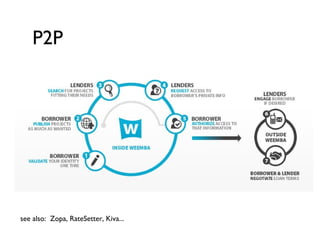

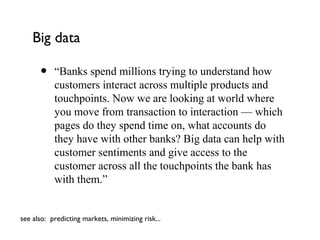

This document discusses how banks are responding to pressures from increased regulation and disruptive technologies. It notes that banks initially fought regulation but are now being forced to adapt. In the long term, banks will likely focus on retail customers and differentiation. New technologies like mobile banking, peer-to-peer payments, and alternative currencies pose challenges while also providing opportunities. Some banks are beginning to experiment with social media and big data, but have yet to fully commit to deeper customer engagement and service. Overall banks must find ways to personalize and add value to services without requiring changes to legacy systems.