- 42% of Romanians are "Feeling the Brunt" of the recession, almost double the number in an international survey, with 86% considering the economic situation to have worsened in the last 6 months. They are pessimistic about the future.

- Television remains the primary source of information, but 70% of Romanians check news of the recession daily online as the internet allows for multiple sources. Newspapers are still key information sources but via their online editions.

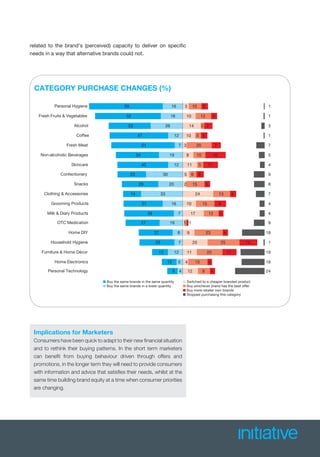

- Consumers have reassessed their needs versus wants and changed shopping habits, with 59% shopping in lower-price stores and 66% seeking promotions. This has impacted purchasing across many categories as consumers prioritize necessities over brands.