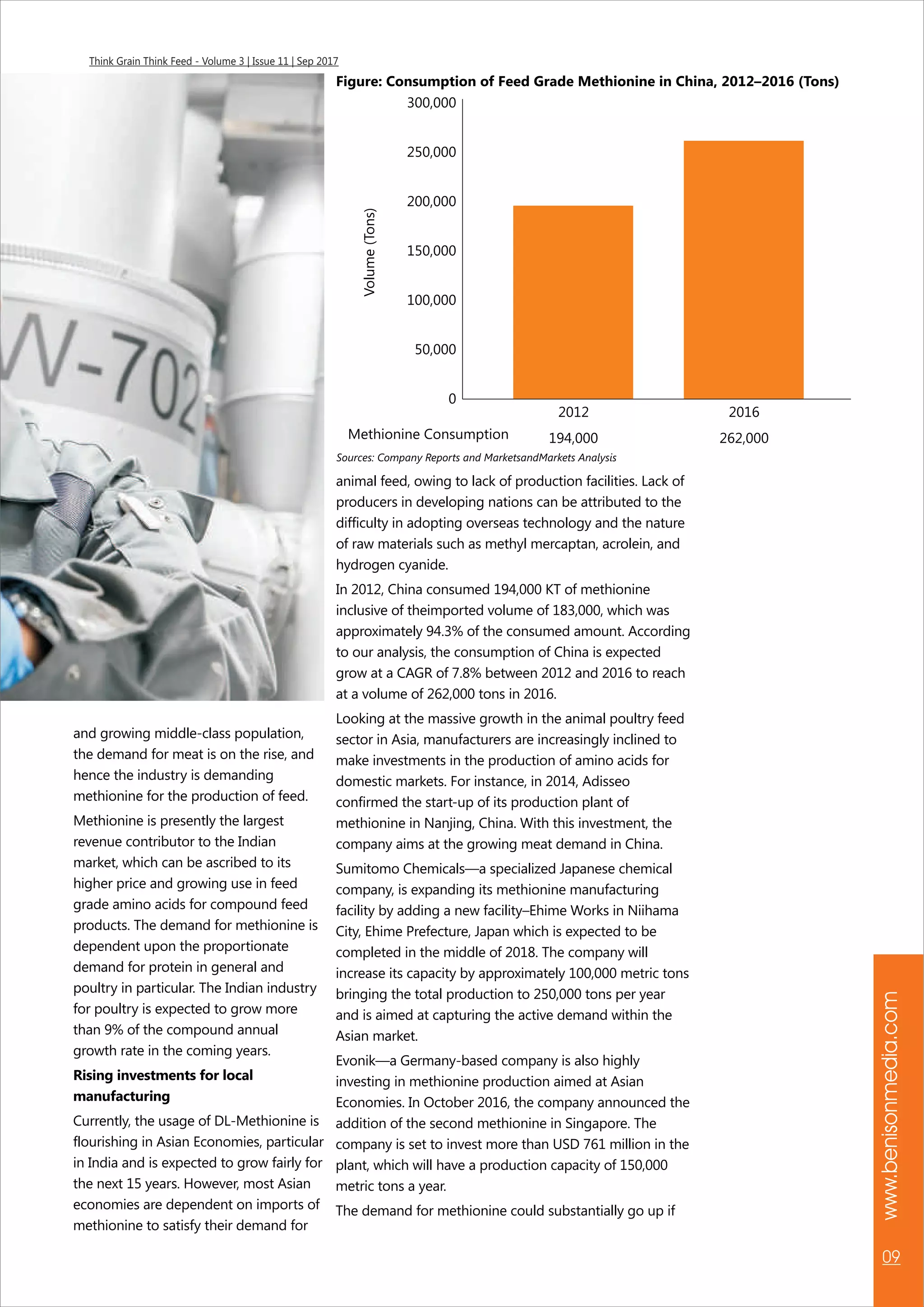

The document discusses the upcoming FeedTech Expo 2018 in Pune and highlights the potential of 'brachiaria', a resilient wild grass that can serve as vital fodder for livestock in arid regions, enhancing soil health and productivity. It also provides updates on maize prices, indicating a stable market with a possible downward trend until the new crop is available, while noting the impact of cyclones on U.S. corn crops. Additionally, it mentions the increasing demand for methionine in Asia's growing animal feed market, particularly in light of rising meat consumption.