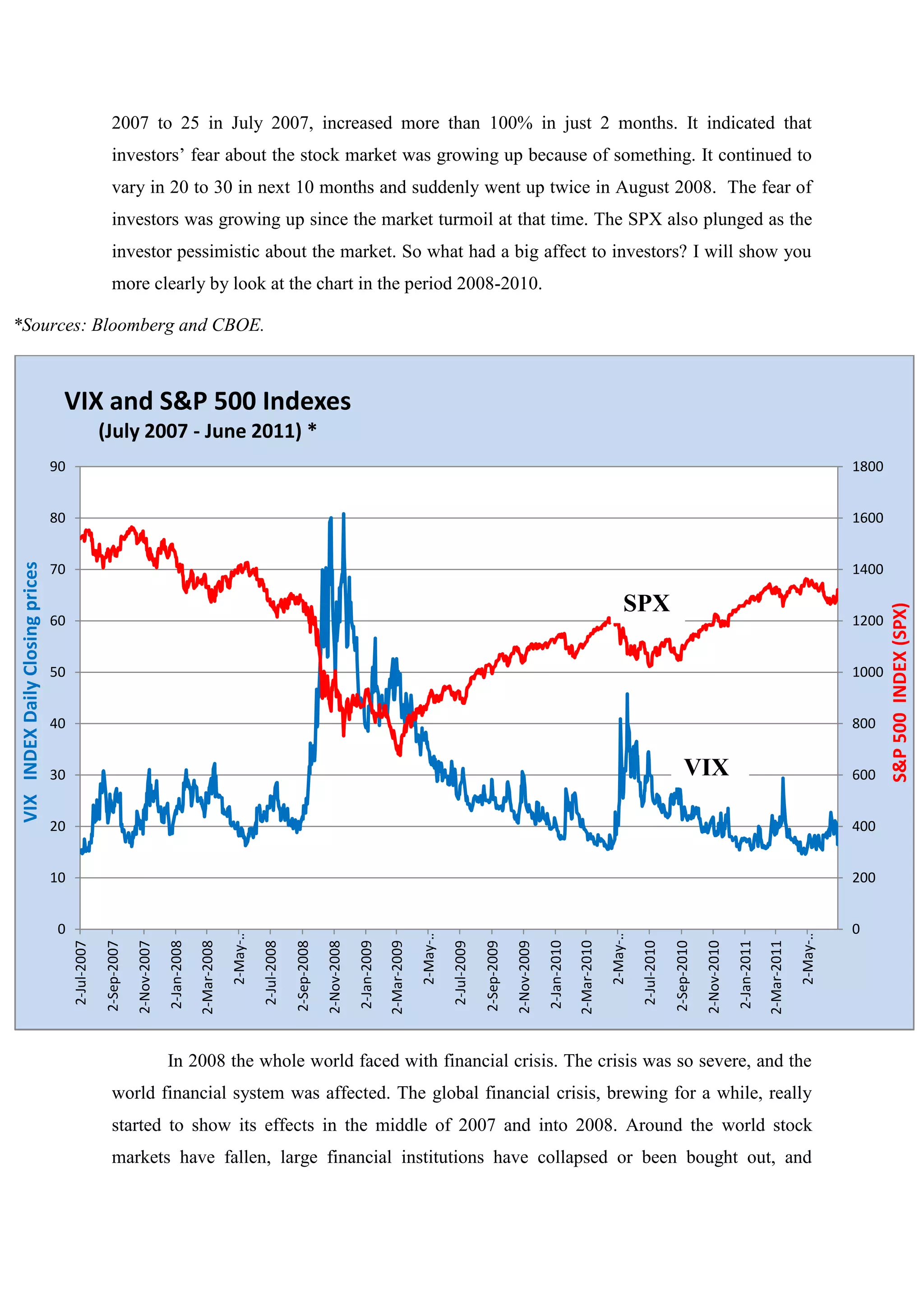

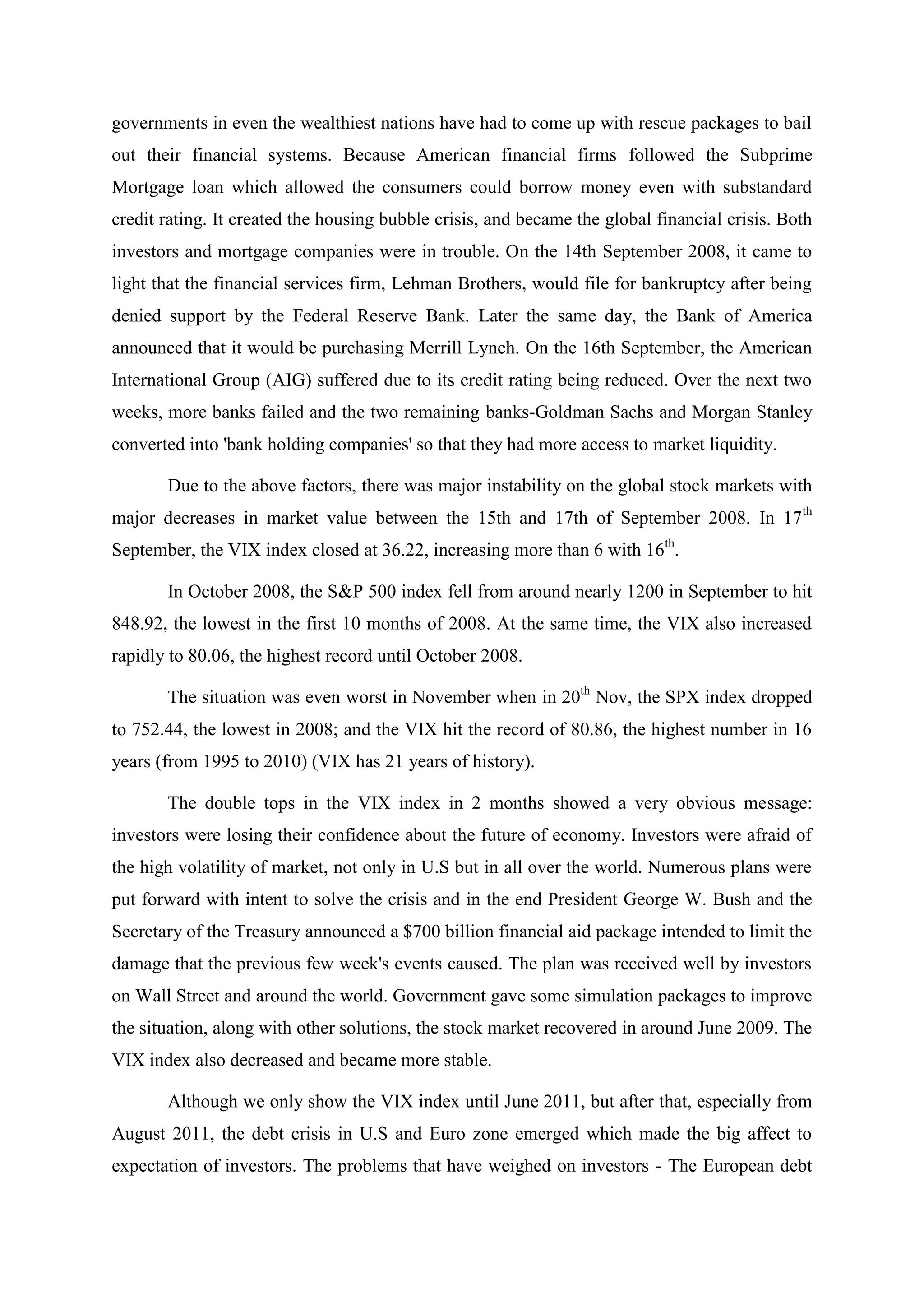

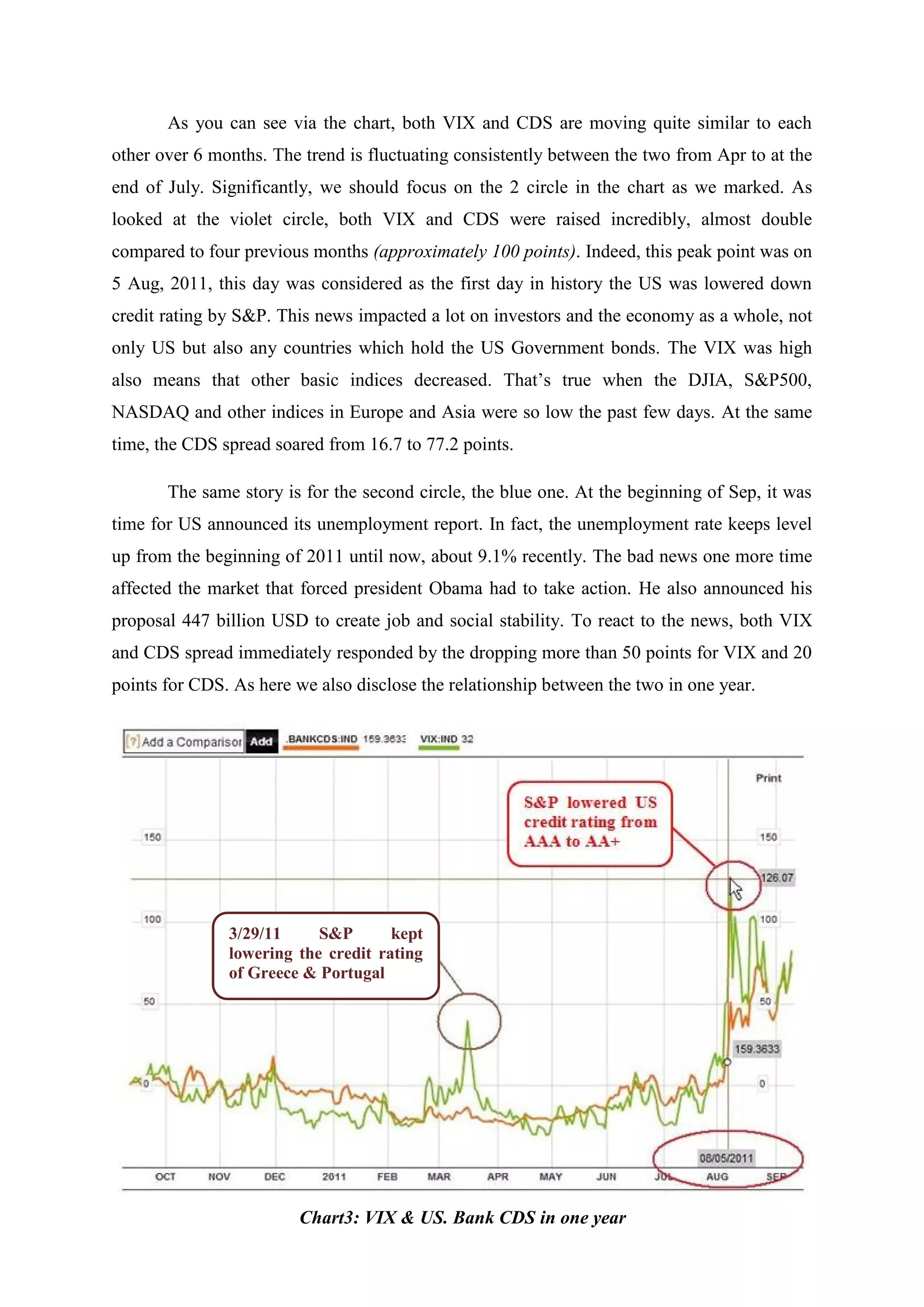

The document discusses the VIX index and credit default swap (CDS) spreads. It provides definitions and background information on both. Regarding the VIX index, it notes that the VIX represents the implied volatility of S&P 500 index options and is often called the "fear index" because high values correspond to periods of uncertainty and falling stock prices. The document then charts the VIX index and S&P 500 from 2003-2011, showing that the VIX rises during financial crises as stock prices fall, such as during the 2008 global financial crisis when the VIX reached record highs above 80. It also discusses how CDS spreads relate to default probabilities.