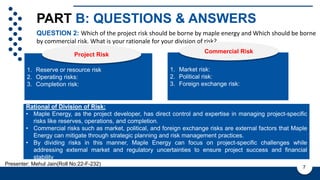

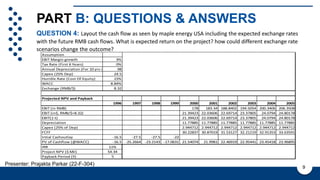

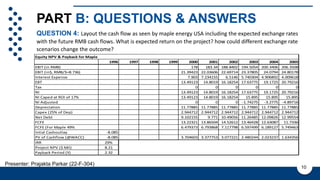

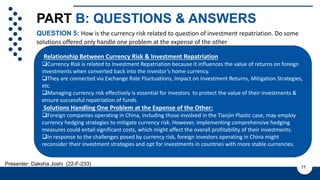

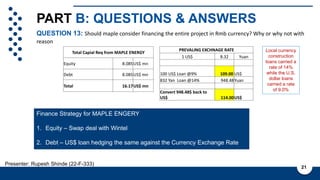

The exchange rate at the time of remittance is critical to Maple Energy as it directly impacts their returns, hedging costs, profitability, competitiveness, and financial planning. Fluctuations in exchange rate can significantly alter Maple Energy's expected earnings and cash flows.

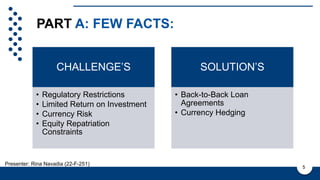

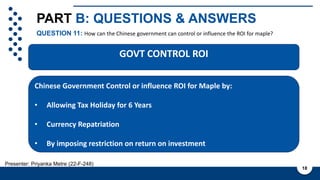

B. Regulatory restrictions on investment returns

Regulatory restrictions on investment returns are critical to Maple Energy as they limit potential profits and introduce uncertainty. This hinders financial planning and decision making. It also increases risk exposure.

C. Tax benefits

Tax benefits are important for Maple Energy as they boost post-tax returns and cash flows. This enhances the overall profitability and attractiveness of the investment. Loss of tax benefits can negatively impact the project viability