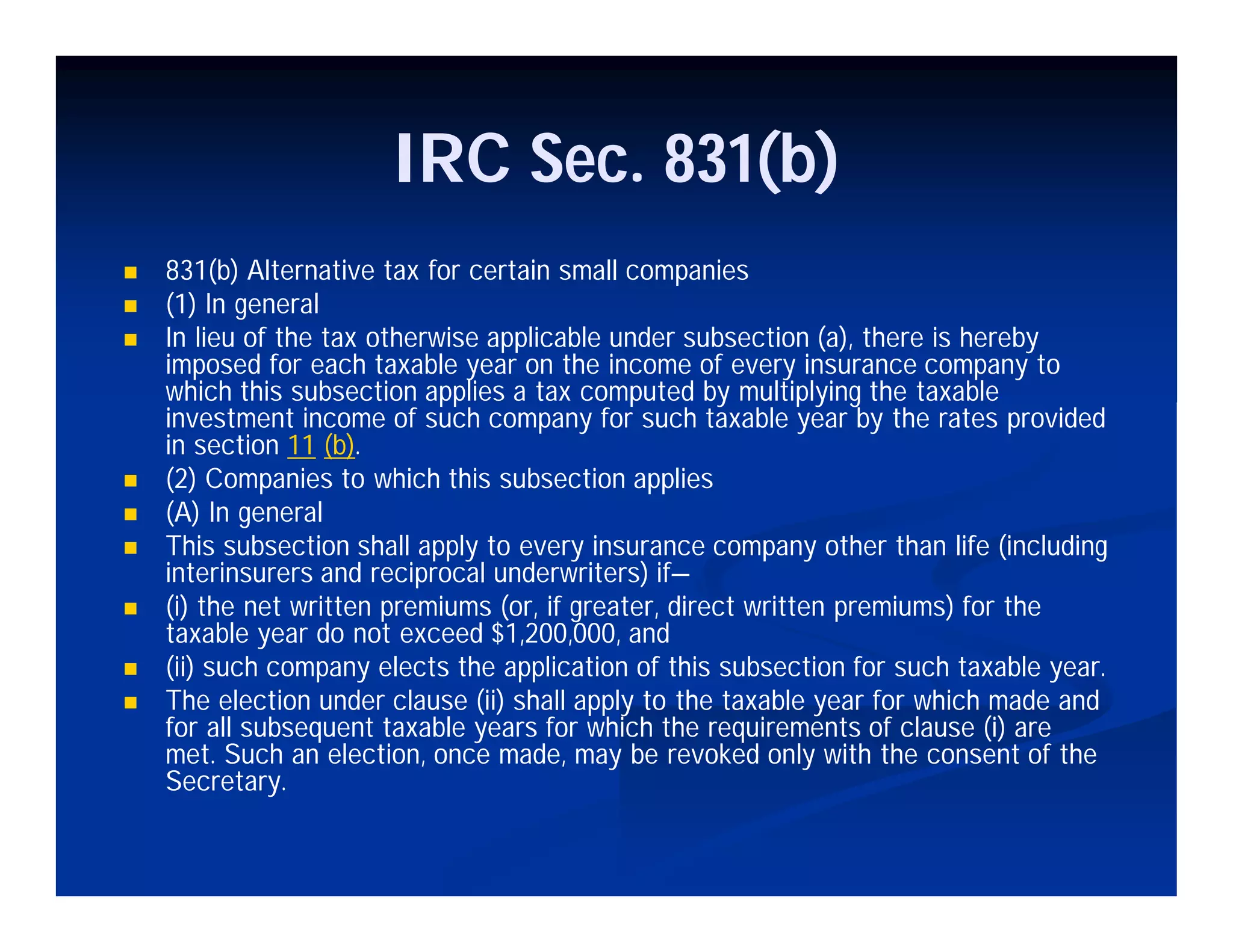

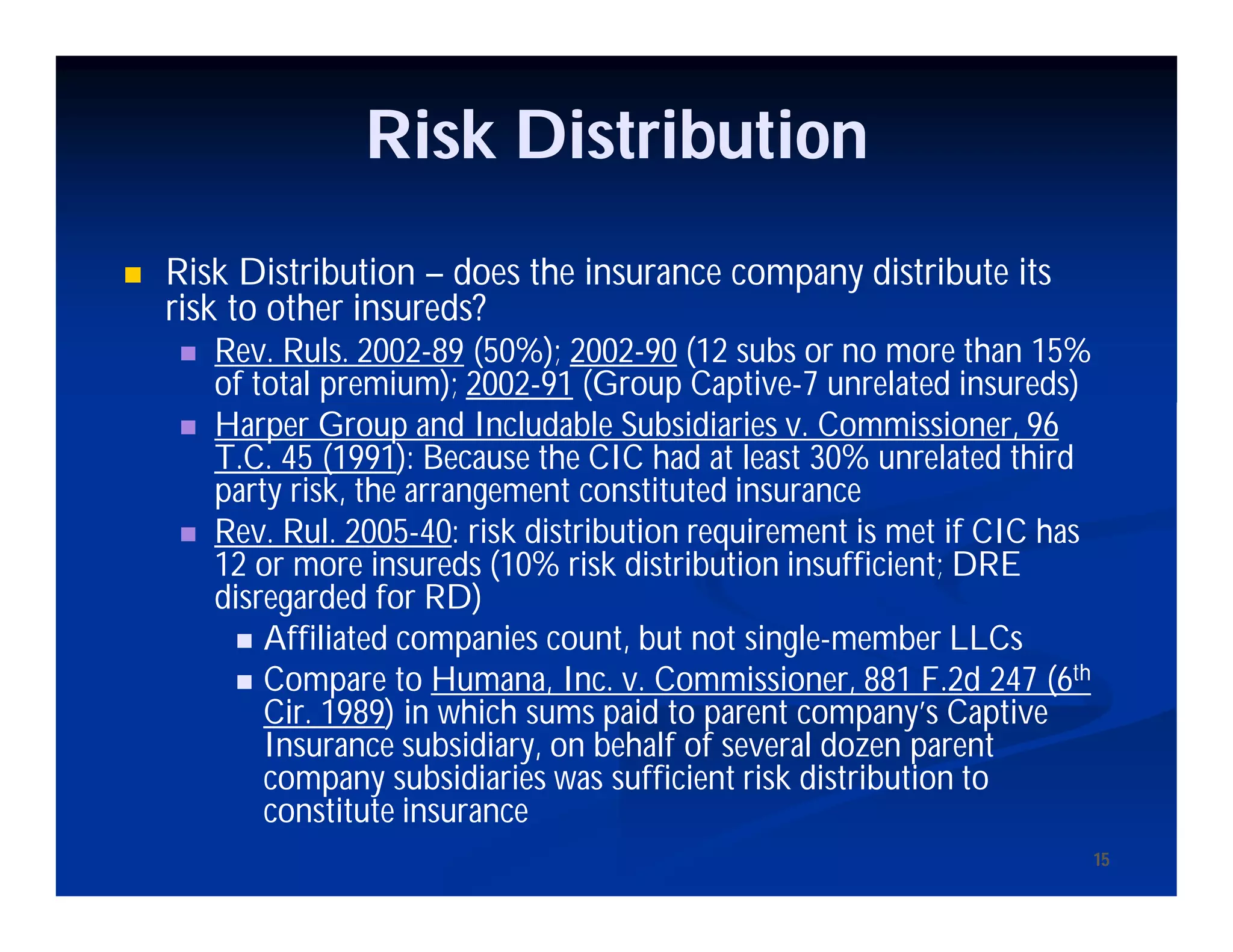

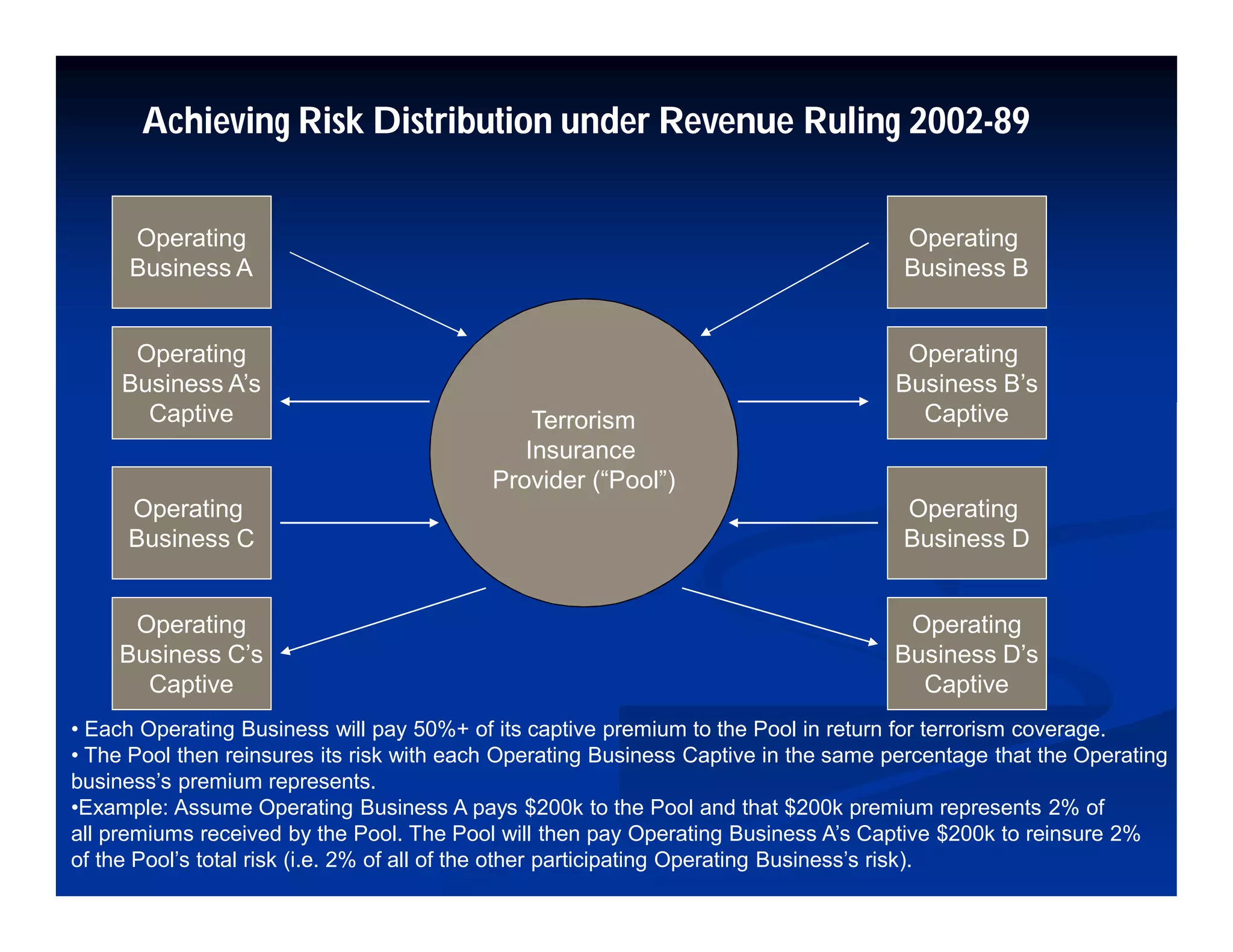

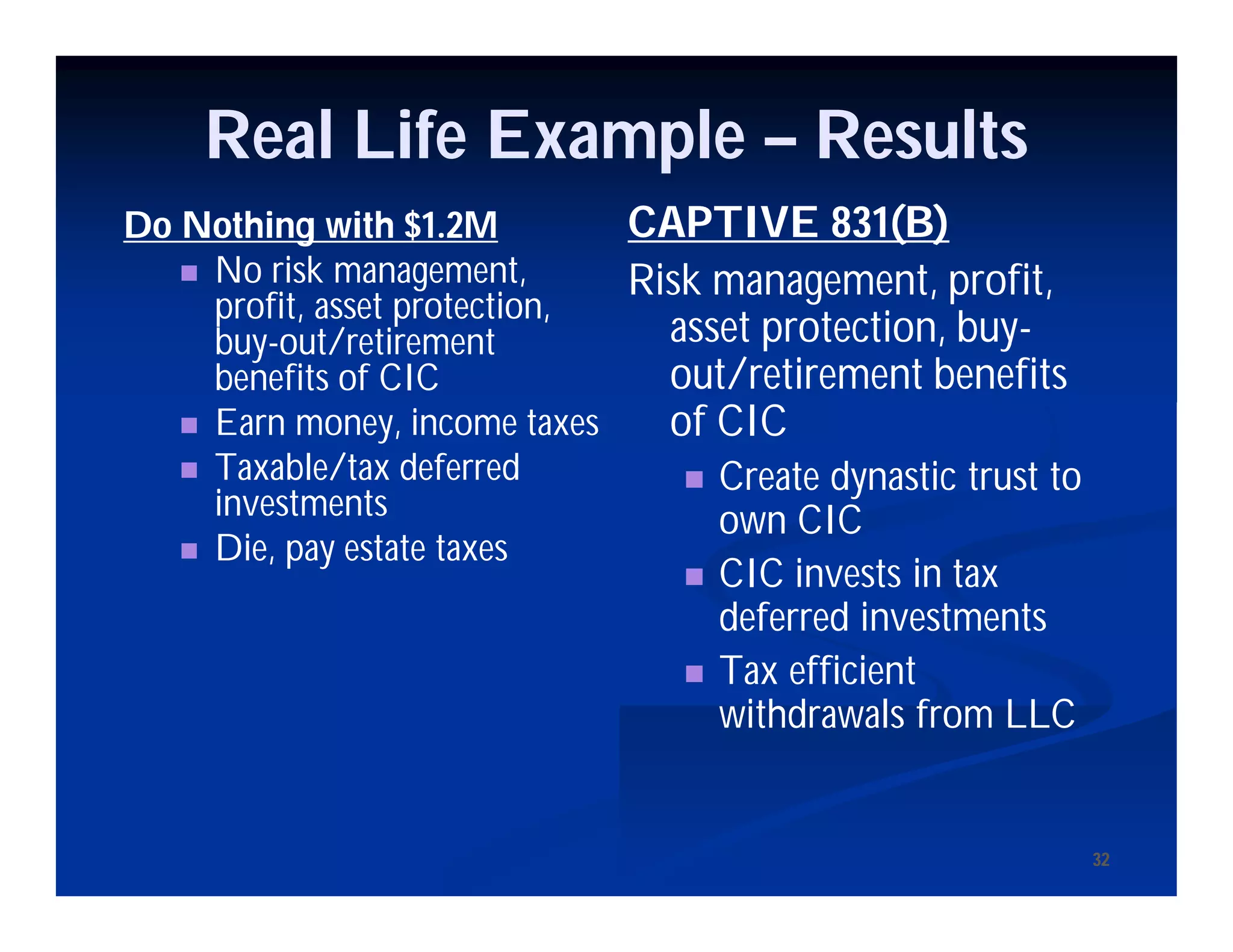

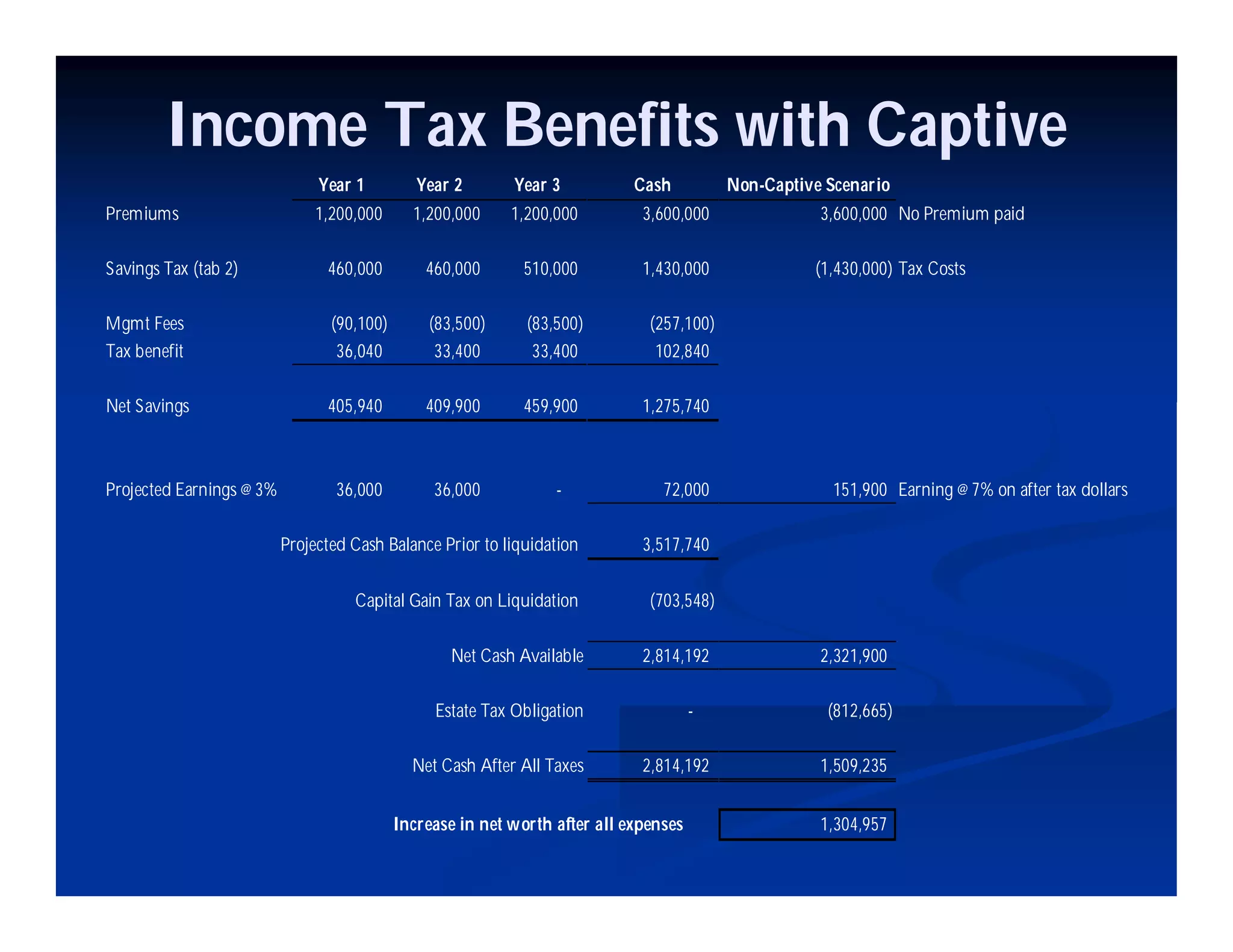

This document provides an overview of micro captives and the 831(b) election for small insurance companies. It discusses how micro captives allow profitable businesses to deduct insurance premium payments of up to $1.2 million annually. The presenters then explain the key aspects of micro captive structures, including risk distribution requirements, premium funding, financial requirements, and policy types that can be written. The tax benefits of micro captives are outlined, such as deferring tax on underwriting profits and accessing funds for retirement or estate planning purposes.