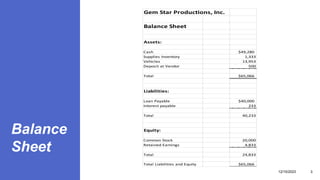

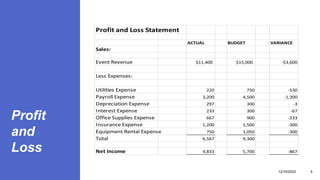

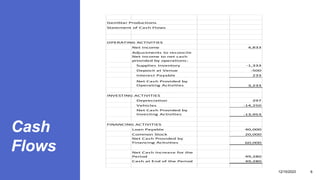

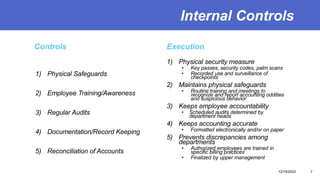

This document provides Tyler Madison with information on Gem Star Productions' balance sheet, ratios, profit and loss statement, cash flows, internal controls, and learned accounting concepts. The balance sheet shows assets of $65,066 including cash, supplies inventory, and vehicles, with total liabilities and equity also of $65,066. The ratios calculated include a debt to assets ratio of 62%, return on assets of 7.4%, and return on equity of 19.5%. The profit and loss statement shows actual revenues and expenses compared to budget, and the cash flows statement analyzes operating, investing and financing cash flows for the period.