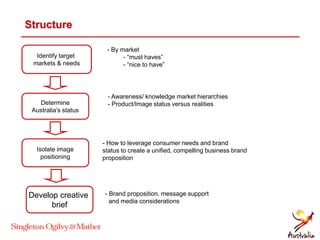

This document outlines a communications strategy to boost international business tourism to Australia. It identifies key target markets and analyzes perceptions of and needs in those markets. Core consumer needs across markets are safety, accessibility, affordability, and infrastructure. However, emotional motivators vary. The strategy recommends positioning Australia as providing life experiences "in a different light" to overcome barriers of distance and cost perceptions. It provides messaging to convince meeting planners that Australia offers value, experiences, sophistication and a zest for life.