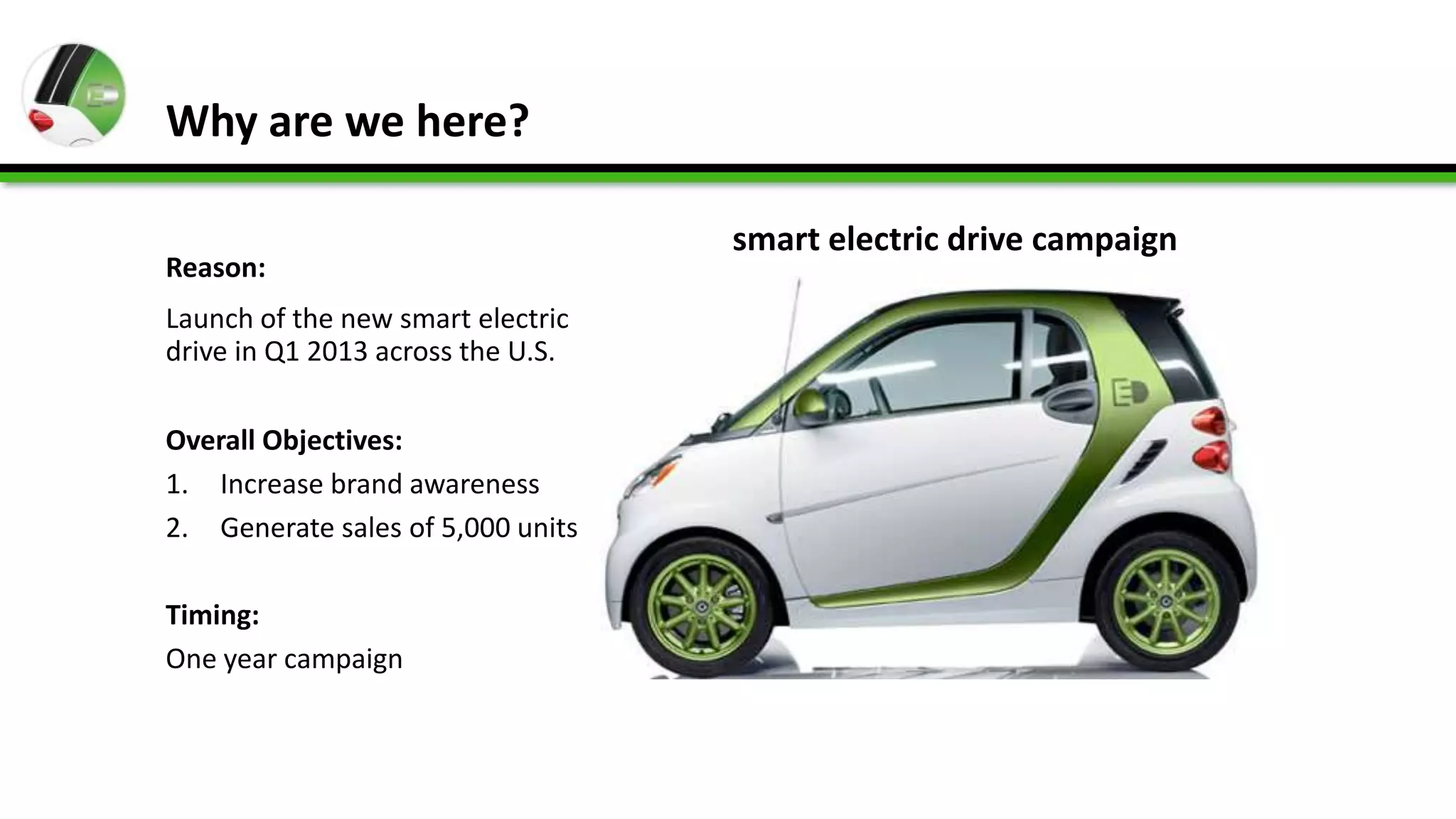

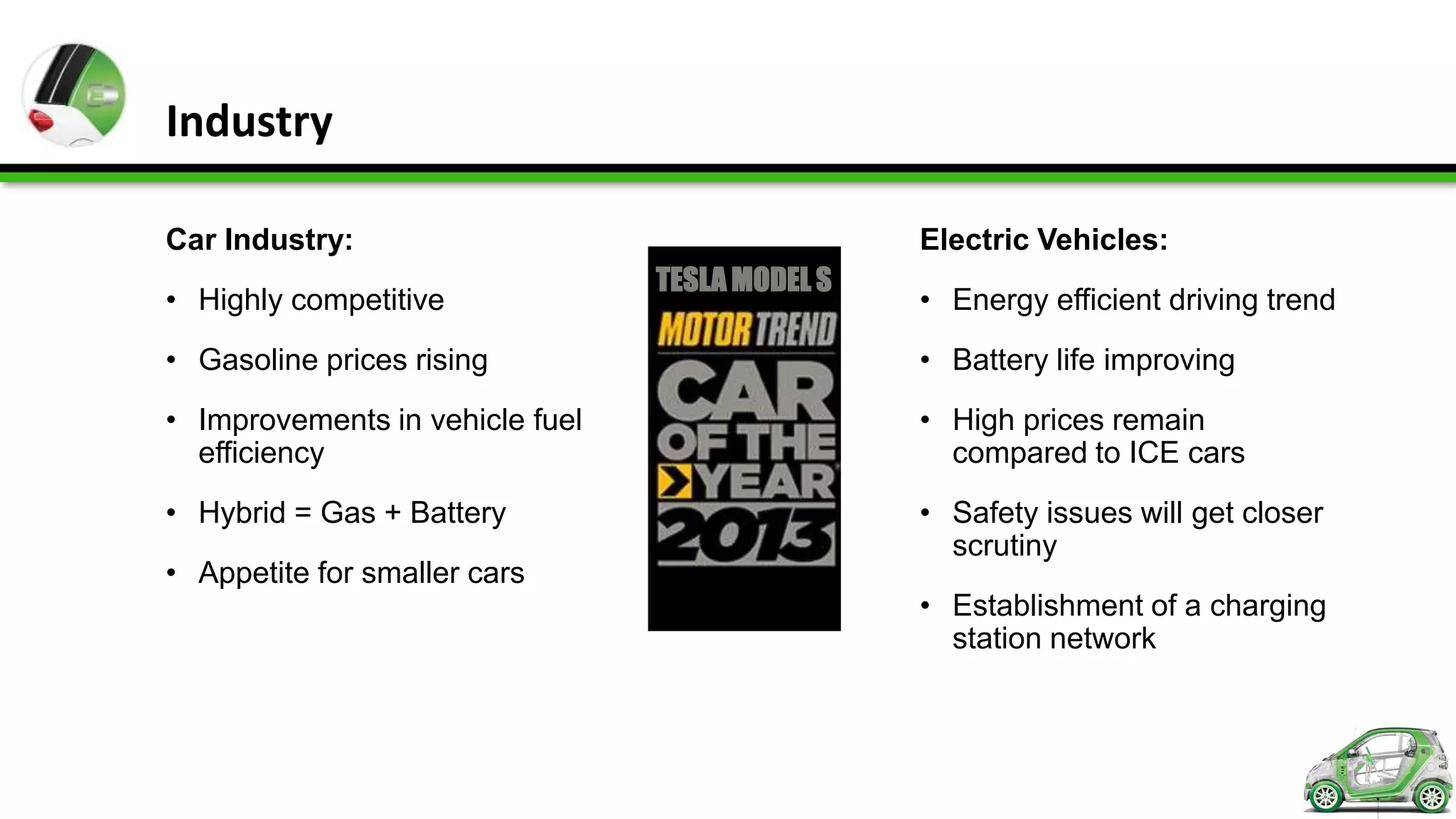

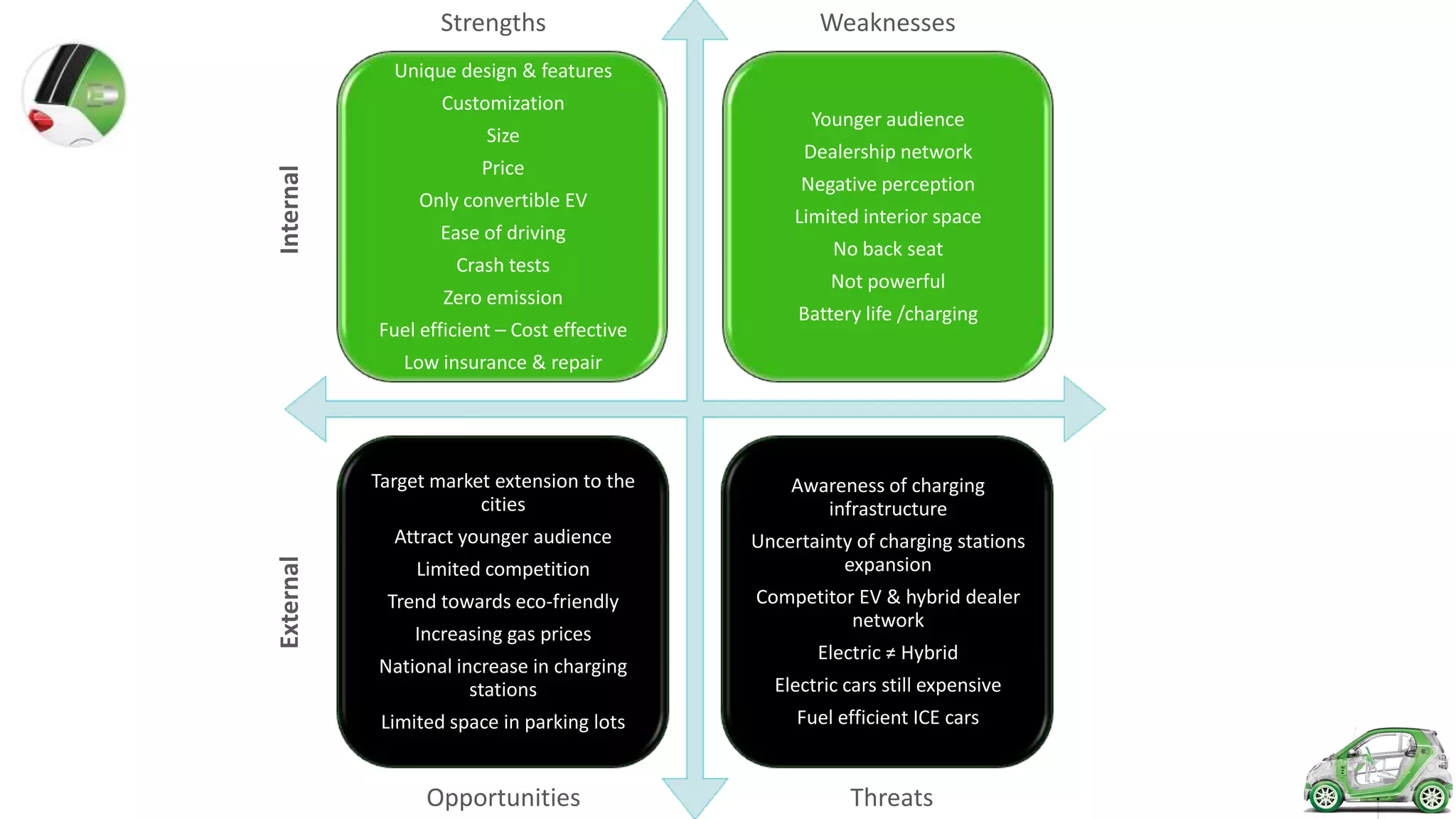

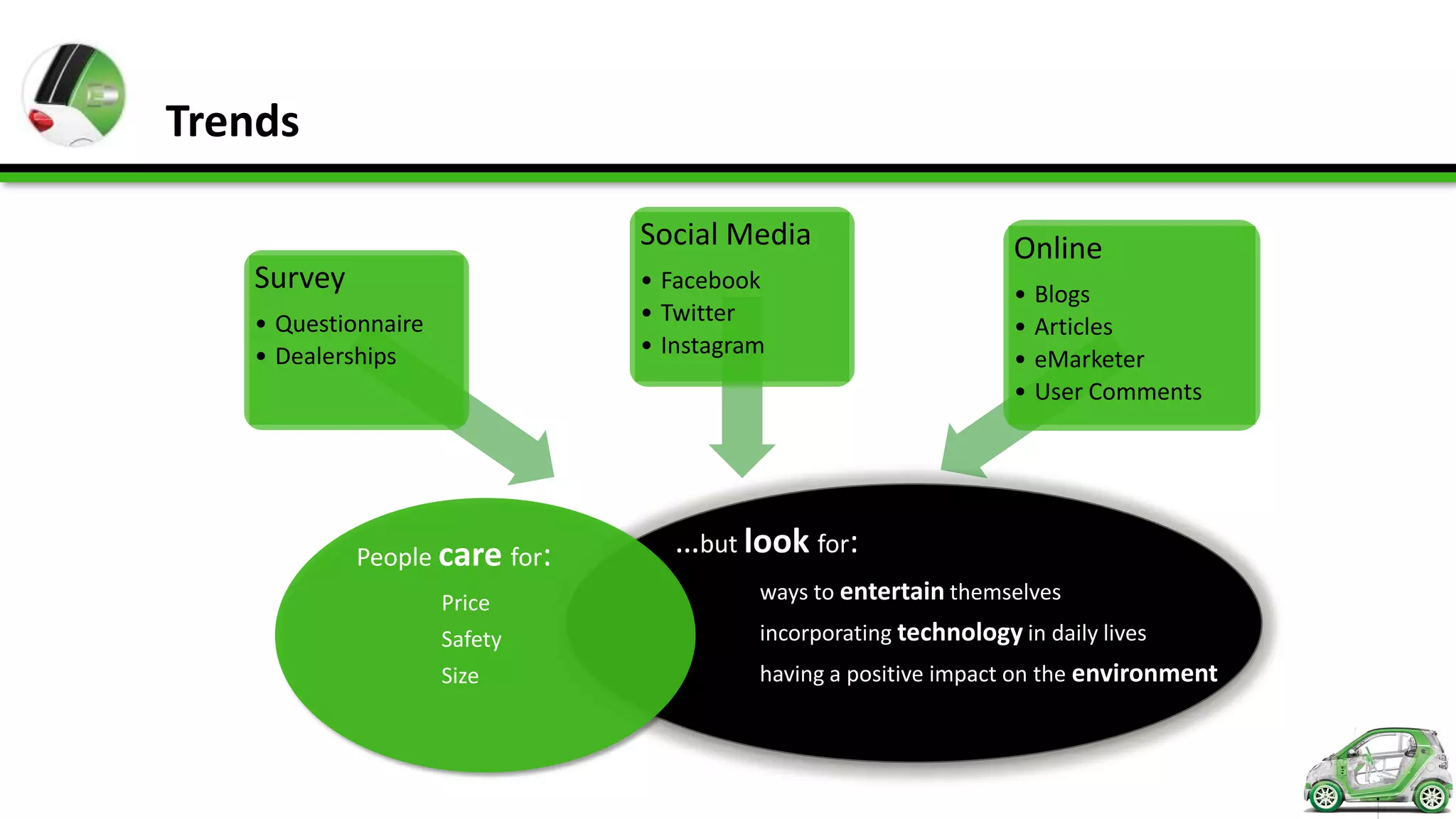

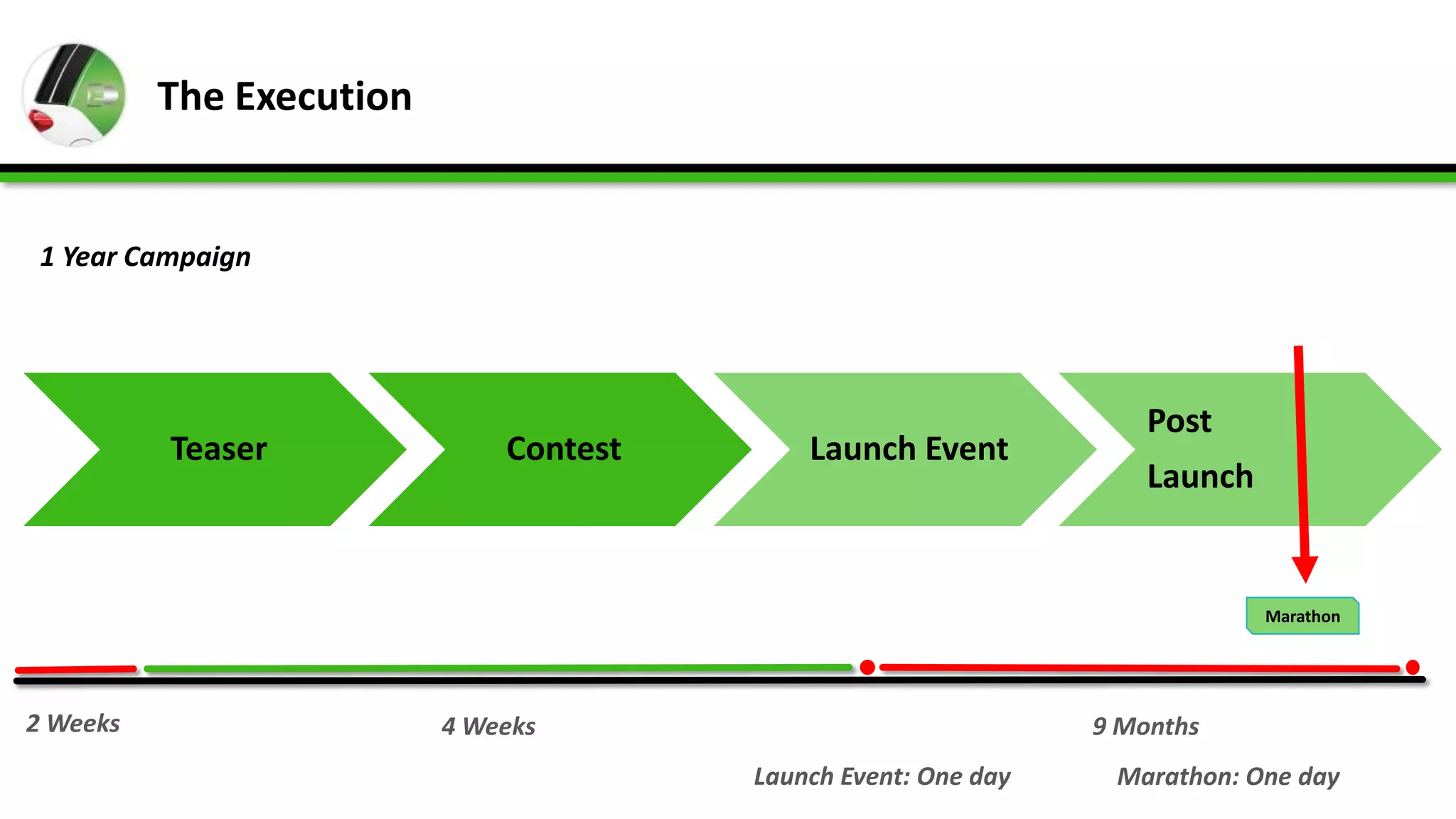

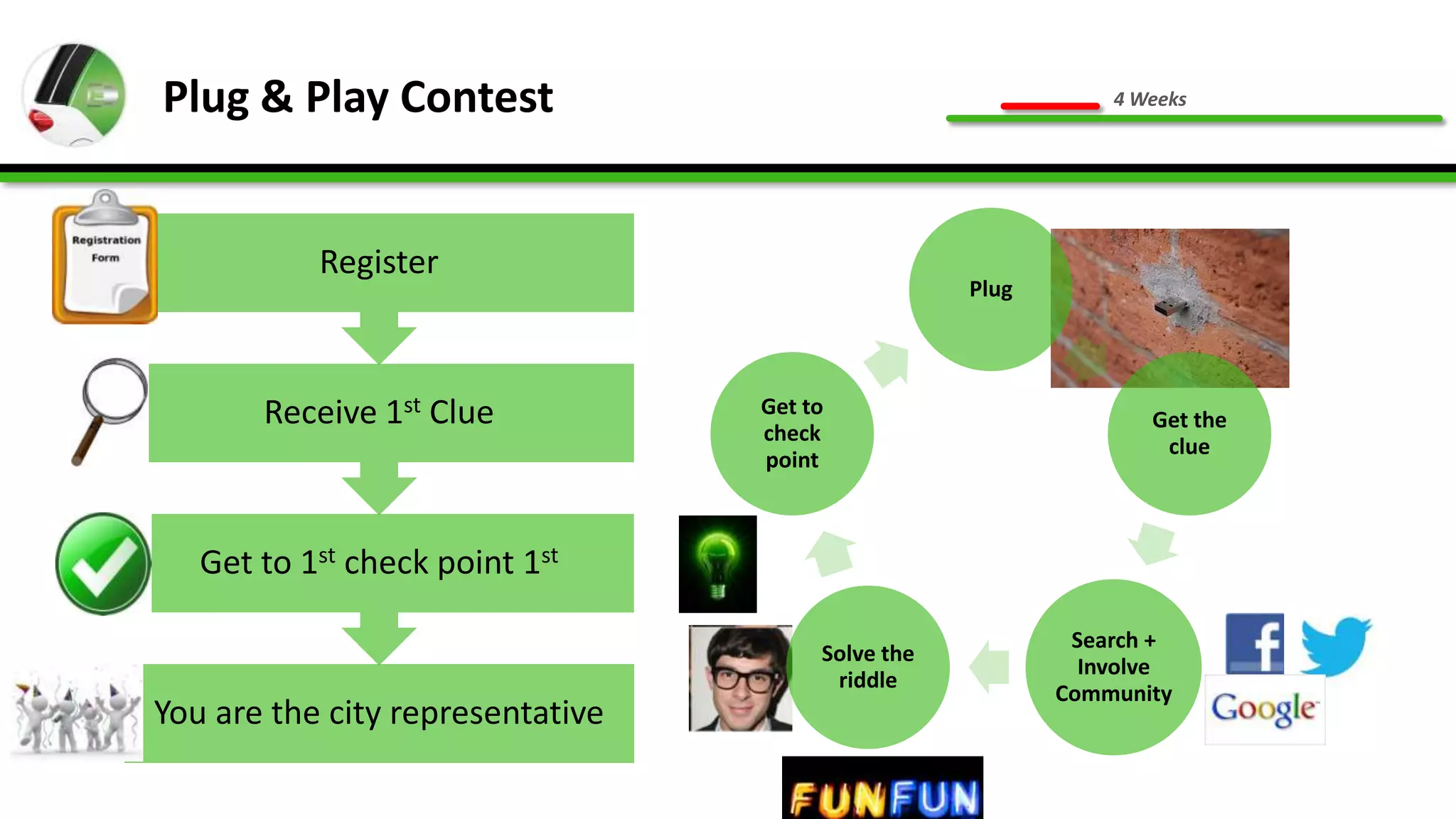

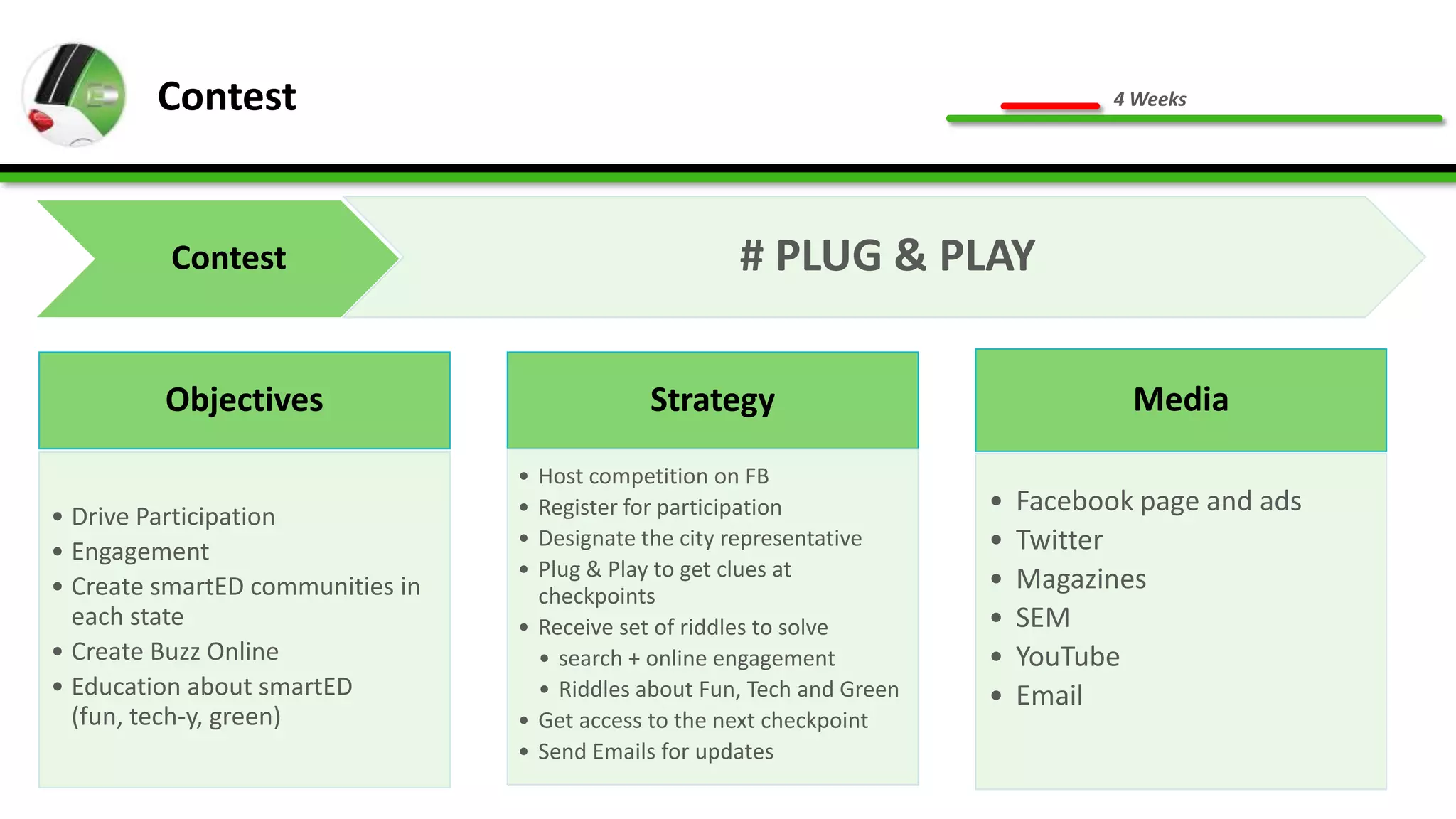

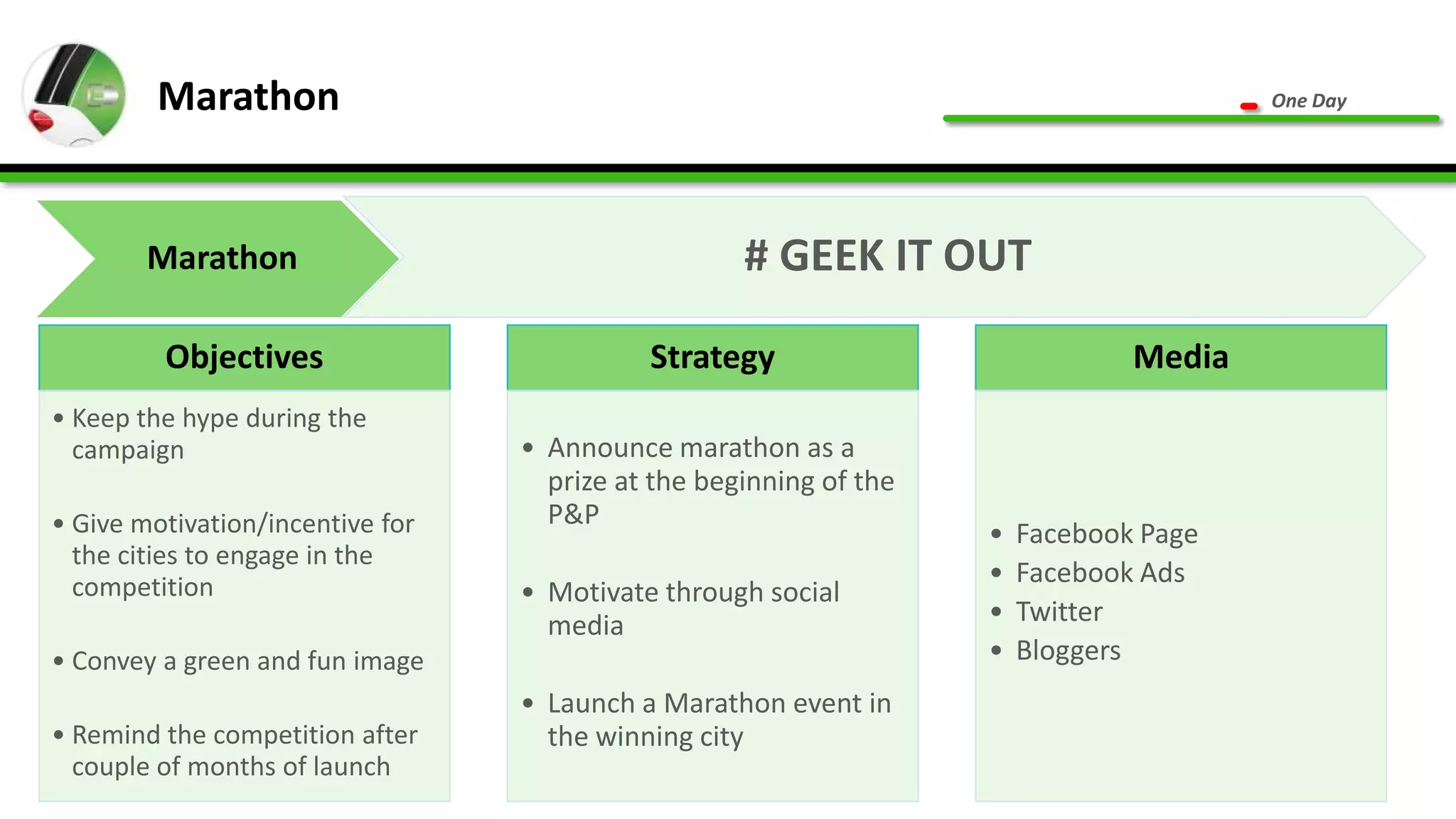

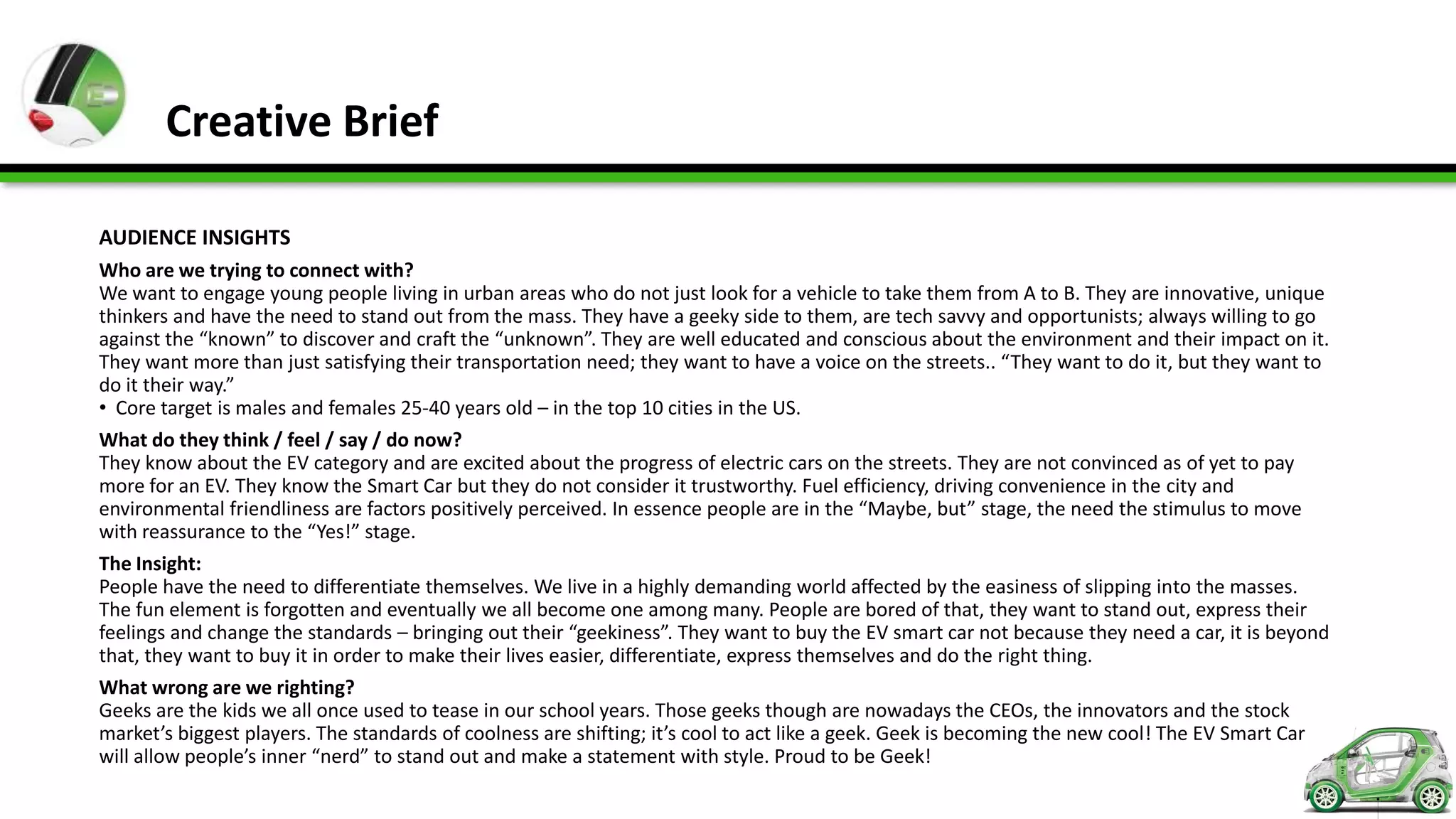

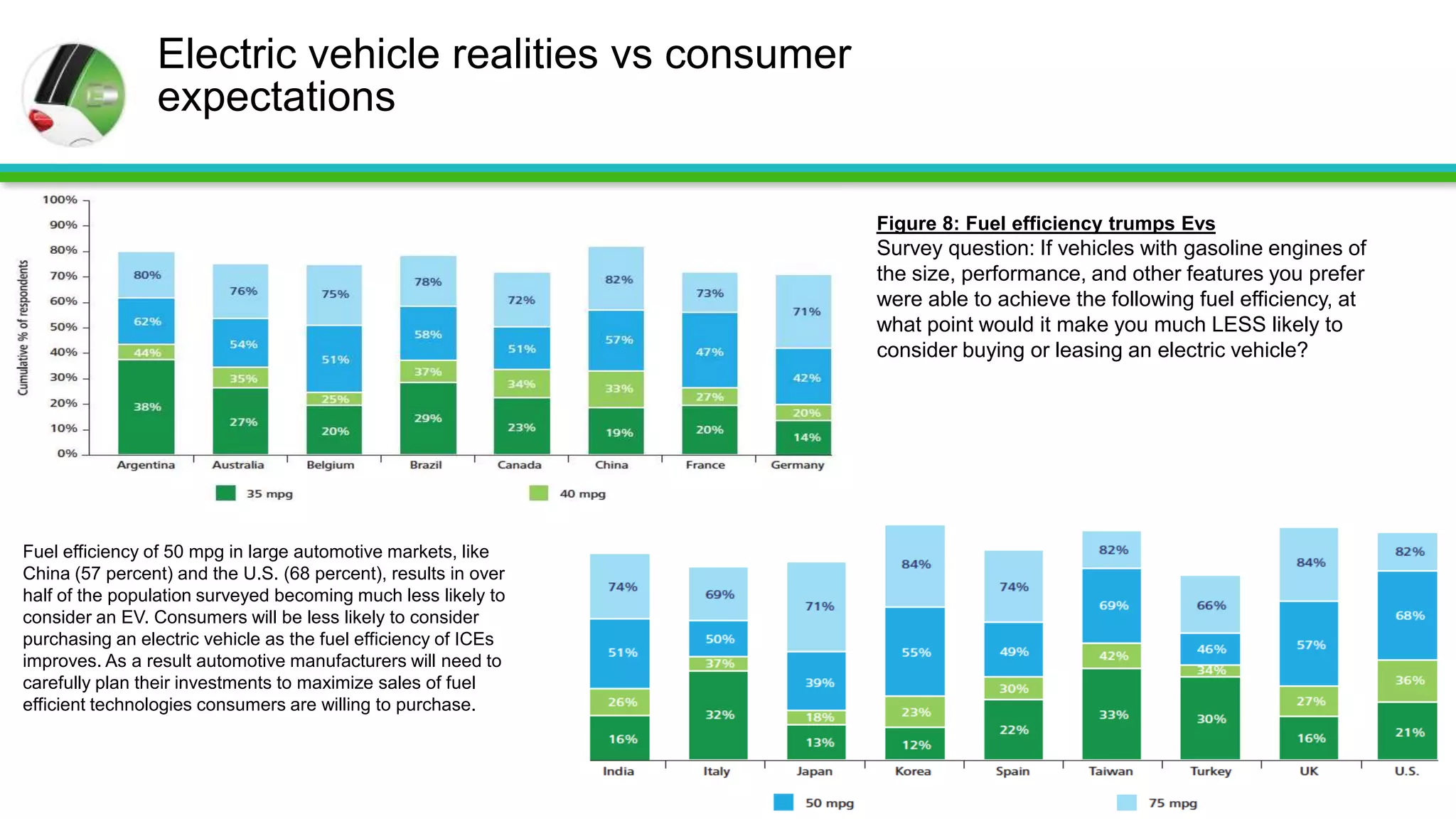

The document outlines plans for a one year marketing campaign to launch the new smart electric drive vehicle in the United States, including generating awareness through an initial teaser campaign, driving engagement with an online puzzle contest where participants solve riddles to unlock clues across different cities, and culminating with a launch event and longer term social media presence to promote the brand's message that being green, tech-savvy and unique is the new definition of "cool".

![Competition Financials

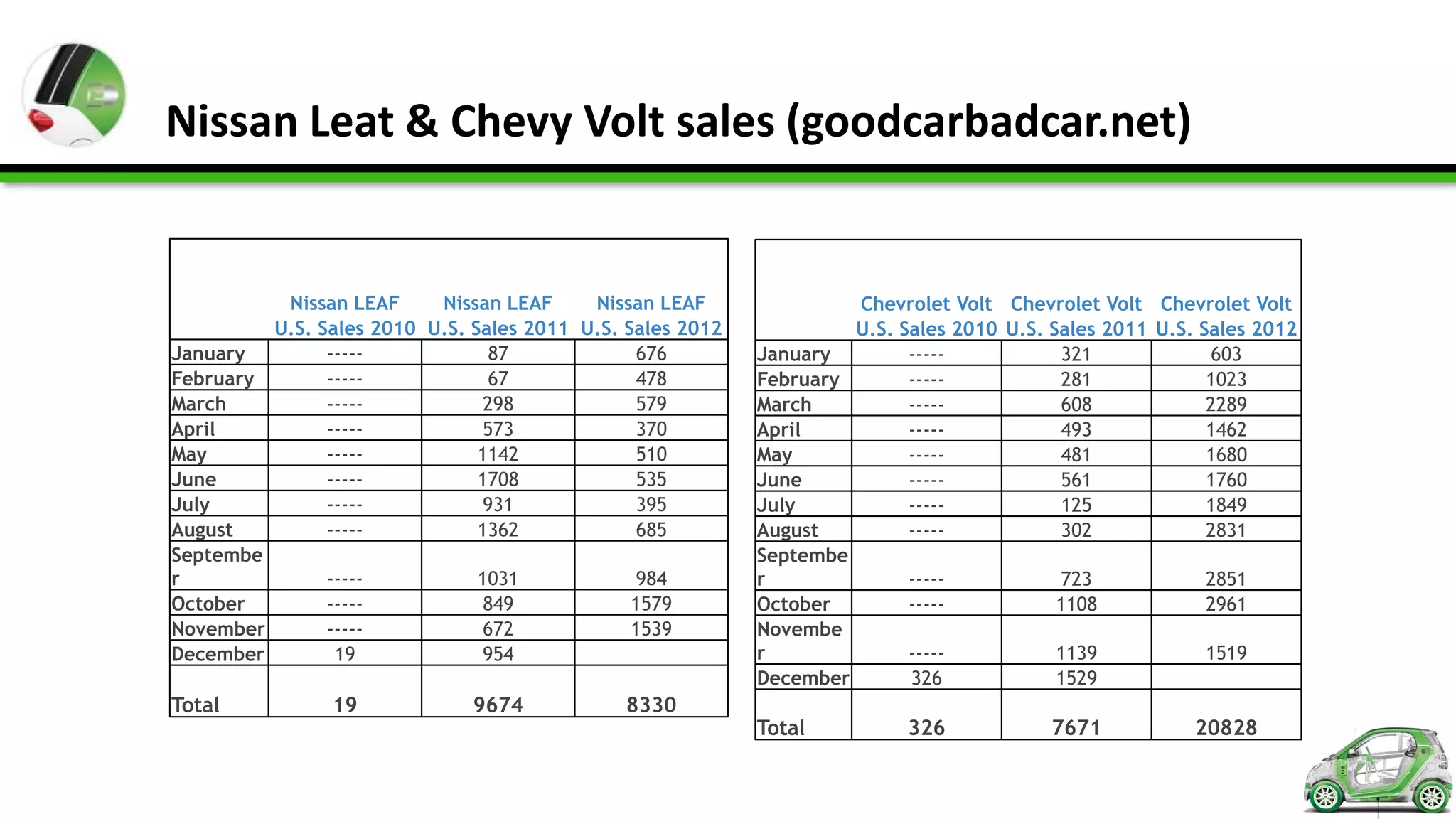

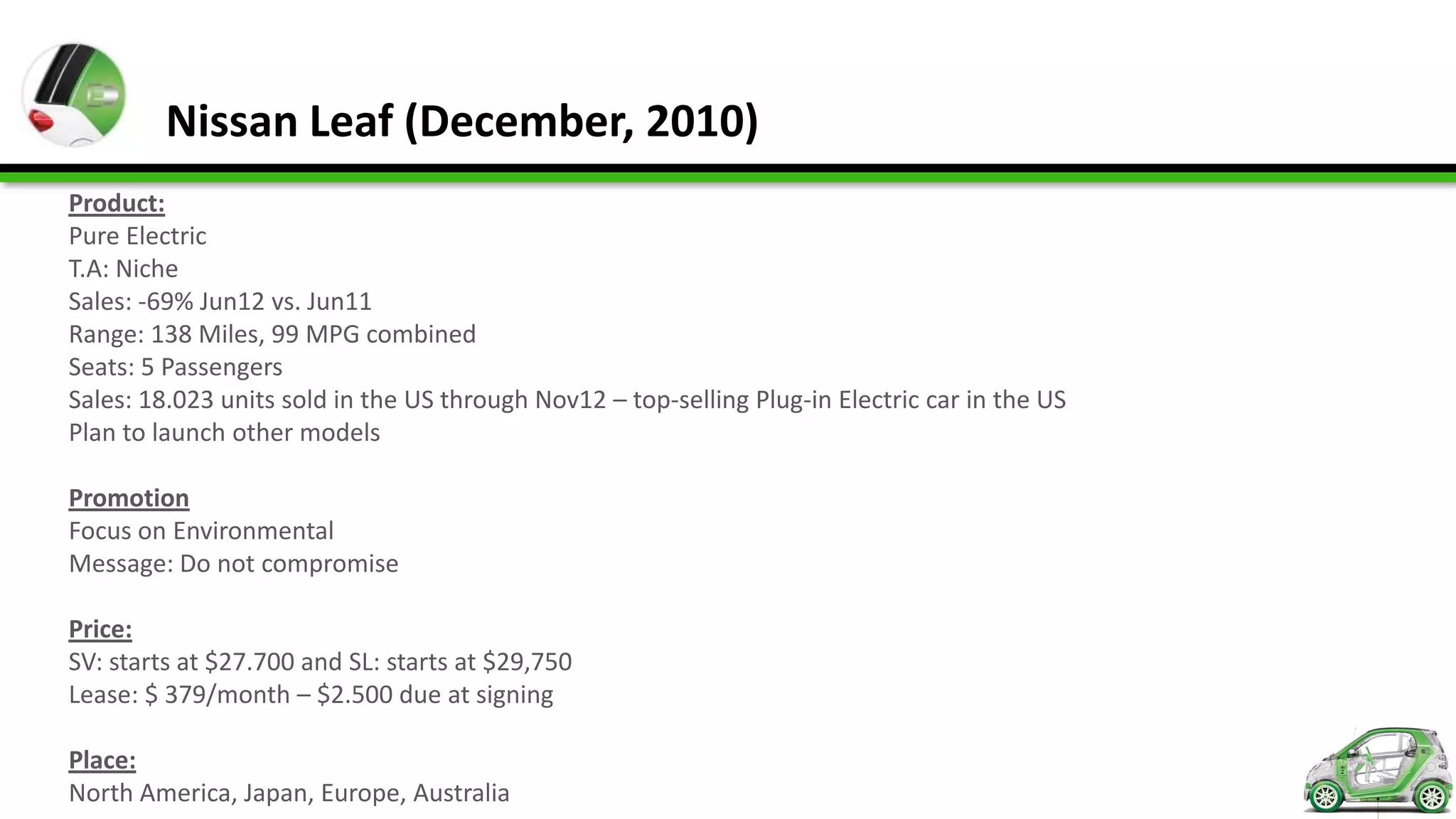

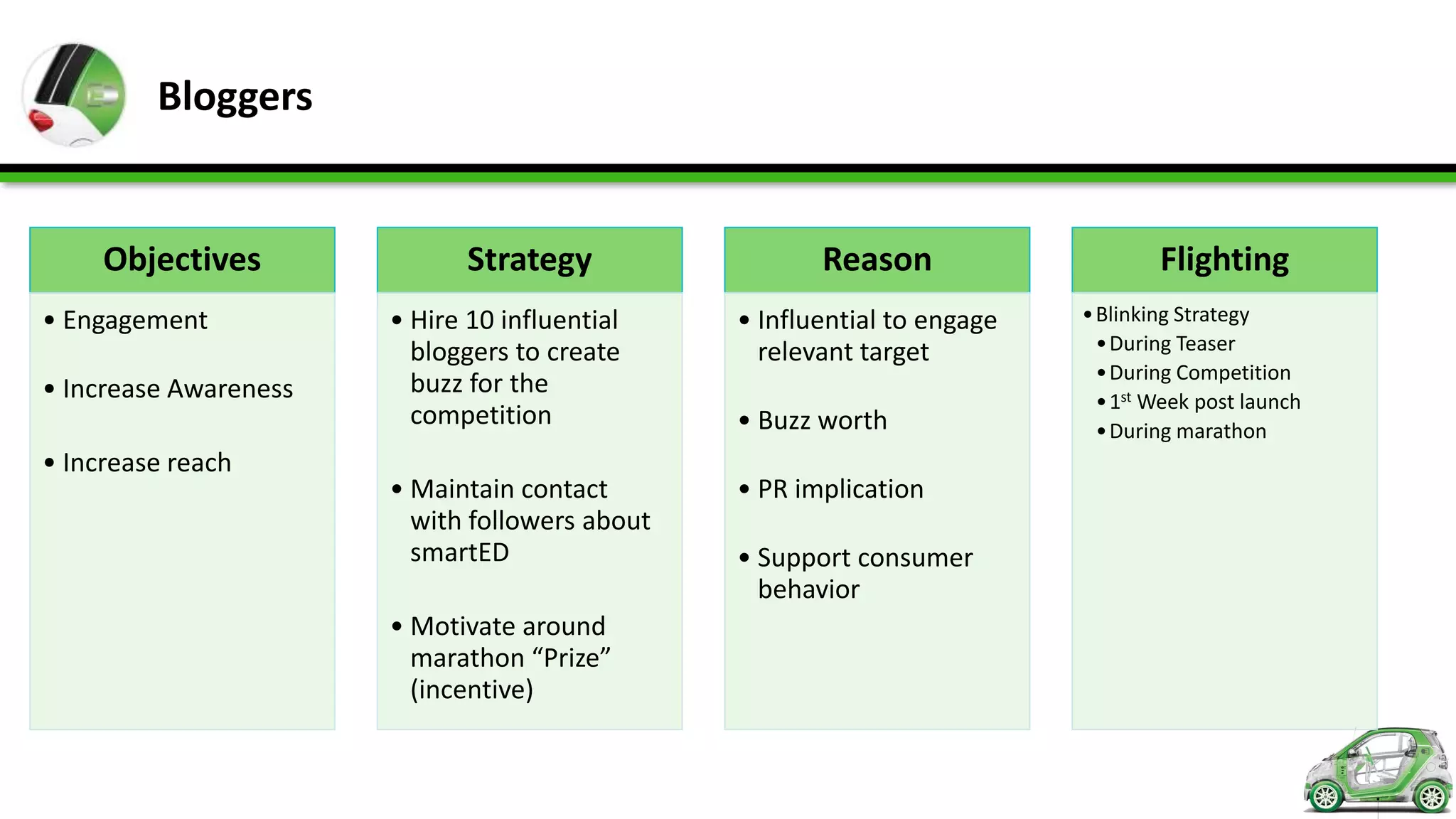

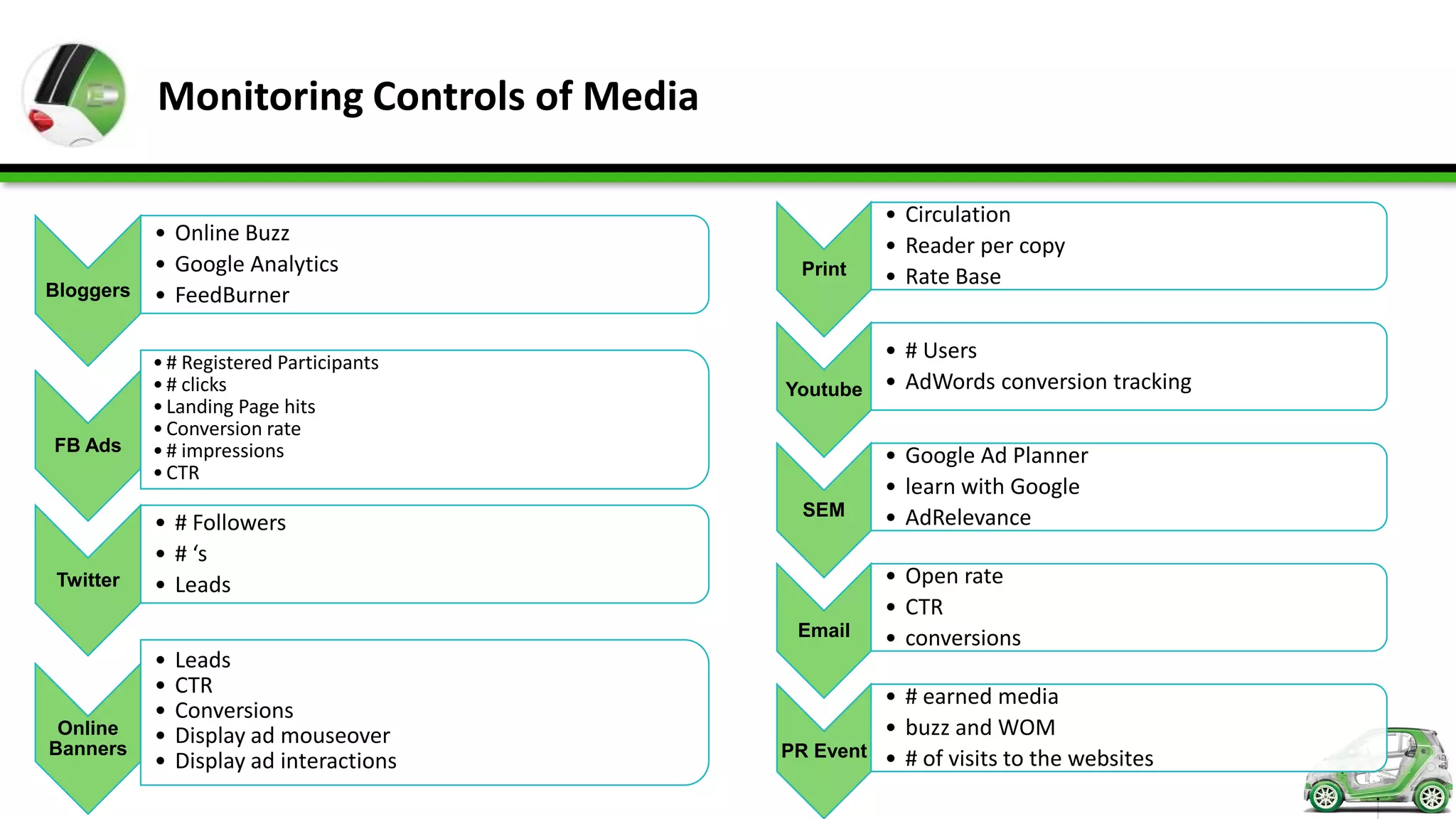

Nissan Leaf history:

• 2009: Displayed at Tokyo Motor Show

• 2010: First Nissan LEAF comes off line at Oppama Plant

• 2011: Nissan LEAF; Sales start in Europe

• New quick charger unit goes on sale

• 2012: LEAF to Home system for powering residences announced

• Awards won: 2010 Good Design Gold Award (for Holistic approach to promote zero emission

• Vehicle [Nissan LEAF] and zero emission mobility)

• 2011 European Car of the Year

• 2011 World Car of the Year

• 2012 RJC Car of the Year

• Car of the Year Japan 2011–2012

• During fiscal 2011, the Nissan LEAF passed the sales milestone to make it the world’s most

successful electric vehicle. In total, 23,000 units sold.](https://image.slidesharecdn.com/thegeekteam-smartevcampaign2013-130327211607-phpapp02/75/Smart-EV-launch-campaign-2013-86-2048.jpg)

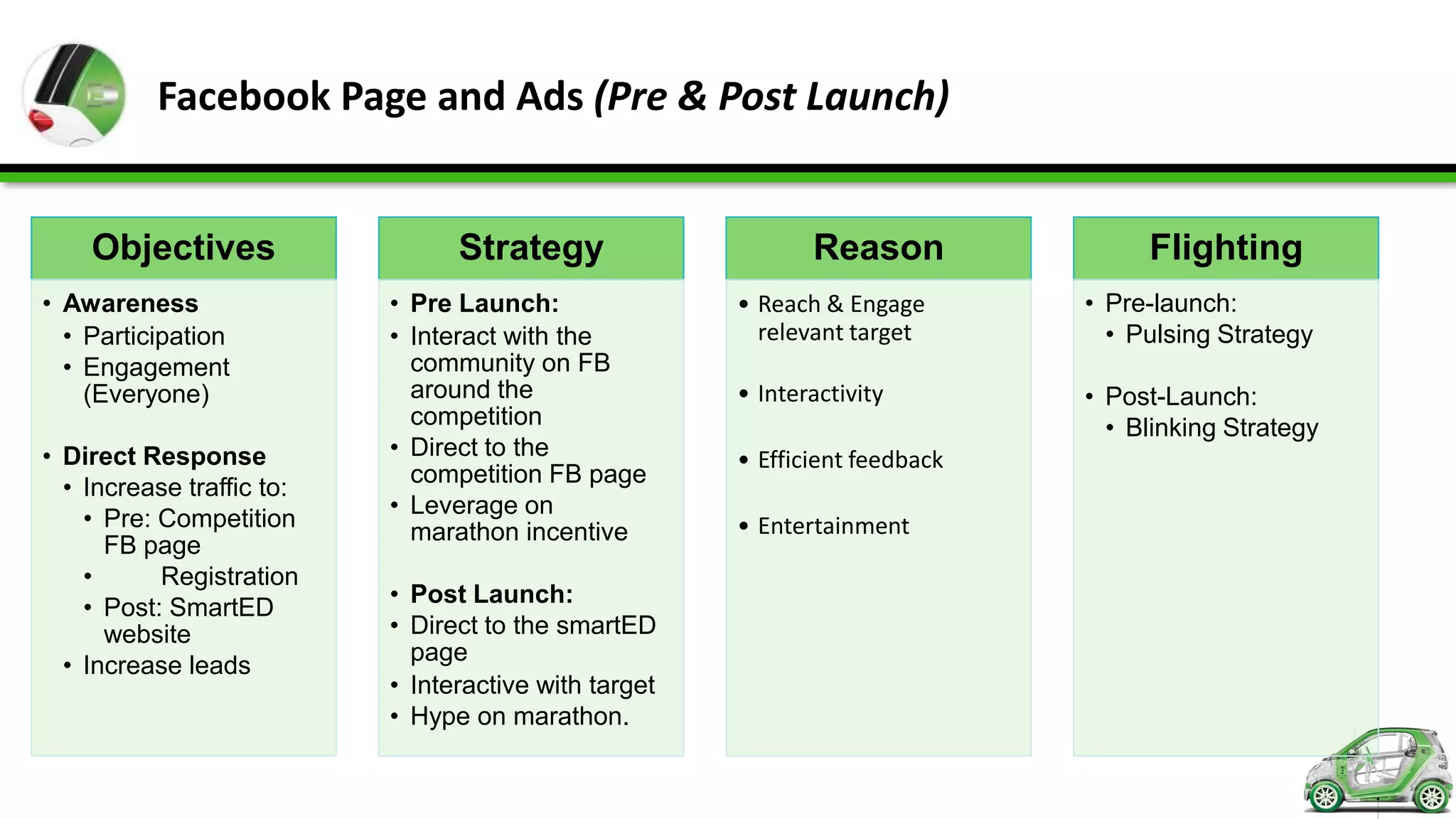

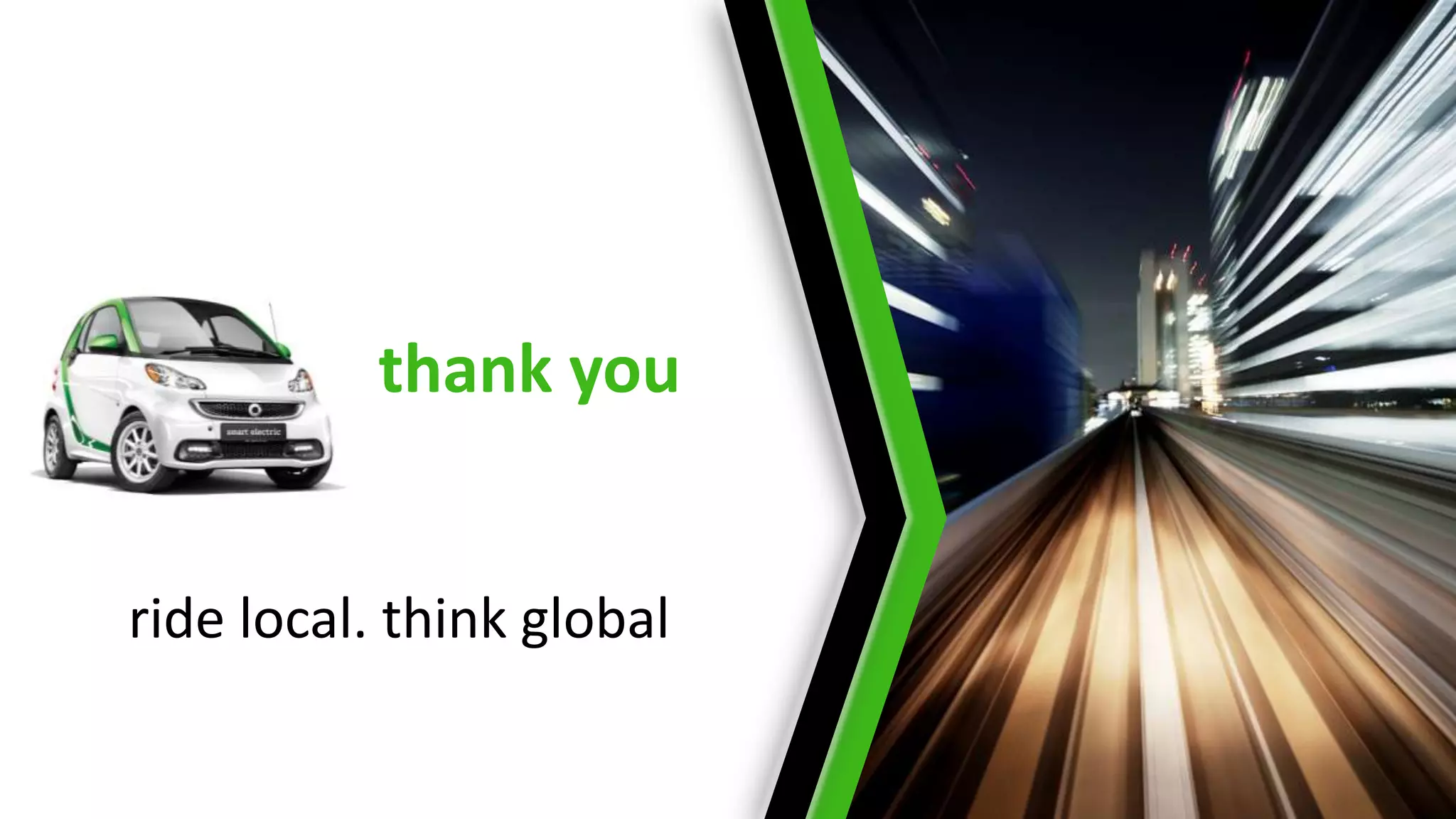

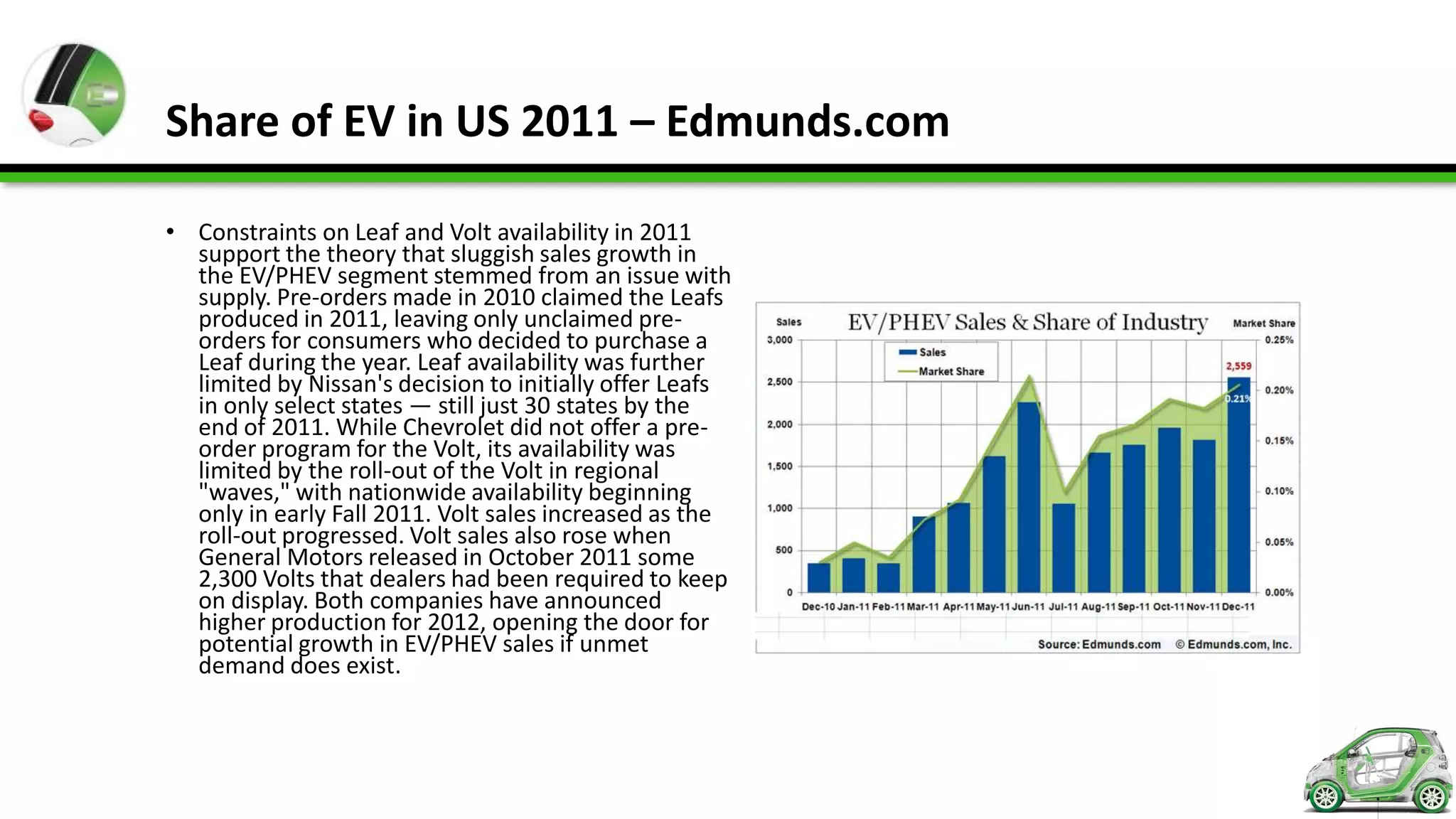

![EV Car sales in U.S. (csmonitor.com)

• Nissan sold just 984 Leafs in the U.S. in • Chevy Volt - This month's[November]

September, for a total of 5,212 so far in 2012 total may not quite equal last month's

vs. 9,674 in all of 2011. But Chevrolet sold plug-in sales of 6,784. The big

2,851 Volts in September for 16,348 so far unknown, however, is deliveries of the

this year, up from 7,671 in all of 2011. Tesla Model S--which Tesla won't discuss.

• [November] Sales of the Nissan Leaf battery- • With just a month left in the year, up to

electric car rose to 1,539, almost matching 50,000 electric cars are likely to find

last month's total of 1,579, and more than buyers during 2012--almost triple the

double its November sales of 672 a year ago. 2011 total of about 17,500.

November marks only the second time this

year that more than 1,000 Leafs have found • This year's sales leader, the Chevy Volt

buyers. range-extended electric car, logged 1,519

sales.

• That still leaves the Leaf in third

place, however, with 8,330 sales so far this • That brings the Volt's total so far this year

year. If the December sales keep pace, it will to 20,828, though the November number

at least ensure that more Leafs are sold this is barely more than half the October total

year than last year's 9,674. of 2,961--a number helped bynow-

expired sales incentives.](https://image.slidesharecdn.com/thegeekteam-smartevcampaign2013-130327211607-phpapp02/75/Smart-EV-launch-campaign-2013-89-2048.jpg)