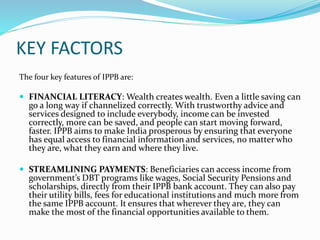

The document outlines the evolution of India's postal services and the establishment of the India Post Payments Bank (IPPB) in 2016, aimed at enhancing financial inclusion. IPPB aims to offer accessible banking services through its extensive network of post offices, which play a crucial role in delivering government benefits and improving financial literacy. Additionally, it highlights services such as domestic remittance, direct benefit transfers, and doorstep banking to facilitate financial transactions for rural populations.