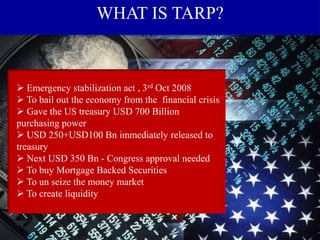

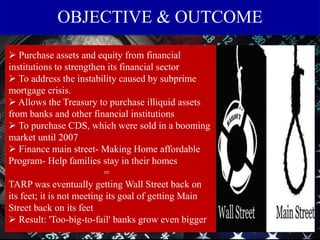

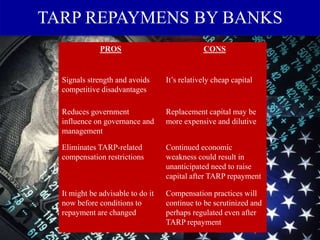

The Troubled Asset Relief Program (TARP) was a $700 billion emergency fund established by the U.S. government in 2008 to stabilize the country's financial system during the subprime mortgage crisis. TARP provided capital to financial institutions to strengthen their balance sheets and increase lending. While TARP helped prevent further economic damage, it faced criticism for bailing out Wall Street firms and not providing enough aid to struggling homeowners or small businesses. Some TARP recipients, like large banks, repaid funds but grew significantly in size, treated TARP as a way to socialize losses from risky behavior.