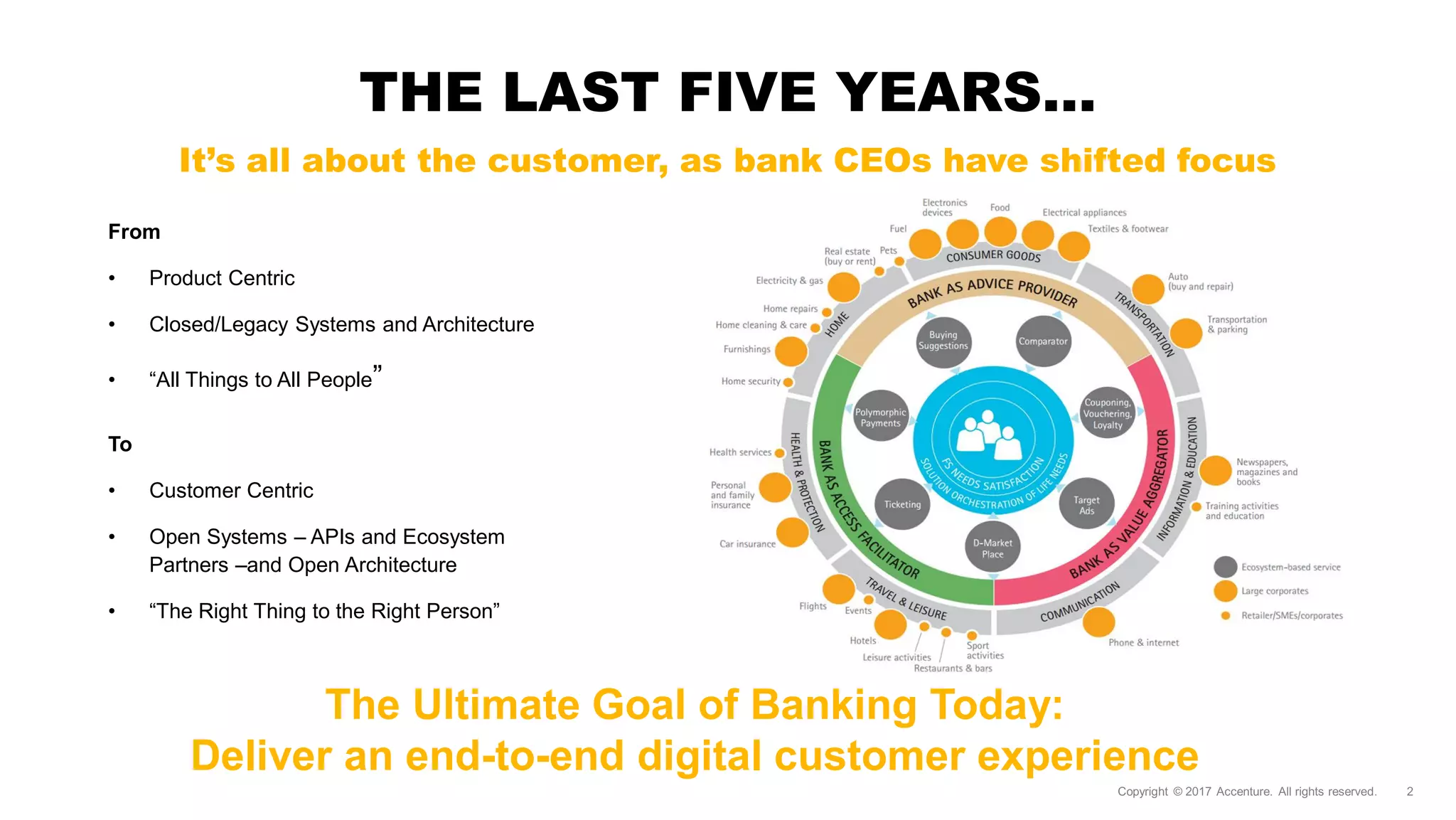

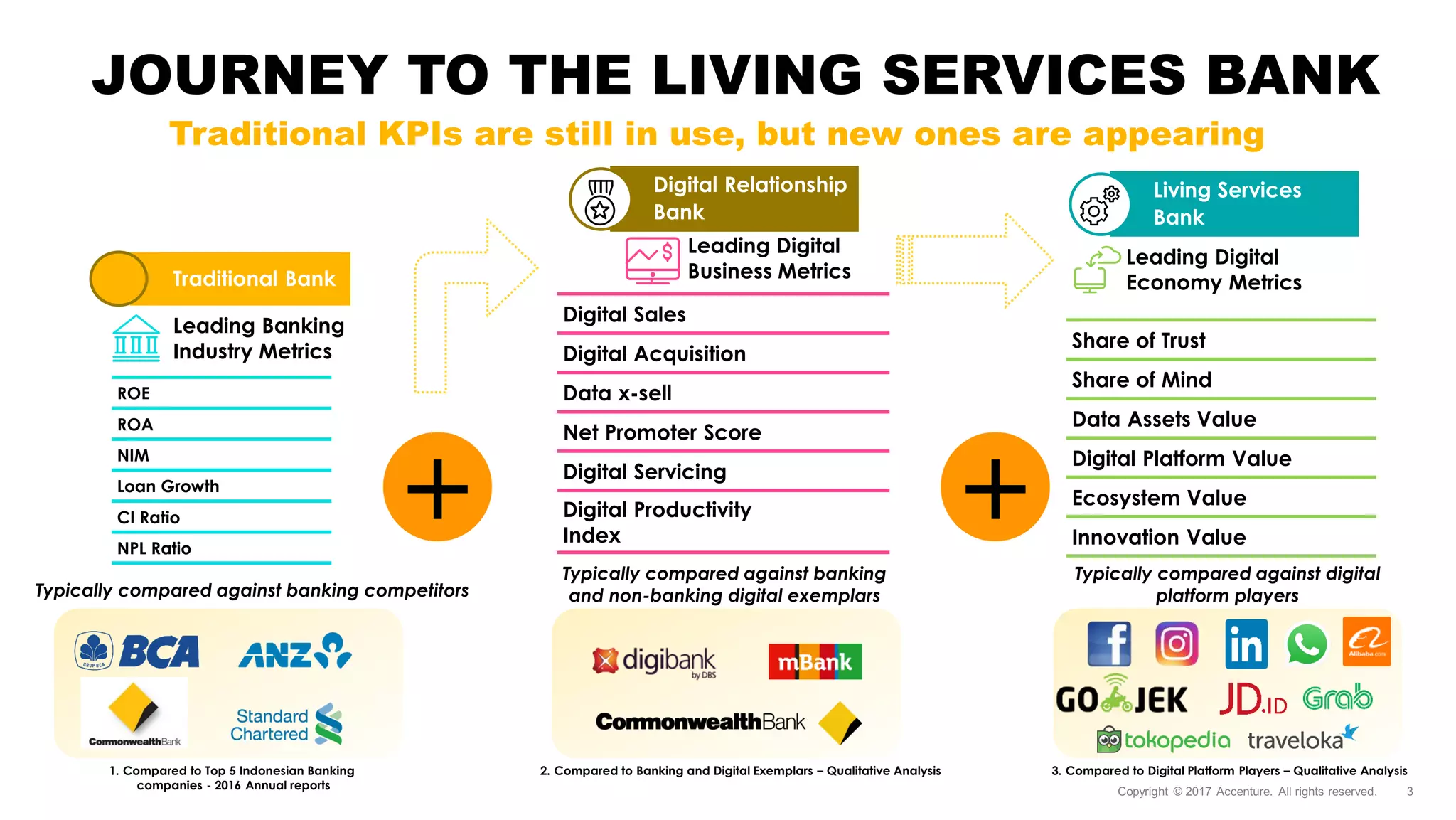

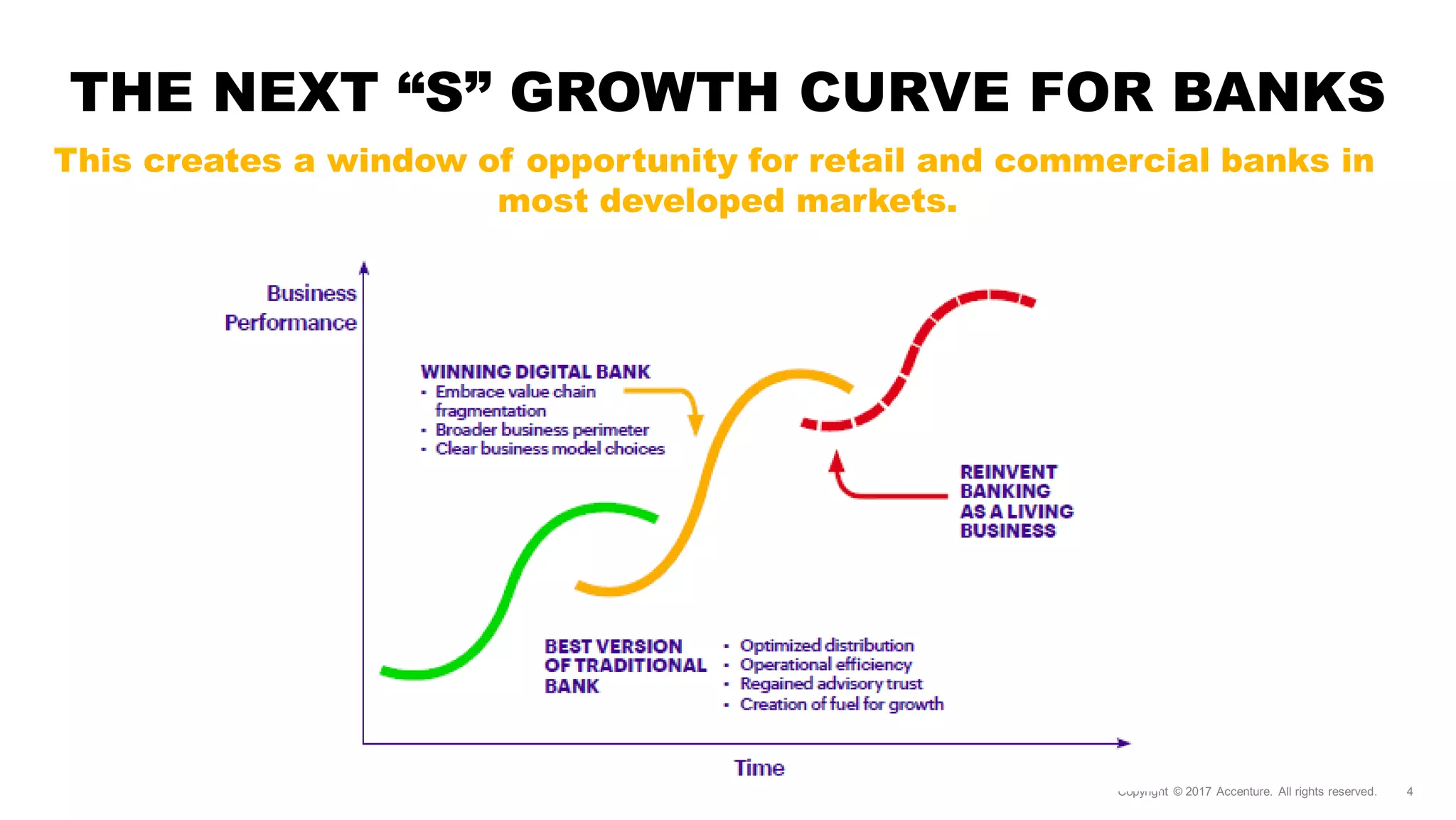

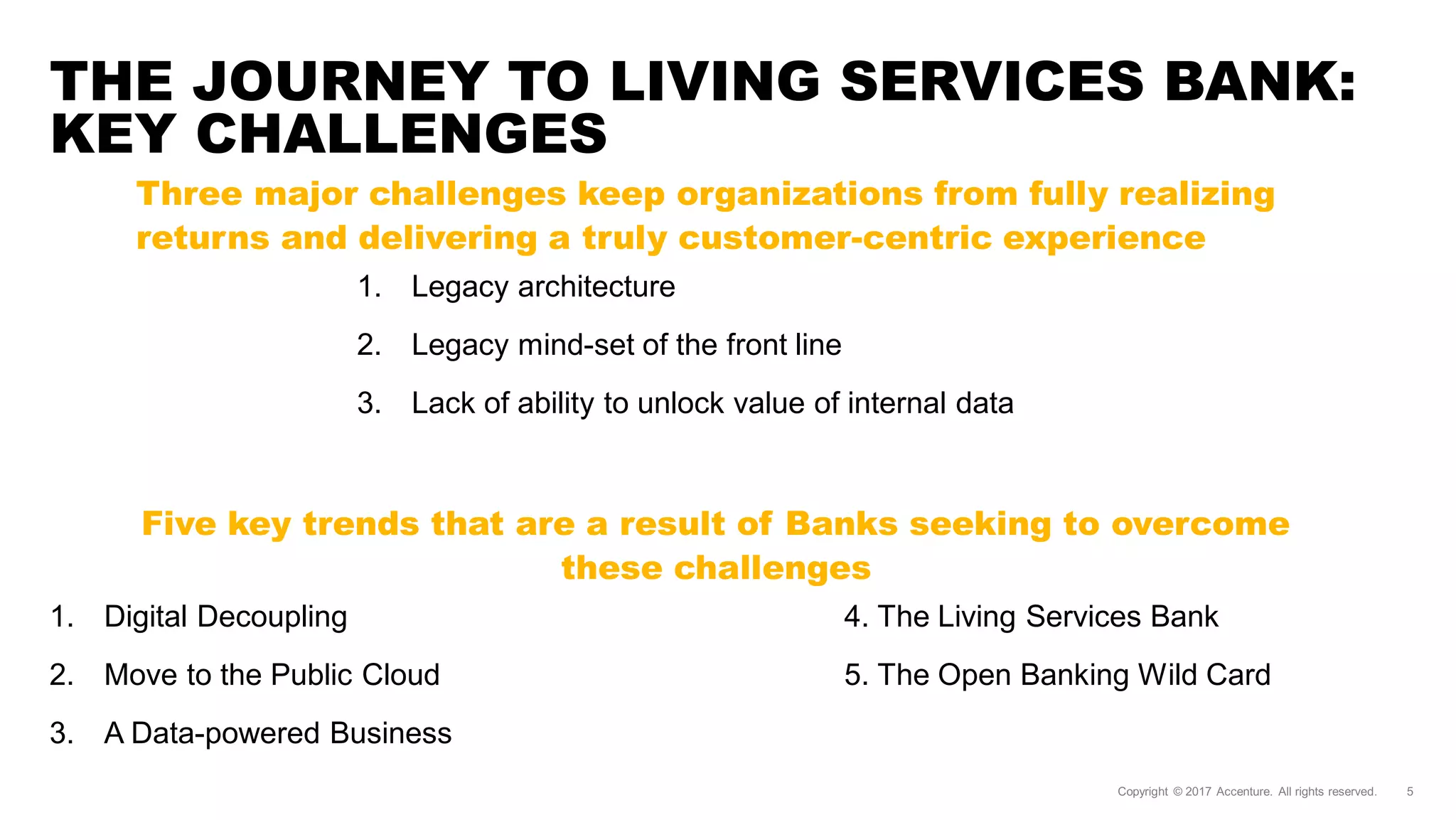

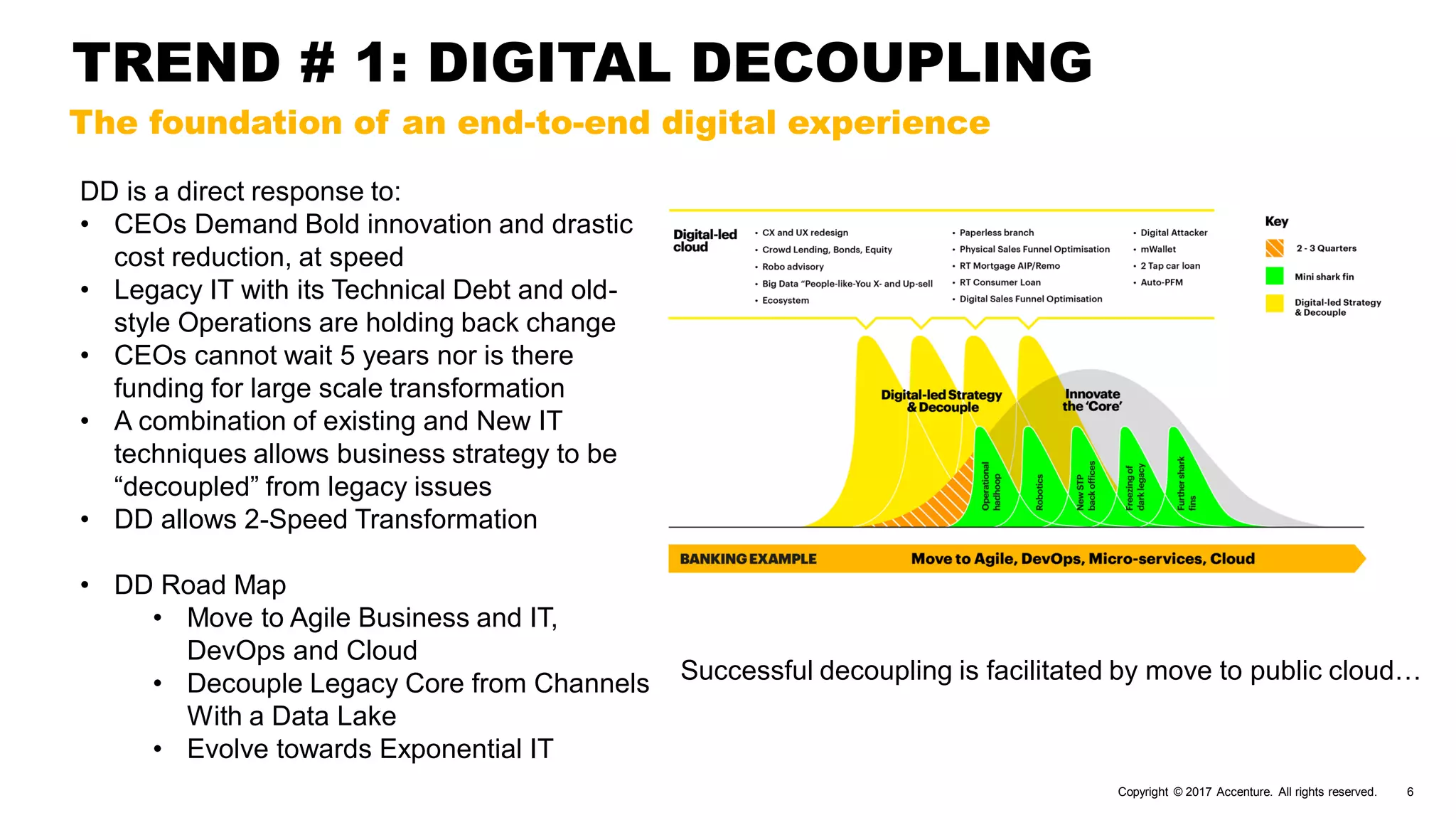

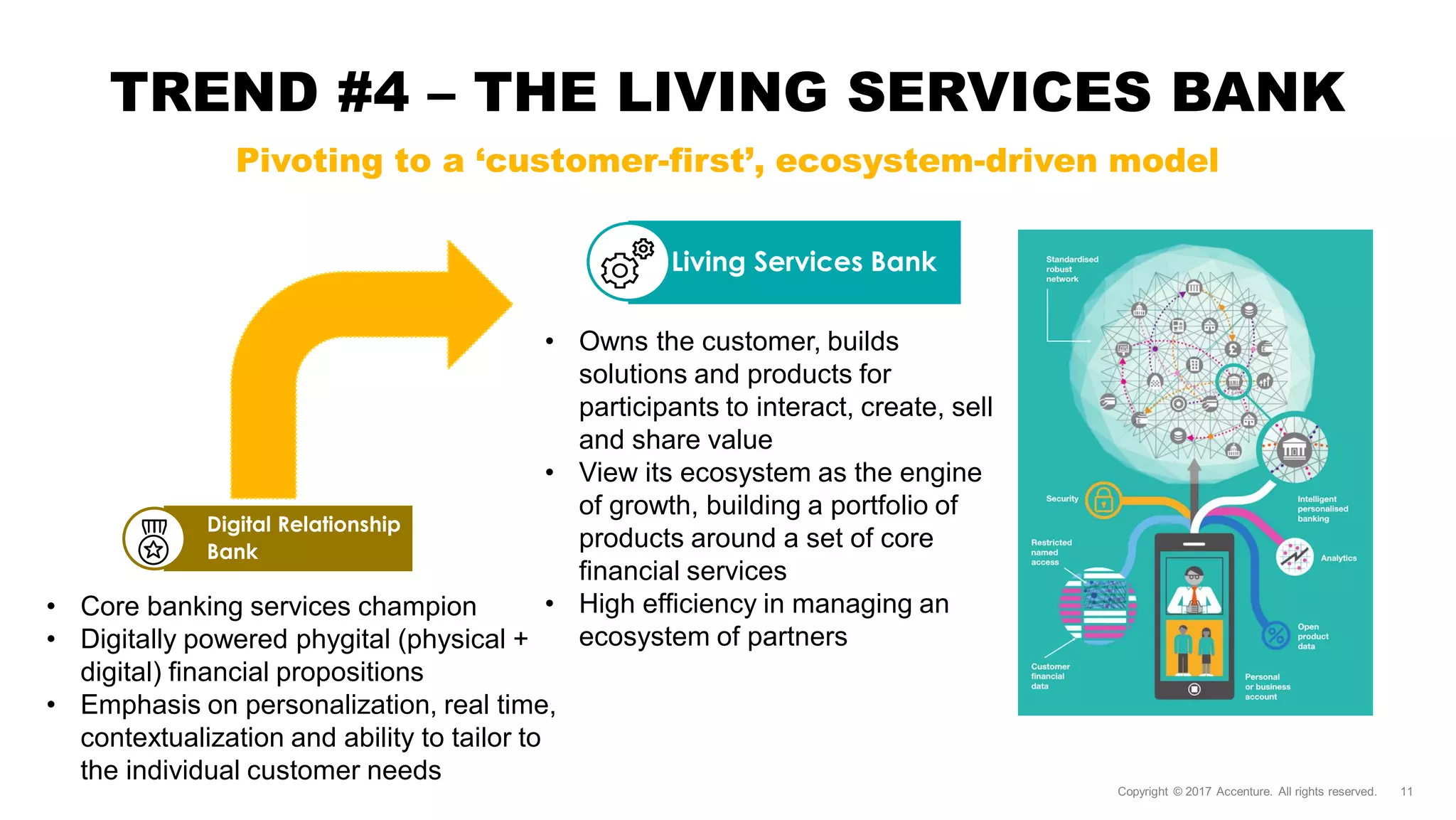

The document discusses the transformation of banking towards a customer-centric model, focusing on five key trends: digital decoupling, public cloud migration, data-driven business, the living services bank, and open banking. It identifies challenges such as legacy architecture and the need for innovation in order to improve customer experience and operational efficiency. The ultimate goal is to create a seamless, personalized digital experience for customers while maintaining competitive advantage in an evolving market.