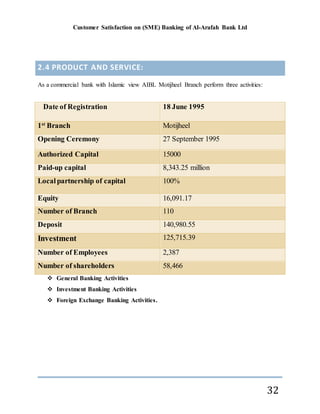

This document is an internship report submitted by Abdulla All Rakib to their lecturer at Jagannath University. The report analyzes customer satisfaction with SME banking at Al-Arafah Bank Ltd, where Rakib completed a two-month internship. The report includes an introduction outlining the importance of banks and SMEs to Bangladesh's economy. It also describes the rationale for measuring customer satisfaction and outlines the report's objectives and methodology. The report then provides an overview of Al-Arafah Bank and its products and services, followed by an analysis of customer satisfaction survey results from SME banking customers. Major findings are also presented.

![Customer Satisfaction on (SME) Banking of Al-Arafah Bank Ltd

61

Chapter-5

REFERENCES

Abhijit, P. (2009), “A Case Study on SME Banking”, pp.7-12

Fresh Mind Ltd, (2006), “Measuring customer satisfaction: A Review of approaches”;

pp.30.

Kotler, P. & Armstrong, G. (2009-10), “Principles of Marketing”, Prentice-Hall, India.

12th edition, pp. 13, 20.

Kanojia, Deepti&Yadav, Dr D.R. (2012), ‘Customer Satisfaction In Commercial Banks’-

A Case Study of Punjab National Bank, Int. J. Trade and Commerce IIARTC, Vol.1,

No.1, pp.90-99

Malhotra, N.K. & Dash, S. (2011-12), “Marketing Research”, Prentice-Hall, India. 6th

edition, pp.293-300.

Zeithaml, V.A, Bitner, M.J, Gremler, D.D, Pandit, A. (2011-12), “Service Marketing”,

McGraw Hill, India, 5th edition, pp.116-17,225.

Motley,L. Biff, (2000), ‘Bank Marketing’: “Customer satisfaction Vs. Customer service”.

[Online, accessed 22 March, 2013] URL: http//www.highbean.com/dec/1G1.

Judith J. Madill, Lisa Feeney 1 April 2002. , International Journal of Bank Marketing,

Vol. 20 No. 2, pp. 86-98](https://image.slidesharecdn.com/internshipreportfinal-190722101444/85/customer-satisfaction-on-sme-banking-internship-report-61-320.jpg)