McKinsey Survey: French B2B decision maker response to COVID-19 crisis

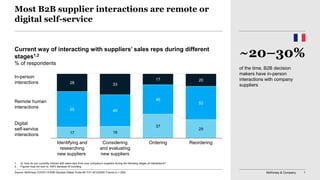

- 1. McKinsey & Company 1 17 18 37 29 55 49 46 52 28 33 17 20 Considering and evaluating new suppliers ReorderingIdentifying and researching new suppliers Ordering Most B2B supplier interactions are remote or digital self-service Current way of interacting with suppliers’ sales reps during different stages1,2 % of respondents 1. Q: How do you currently interact with sales reps from your company’s suppliers during the following stages of interactions? 2. Figures may not sum to 100% because of rounding. In-person interactions Remote human interactions Digital self-service interactions Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) of the time, B2B decision makers have in-person interactions with company suppliers ~20–30%

- 2. McKinsey & Company 2 20 19 32 30 51 52 48 46 29 29 20 24 Identifying and researching new suppliers ReorderingOrderingConsidering and evaluating new suppliers This current remote and self-service sales model is exactly what is preferred by B2B buyers Preferred way of interacting with sales reps of company’s suppliers during different stages1,2 % of respondents 1. Q: How would you prefer to interact with sales reps from your company’s suppliers during the following stages of interactions? 2. Figures may not sum to 100% because of rounding. In-person interactions Remote human interactions Digital self-service interactions Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) of B2B decision makers prefer remote human interactions or digital self-service instead of in-person interactions, citing easier scheduling, safety, and savings on travel expenses as their top three reasons why ~70–80%

- 3. McKinsey & Company 3 Three in four B2B decision makers believe the new (mostly remote) sales model is as effective or more so now than prior to COVID-19 Effectiveness of new sales model in reaching and serving customers1,2 % of respondents 18 26 40 13 4 13 32 36 16 4 48% as effective or more so compared to prior to COVID-19 24 42 23 7 5 49% as effective or more so compared to prior to COVID-19 71% as effective or more so compared to prior to COVID-19 April 3 April 28 August 10 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 200); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/28/2020 (n = 219): McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 (n = 200) Much less effective Somewhat less effective As effective as before Somewhat more effective Much more effective 1. Q: How effective is your company’s new sales model at reaching and serving customers? 2. Figures may not sum to 100% because of rounding.

- 4. McKinsey & Company 4 Both SMB and enterprise B2B decision makers view the new sales model to be just as effective or more so 1. Q: How effective is your company’s new sales model at reaching and serving customers? 2. Figures may not sum to 100% because of rounding. 3. SMBs are companies with annual revenue less than US $100 million. 4. Enterprises are companies with annual revenue equal to or more than US $100 million. 5 12 20 53 10 April 3 37% 42% 64% Effectiveness of new sales model in reaching and serving customers1,2 % of respondents SMB3 Enterprise4 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #1 4/2–4/3/2020 (n = 200); McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/28/2020 (n = 219); McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 (n = 200) 8 32 46 12 2 April 28 18 42 24 13 4 August 10 20 28 34 14 4 April 3 52% 52% as effective or more so compared to prior to COVID-19 76% 15 32 31 17 5 April 28 6 27 43 22 3 August 10 Much less effective Somewhat less effective As effective as before Somewhat more effective Much more effective

- 5. McKinsey & Company 5 B2B decision makers believe the new model is just as effective for prospecting as it is for existing customers Effectiveness of new sales model at reaching and serving customers and in acquiring new customers1,2,3 % of respondents 22 35 28 10 6 August 10 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) Somewhat less effective As effective as before Somewhat more effective Much more effective Much less effective 63% as effective or more so compared to prior to COVID-19 1. Q: How effective is your company’s new sales model at reaching and serving customers? 2. Q: How effective is the new sales model in acquiring new customers (eg, those that have never purchased from your organization before)? 3. Figures may not sum to 100% because of rounding. Current customers New customers August 10 24 42 23 5 7 71% as effective or more so compared to prior to COVID-19

- 6. McKinsey & Company 6 The effectiveness of the new model has some variations across industries and customer interaction types 1. Effectiveness: % of companies who think new sales model is as effective or more effective. 2. Q: How effective is your company’s new sales model at reaching and serving customers overall? 3. Q: How effective is the new sales model in acquiring new customers (eg, those that have never purchased from your organization before)? 4. SMBs are companies with annual revenue less than US $100 million. 5. Enterprises are companies with annual revenue equal to or more than US $100 million. Effectivenesss1 of new sales model in reaching and serving customers and acquiring new customers2,3 % of respondents Effectiveness: % of companies who think new sales model is as effective or more effective <60% 61% to 70% 71% to 80% 81% to 90% >90% Consumer/retail Global finance, banking, and insurance Travel, transportation, and logistics Pharma and medical products Global energy and materials Technology, media, and telecom Advanced industries Overall effectiveness Reaching and serving customers Reaching and serving customers Acquiring new customers Acquiring new customers SMB4 Enterprise5 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200)

- 7. McKinsey & Company 7 48 26 11 10 2 I would not make a purchase via end-to-end digital self-service under $50,000 $50,000 to < $500,000 $500,000 to < $1 million $1 million or more Remote and self-service is not just for low-value purchases; many spend $50K or more Maximum order value you would purchase through end-to-end digital self-service and remote human interactions for a new product or service category1,2 % of respondents 1. Q: What is the maximum order value that you would purchase through end-to-end digital self-serve and remote human interactions for a new product or service category? 2. Responses to “I don’t know” option not included for analysis. Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) would spend more than $50,000 on a completely self-serve or remote interaction 95% of B2B buyers might make a purchase in a fully end-to-end, digital self-serve model ~50%

- 8. McKinsey & Company 8 Before COVID-19 During COVID-19 The majority of B2B companies have shifted their go-to-market model from traditional to digital, with heavy reliance on video and online chat 1. Q: In what ways was your company’s product or service sold before COVID-19? 2. Q: Now today, in what ways is your company’s product or service sold during COVID-19? Go-to-market sales model during COVID-191,2 % of respondents Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 56 52 9 28 50 21 42 36 53 7 35 48 29 42 Traditional Digital interaction with sales rep Digital self-service In-person Via videoconference (eg, sales reps interacting with customers via Zoom, Skype, etc.) Phone Email Online chat (eg, chatting with customers via web chat, email, etc.) E-commerce (eg, products/services sold directly online with no sales rep involved) Fax X% % change % change -35% 2% -28% 27% -3% 36% -1%

- 9. McKinsey & Company 9 1. Q: Approximately what percentage of your company’s revenue before COVID-19 was driven by…/during COVID-19 is now driven by… 2. Figures may not sum to 100% because responses to “other” option not included in analysis, and because of rounding. Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) Before COVID-19 During COVID-19 Revenue from e-commerce, videoconference, and online chat has increased substantially -35% 13% -40% 51% -2% 53% 22% X% % change Source of revenue before and during COVID-191,2 % of revenue % change 27 18 2 10 18 4 16 17 21 1 14 17 7 19 Traditional Digital interaction with sales rep Digital self-service In-person Via video conference (eg, sales reps interacting with customers via Zoom, Skype, etc.) Phone Email Online chat (eg, chatting with customers via web chat, email, etc.) E-commerce (eg, products/services sold directly online with no sales rep involved) Fax

- 10. McKinsey & Company 10 E-commerce revenue has increased more among enterprise companies than SMBs; videoconference has increased across both Source of revenue before and during COVID-191 % of revenue 1. Q: Approximately what percentage of your company’s revenue before COVID-19 was driven by…/during COVID-19 is now driven by… 2. SMBs are companies with annual revenue less than US $100 million. 3. Enterprises are companies with annual revenue equal to or more than US $100 million. Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 15 11 17 15 E-commerce Videoconference Pre-COVID-19 During COVID-19 16 9 21 14 E-commerce Videoconference 12% and 41% 26% and 57% increase in revenue from e-commerce and videoconference, respectively for SMBs during COVID-19 compared to pre-COVID-19 increase in revenue from e-commerce and videoconference, respectively for enterprises during COVID-19 compared to pre-COVID-19 SMB2 Enterprise3

- 11. McKinsey & Company 11 Video is almost always ‘more helpful’ than audio alone 74 71 71 69 16 18 17 19 10 11 13 12 Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 1. Q: How much more or less helpful is it to use video (eg, Zoom, WebEx, Microsoft Teams) vs phone only in the following situations? 2. Q: What percentage of your customer meetings now take place via videoconference (eg, Zoom, Skype, etc.) where participants can “see” one another via video? 3. Q: If you are unable to physically meet in-person, for which of these commercial activities do you prefer video in addition to audio? Helpfulness of video (eg, Zoom, WebEx, Microsoft Teams) vs phone only in different situations1 % of respondents Meeting with others in your company Meeting with existing customers Meeting with prospects Meeting with vendors/suppliers More helpful to use video Neutral Less helpful to use video of B2B customer meetings now take place via videoconference (eg, Zoom, Microsoft Teams, Skype, etc.) where participants can see one another via video2 52% B2B buyers also believe video is preferred for:3 Demonstration of products/services Pricing negotiations Customer support/ trouble shooting Day-to-day account management

- 12. McKinsey & Company 12 Screensharing and seeing one another are the most helpful features of videoconferencing Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 1. Q: What features/functionality of video conferencing are most helpful for you? 72 68 31 30 26 Most helpful features/functionality of videoconferencing1 % of respondents ranking in top 3 Screensharing Whiteboards Breakout rooms Annotation Seeing one another

- 13. McKinsey & Company 13 7 13 42 24 14 One in three B2B companies has already reduced both their in-person sales FTEs and number of physical locations 6 6 49 23 1438% companies reduced their number of people (FTEs) on in-person sales teams by more than 4% due to COVID-19 37% companies reduced their number of physical locations using in-person sales by more than 4% due to COVID-19 Number of people (FTEs) in in-person sales Number of physical locations3 using in-person sales Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 1. Q: How has your organization changed your in-person sales team structure? 2. Figures may not sum to 100% because of rounding; responses to “not applicable” option not included for analysis. 3. Dealerships, stores, branches, etc. Reduced +11% Reduced 4–10% About the same (within ±3%) Increased 4–10% Increased +11% Changes to in-person sales team structure (changes already made)1,2 % of respondents

- 14. McKinsey & Company 14 -40 -30 0-6-48-52 -44-50 -38-42 -34-36 -32 -30 -28 -26 -24 -50 -22 -20 4-18 8-14 -12 -10 -2-8 -4 2 6-46 -40 -60 -20 -10 0 -16 10 10 Global finance, banking, and insurance Consumer/retail Advanced industries Technology, media, and telecom Pharma and medical products Travel, transportation, and logistics Global energy and materials The pharma and medical products industry is seeing the sharpest reductions in FTEs for in-person sales and physical locations Number of physical locations using in-person sales Number of people (FTEs) in in-person sales Net addition1 of people (FTEs) in in-person sales and number of physical locations (changes already made)2 % of respondents 1. Net addition: % of respondents reporting reduction subtracted from % of respondents reporting increase. 2. Q: How has your organization changed your in-person sales team structure? Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200)

- 15. McKinsey & Company 15McKinsey & Company 15 Contents The next normal of sales is here to stay—what it will take to succeed

- 16. McKinsey & Company 16 The next normal is here to stay: companies expect the new sales model to persist Source: McKinsey COVID-19 B2B Decision-Maker Pulse #2 4/23–4/28/2020 (n = 219): McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 (n = 200) 1. Q: Which of the following statements best describe the changes your company has made to its commercial and go-to-market model during COVID-19? Figures may not sum to 100% because of rounding. Staying power of new sales models1 % of respondents 88% are “very likely” and “somewhat likely” to sustain these shifts 12+ months after COVID-19, up from 76% in April 2020 33 43 22 2 41 47 10 3 April 28 August 10 Very likely to sustain 12+ months after Somewhat likely to sustain 12 months after Unlikely to sustain 12 months after Made no GTM changes

- 17. McKinsey & Company 17 8 29 23 28 13 In-person meetings might not return at scale until 2021; even then, more than half are expected to remain virtual 17 49 27 8 37% of B2B companies expect to have in-person meetings again in 2021 66% of B2B companies expect to have less than 50% in-person interactions even when their sales force is capable of having in-person meetings again Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) Quarter when sales force is expected to have in-person meetings again1 % of respondents In-person vs remote interactions (when your sales force is capable of having in-person meetings)2 % of respondents 1. Q: When do you expect your sales force to have in-person meetings again? Figures may not sum to 100% because of rounding. 2. Q: When your sales force is capable of having in-person meetings, what percent of interactions do you think will be in-person vs remote? Figures may not sum to 100% because of rounding. 76–100% in-person 51–75% in-person 26–50% in-person 1–25% in-person Aug–Sep 2020 Oct–Dec 2020 Jan–Mar 2021 Apr 2021 or later Already having in-person meetings

- 18. McKinsey & Company 18 Most companies believe that their sales teams need both skill building and technology for effective remote selling 1. Q: How much do you agree or disagree with the following statements? 2. Q: Thinking about your company’s future in the context of COVID-19, how much do you agree or disagree with the following statements? Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) 75% 83% 76% Tech beyond videoconference Additional skills for in-person to remote transition Basic video technology “Strongly agree,” “agree,” and “somewhat agree” 63% 68% New profiles of sales reps Redesigned sales trainings B2B companies believe that they have both capabilities and technology to sell today, however… 77% 87% Have both capabilities and technology to effectively sell today Need both skill building and technology 3 in 4 companies believe that they need to further develop both capabilities and technology ~90% B2Bs believe that their sales teams need to adjust to the following terms1 % of respondents Skills and technologies needed2 % of respondents

- 19. McKinsey & Company 19 Half of B2B companies are looking to potentially reduce their numbers of sales reps as they refine their overall sales model 37 52 Have already reduced Expect to reduce going forward 1.4X 1. Thinking about your company’s future in the context of COVID-19, how much do you agree or disagree with the following statements? 2. How has your organization changed your in-person sales team structure? 3. For example, ability to shift sales rep territories or quotas mid-year to target higher-value opportunities. 52% 66% 68% 76% Will be decreasing the number of sales reps Need to switch to a different, more dynamic resourcing model Will be redefining sales roles to focus on different sales methods Will introduce a more agile sales planning process3 B2B companies believe that they need to adjust to the following terms as new normal1 % of respondents …and as an implication, future reductions in the number of sales reps are expected1,2 % of respondents “Strongly agree,” “agree,” and “somewhat agree” Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200)

- 20. McKinsey & Company 20 Companies expect to make other adjustments in addition to shifting their sales model 1. How much do you agree or disagree with the following statements? Source: McKinsey COVID-19 B2B Decision-Maker Pulse #3 7/31–8/10/2020 France (n = 200) B2B companies believe that they need to adjust to the following terms as new normal1 % of respondents % of respondents who agree (includes “strongly agree,” “agree,” and “somewhat agree”) <60% 61% to 70% 71% to 80% 81% to 90% >90% Overall France (all industries) Advanced industries Technology, media, and telecom Global energy and materials Pharma and medical products Travel, transport, and logistics Consumer/ retail Will shift geographic focus to areas of lower risk for COVID-19 Will introduce new products or services as a result of COVID-19 Will increase focus on long-term sustainability of products and services Global finance, banking, and insurance