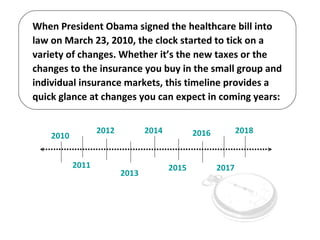

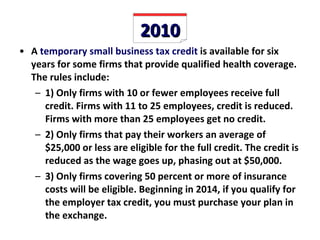

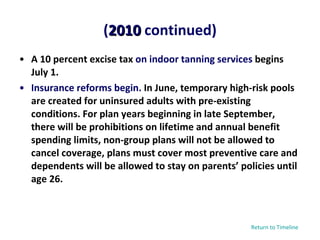

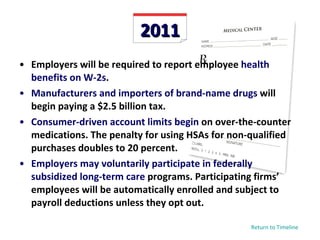

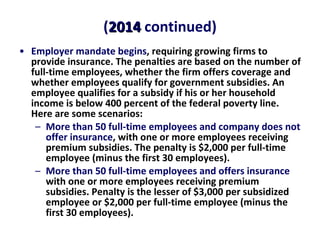

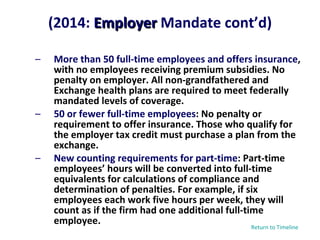

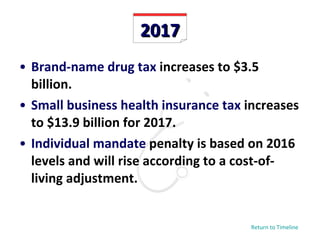

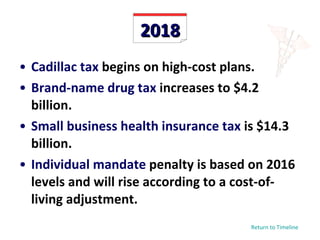

The document outlines the healthcare reform timeline beginning from March 23, 2010, when President Obama signed the healthcare bill into law, detailing various changes to expect each year. Key reforms include tax credits for small businesses, the creation of health insurance exchanges, the individual mandate, and penalties for employers based on their coverage offerings. The timeline highlights significant tax implications and insurance regulations that aim to expand coverage and improve accessibility for individuals and small businesses.