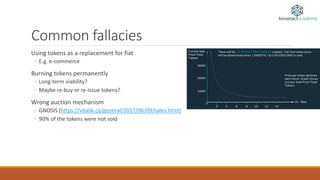

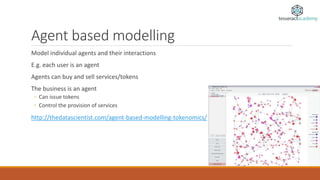

Tokenomics refers to the economics of blockchain-based tokens and cryptocurrencies. It involves determining parameters for initial coin offerings (ICOs) like the total number of tokens and allocation percentages. Key considerations include incentivizing token value appreciation and controlling inflation/volatility. A good tokenomics model provides protection from speculation while establishing the right incentive structures to support the business model and usability. Agent-based modeling can help evaluate different tokenomic designs by simulating user and business behaviors.