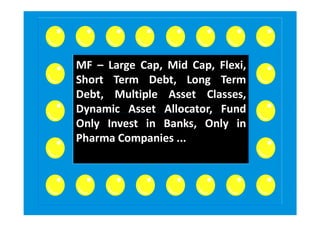

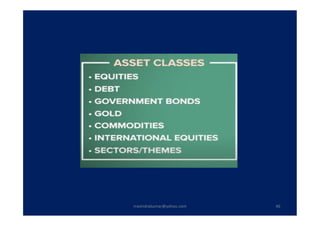

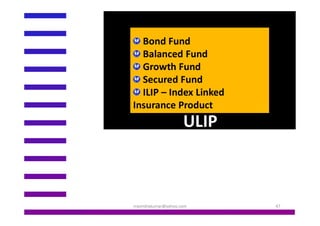

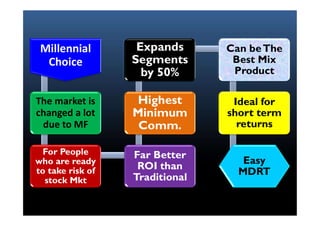

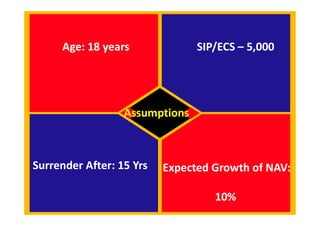

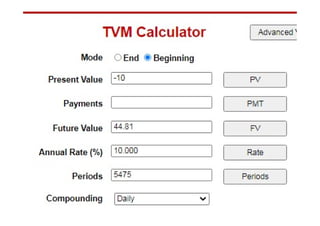

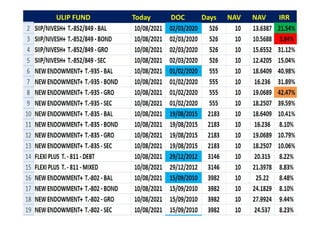

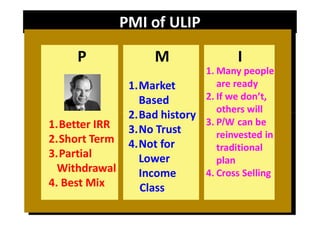

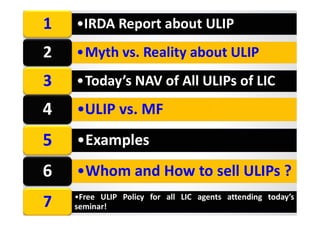

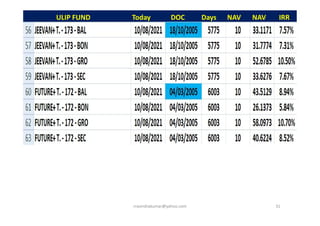

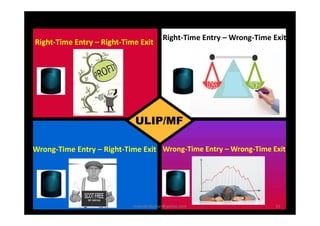

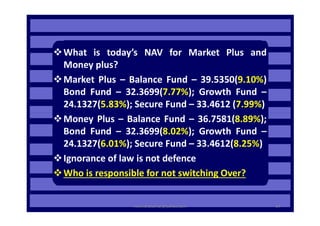

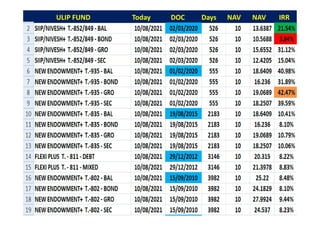

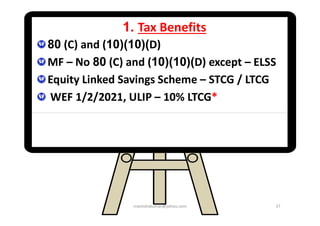

Sri Ravindra Kumar is an experienced life coach and trainer with over 30 years in the life insurance industry, currently serving as a regional manager at LIC of India. He specializes in sales operations, financial consulting, and agency management, providing coaching for professionals across various levels and sectors. The document also discusses the benefits and features of ULIPs compared to mutual funds, emphasizing their investment potential and tax advantages.

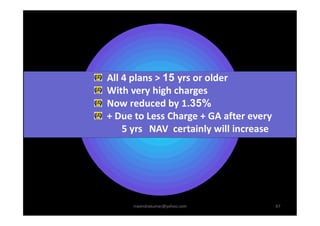

![2. Triple Benefit Product

(1) 80C up to 1.50 Lakhs

(2) Built in insurance

(3) Maturity is Tax Free is if the annual

premium is less than Rs. 2.50 lakhs

38

MF does not have any of these

Dr. Manoj Shukla [MBA; Ph.D.]

rravindrakumar@yahoo.com](https://image.slidesharecdn.com/ulipvs-211207082057/85/ULIP-V-s-MF-FOR-ADVISORS-38-320.jpg)