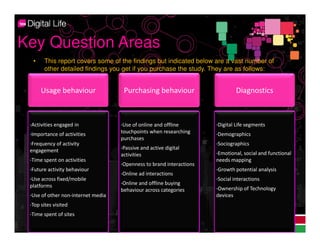

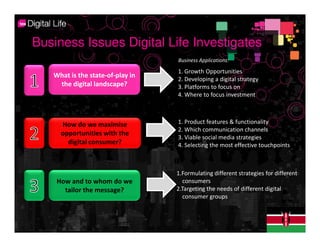

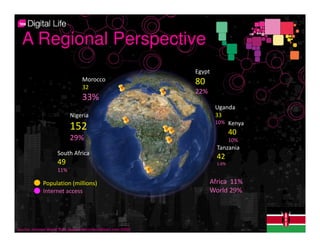

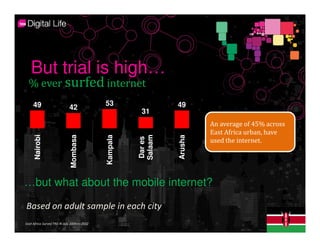

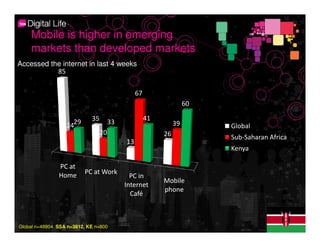

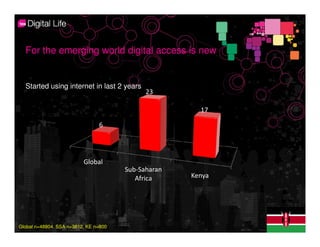

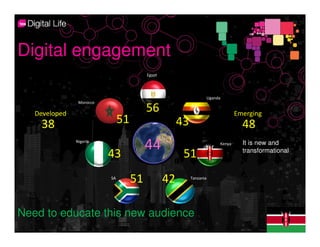

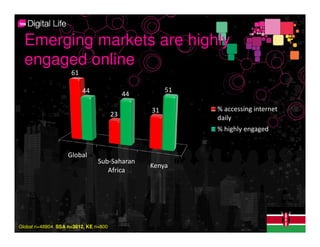

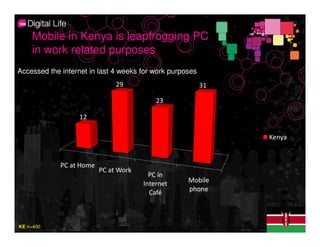

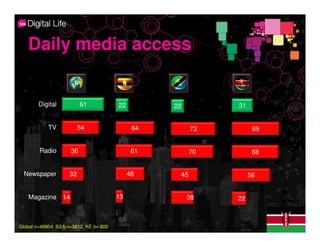

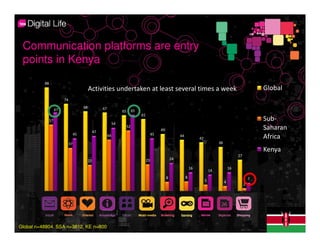

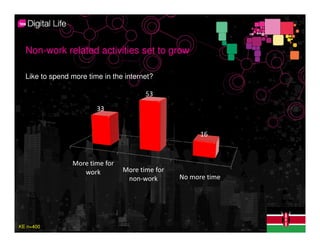

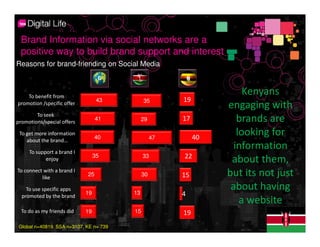

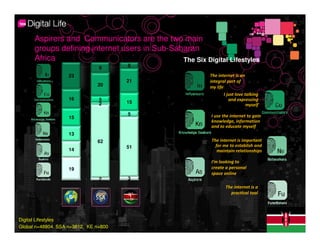

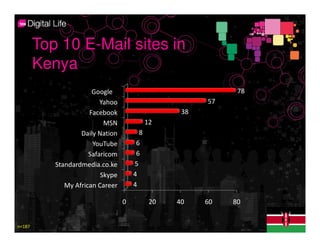

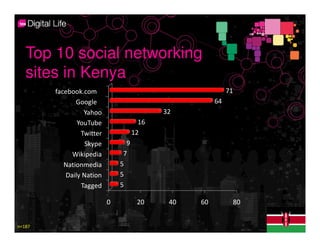

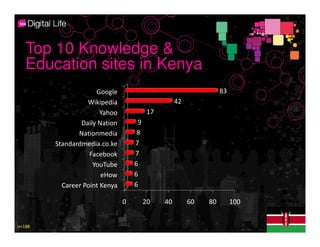

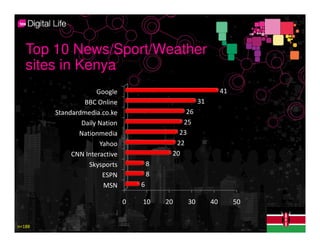

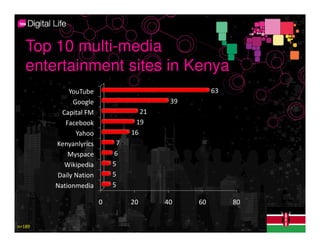

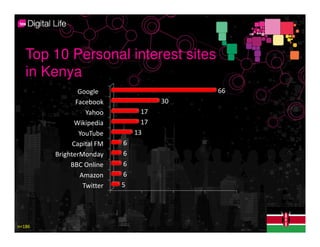

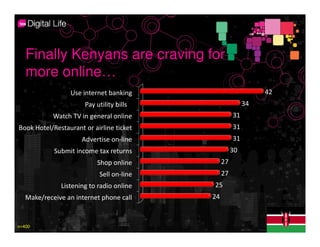

This document presents a summary of findings from a 2010 study on digital life in Kenya, Uganda, and Tanzania. It discusses key usage behaviors and purchasing behaviors uncovered. The full detailed findings are available for purchase, ranging in price from $3,500-$5,000 depending on the region. It covers topics like digital lifestyle segments, activities conducted online, brand interactions, and growth opportunities. Sample sizes were 800 interviews total across the three countries. The top websites used differ based on activity but Google and Facebook are consistently among the most used. Marketers should focus on mobile and social media strategies given emerging behaviors.