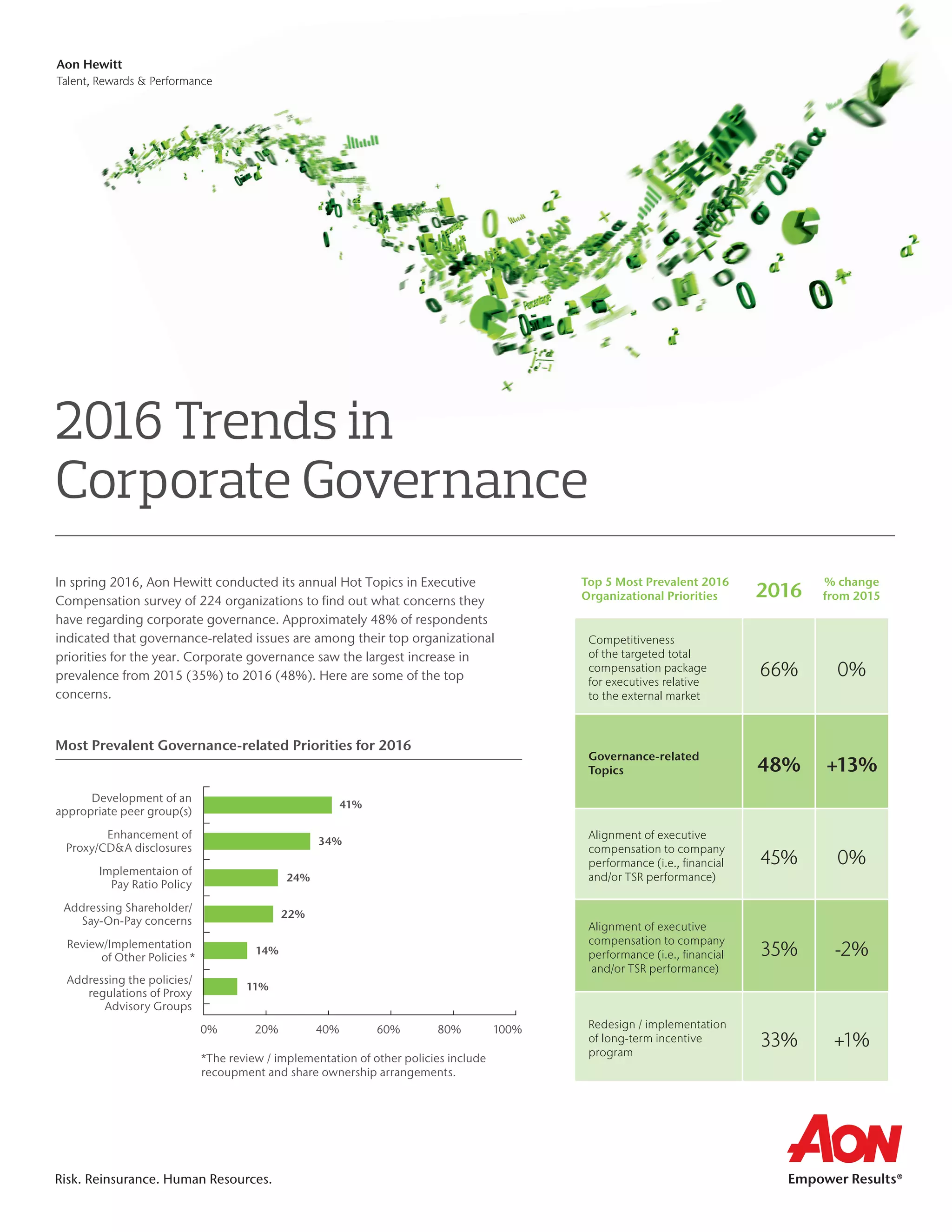

A survey of 224 organizations found that approximately 48% indicated that governance-related issues were among their top priorities for 2016, a significant increase from 2015. The top concerns were enhancing proxy and compensation committee report disclosures, addressing shareholder concerns over executive pay votes, developing appropriate peer groups, and implementing pay ratio policies. Governance programs like stock ownership guidelines and trading limits were most common for CEOs and direct reports, declining at lower levels. Most organizations have begun outlining their approach to collecting data and disclosing CEO pay ratios compared to median employee pay in 2017.