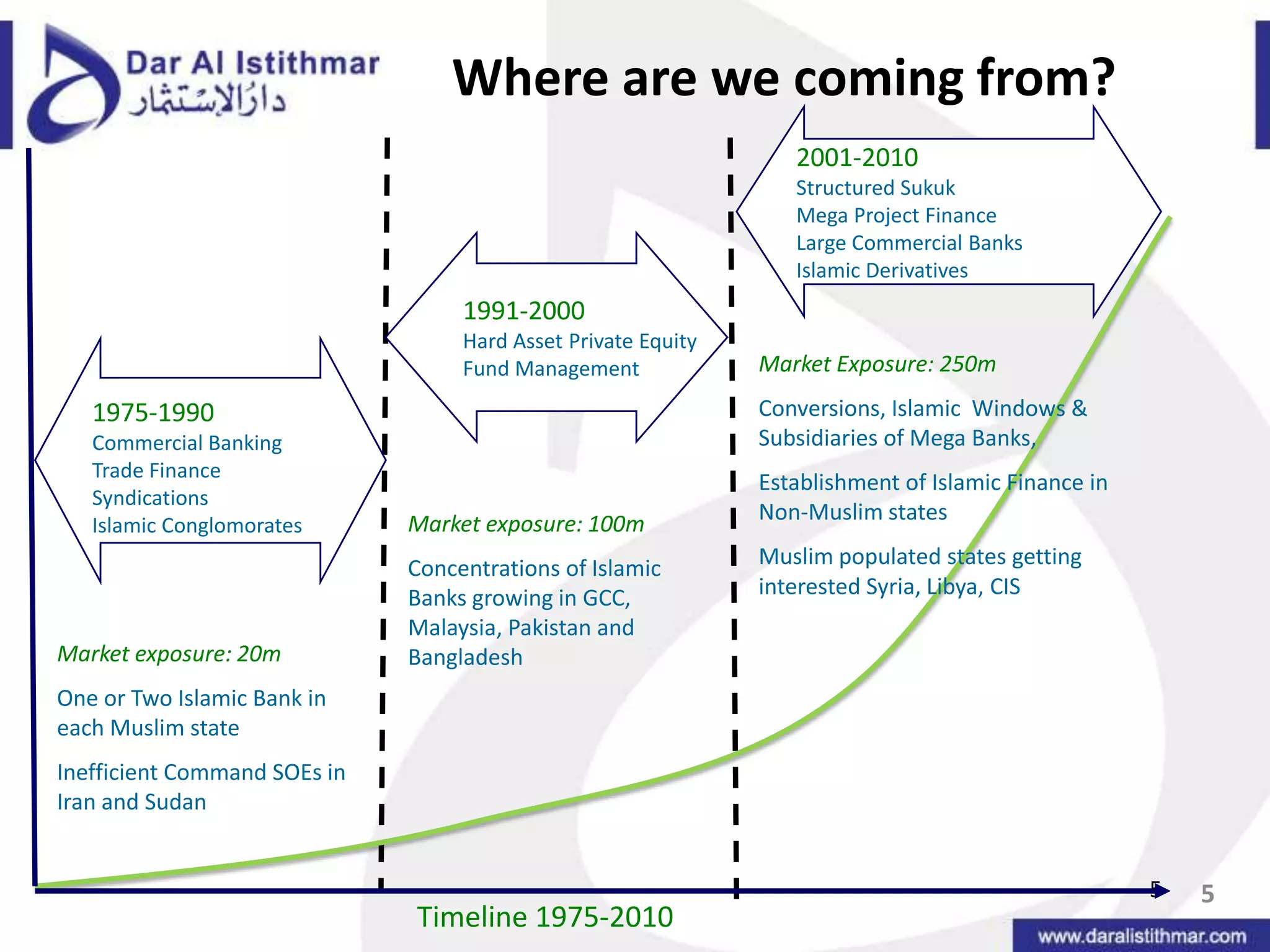

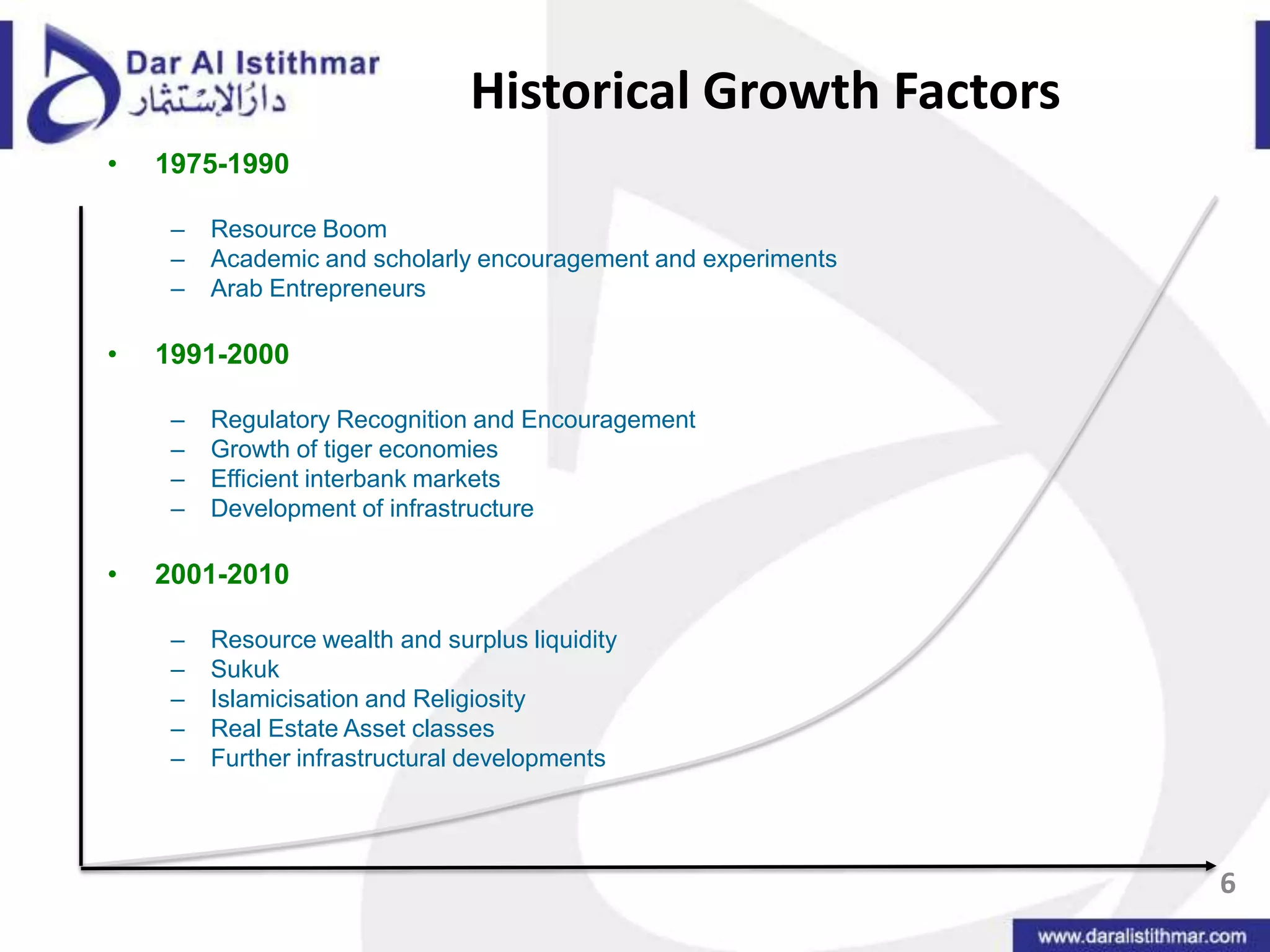

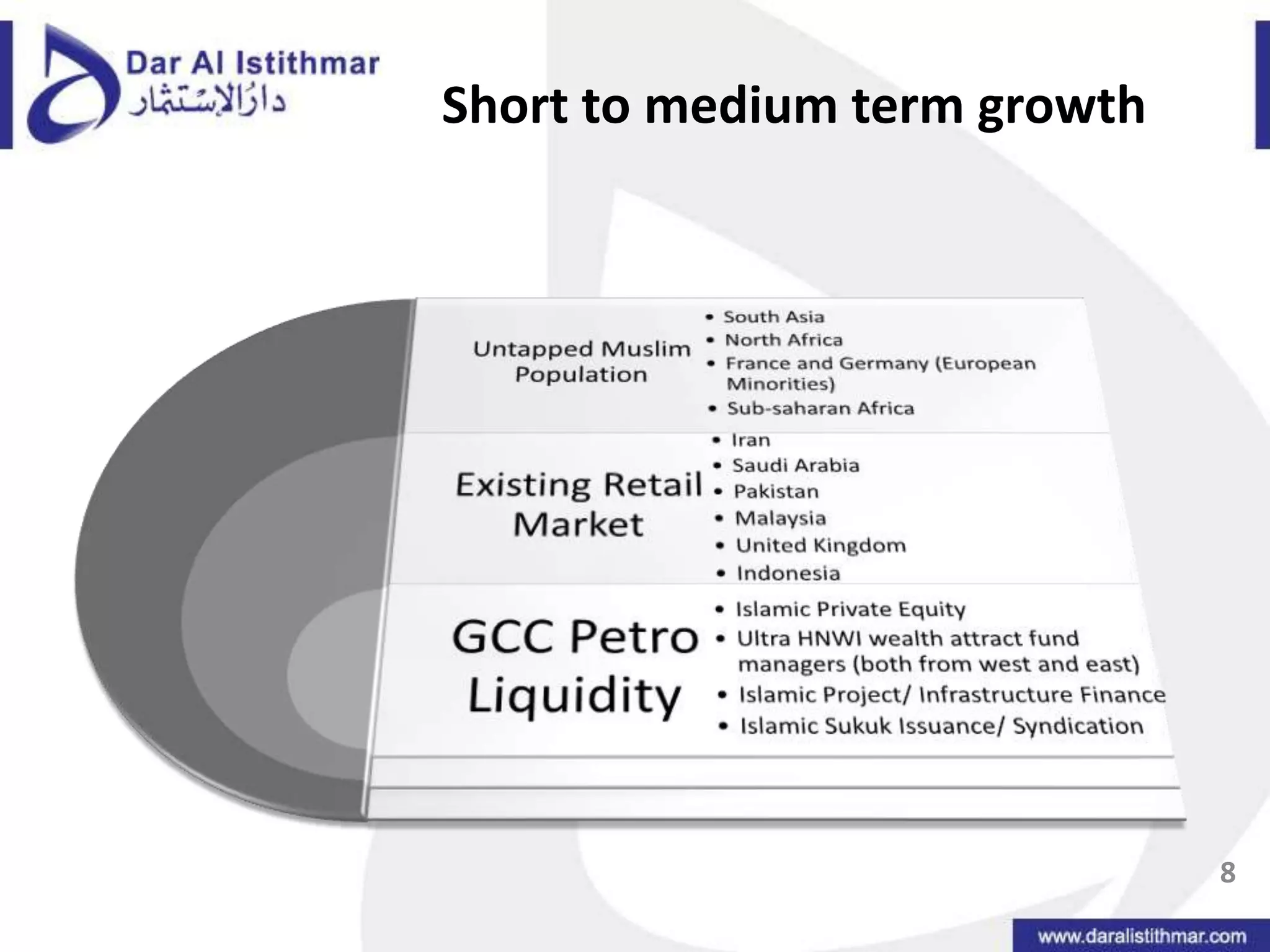

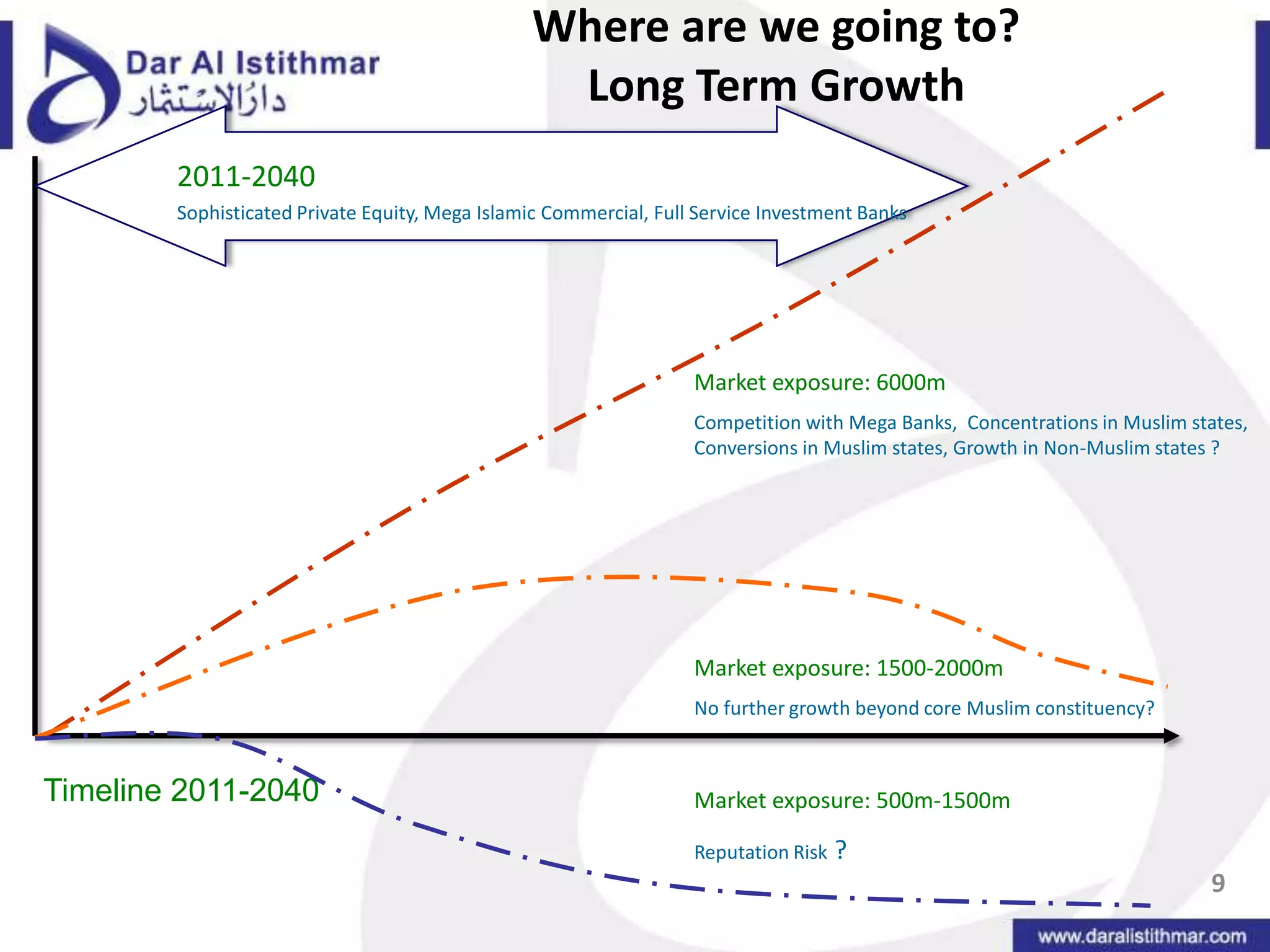

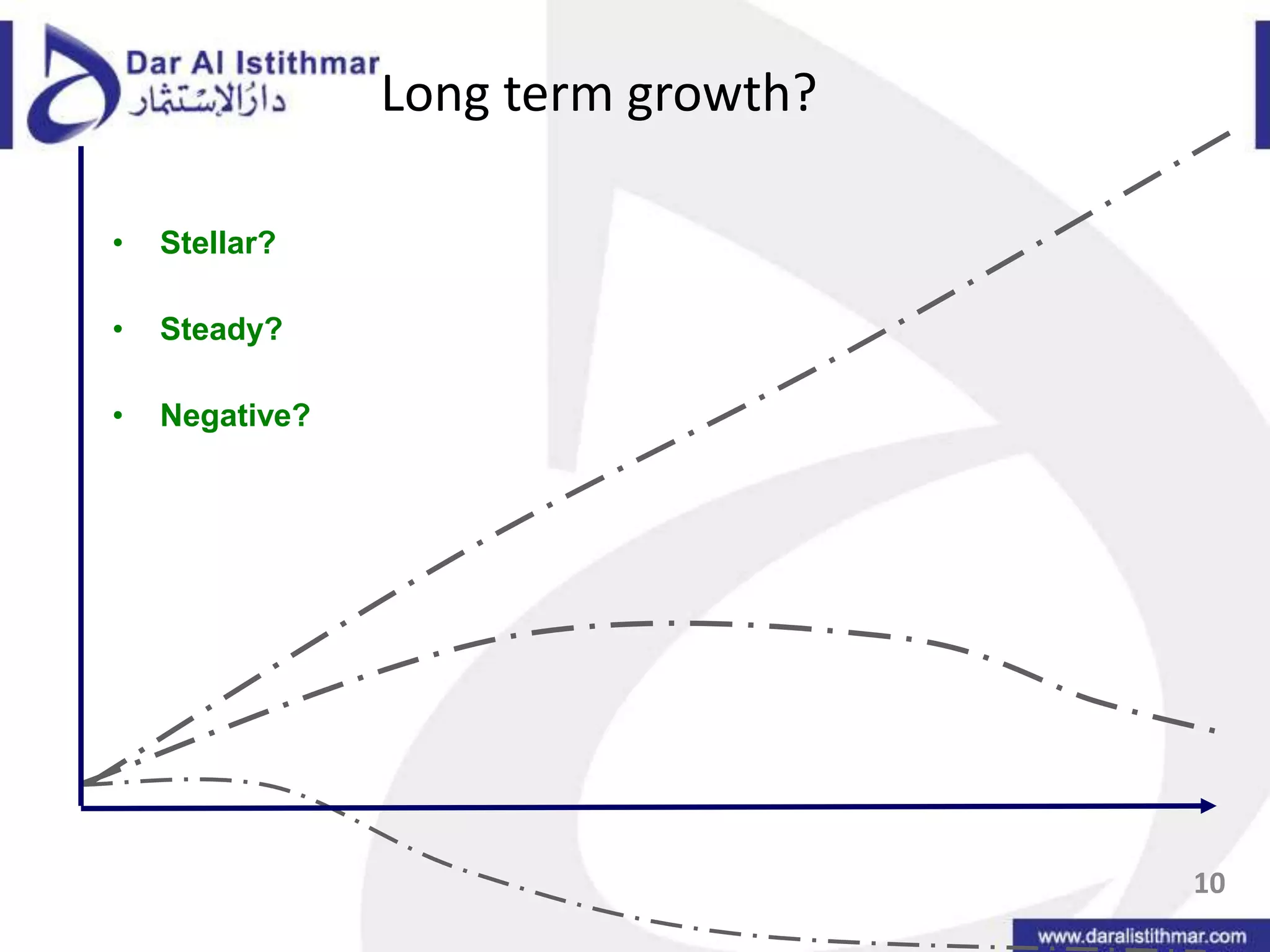

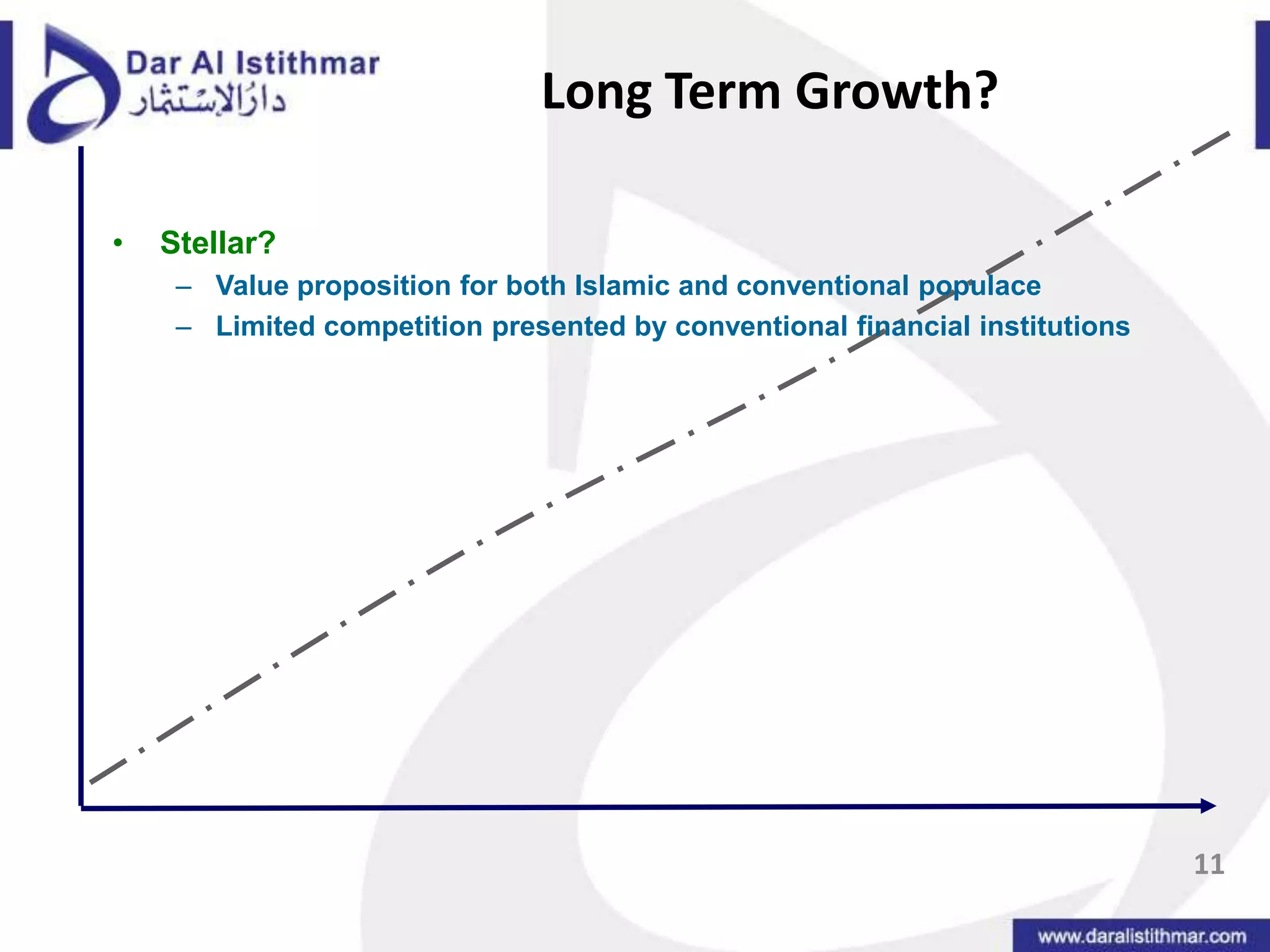

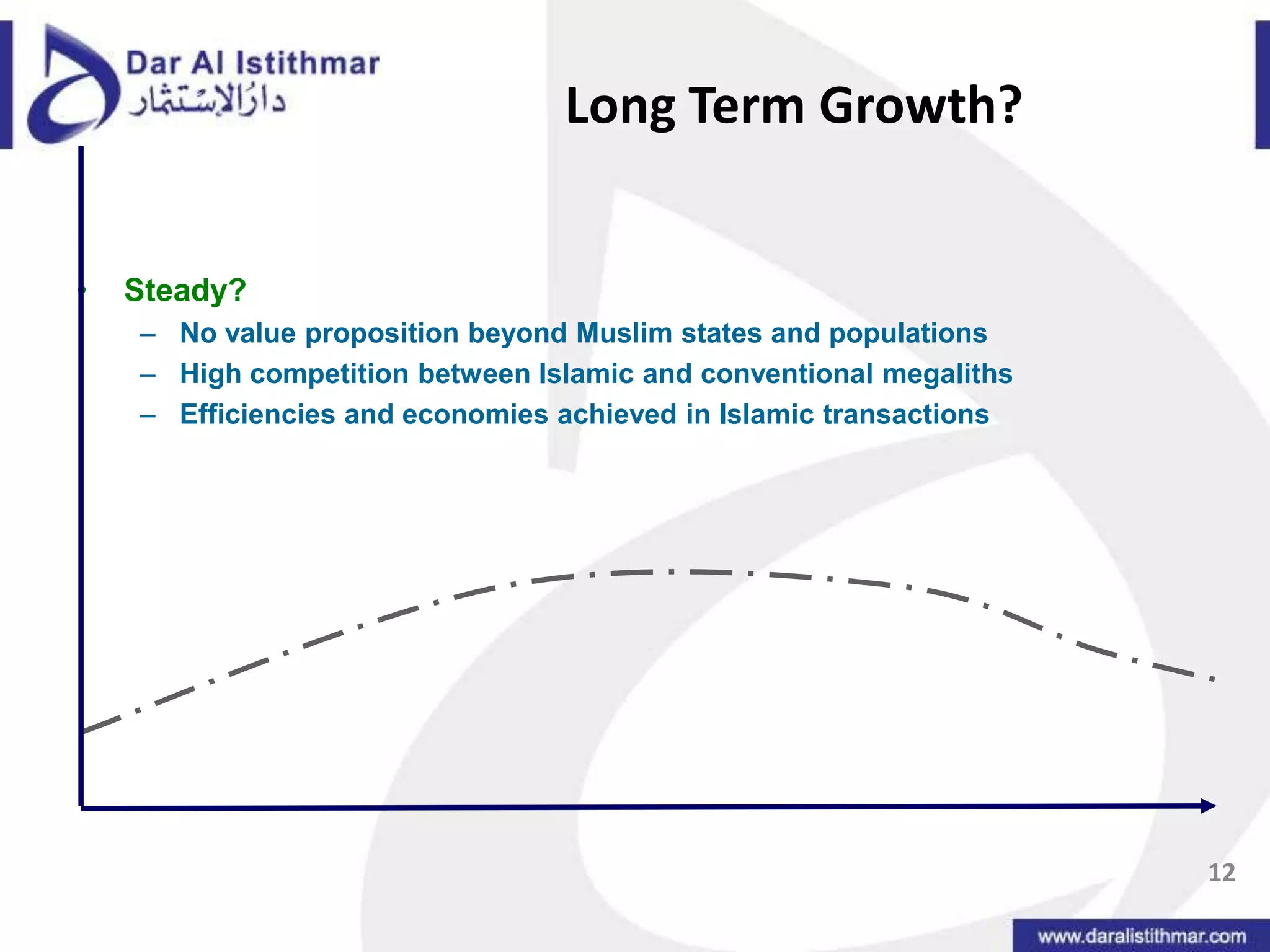

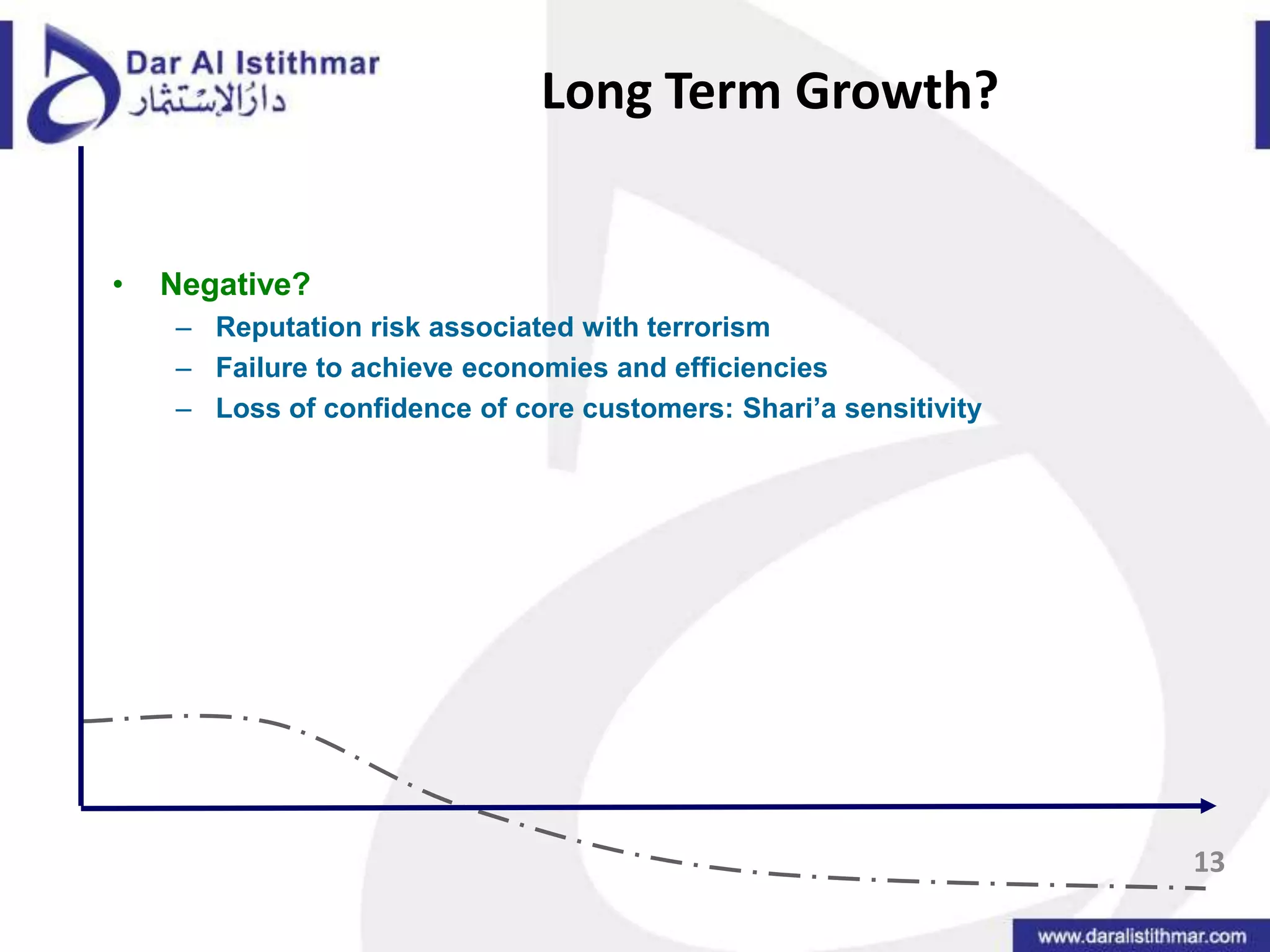

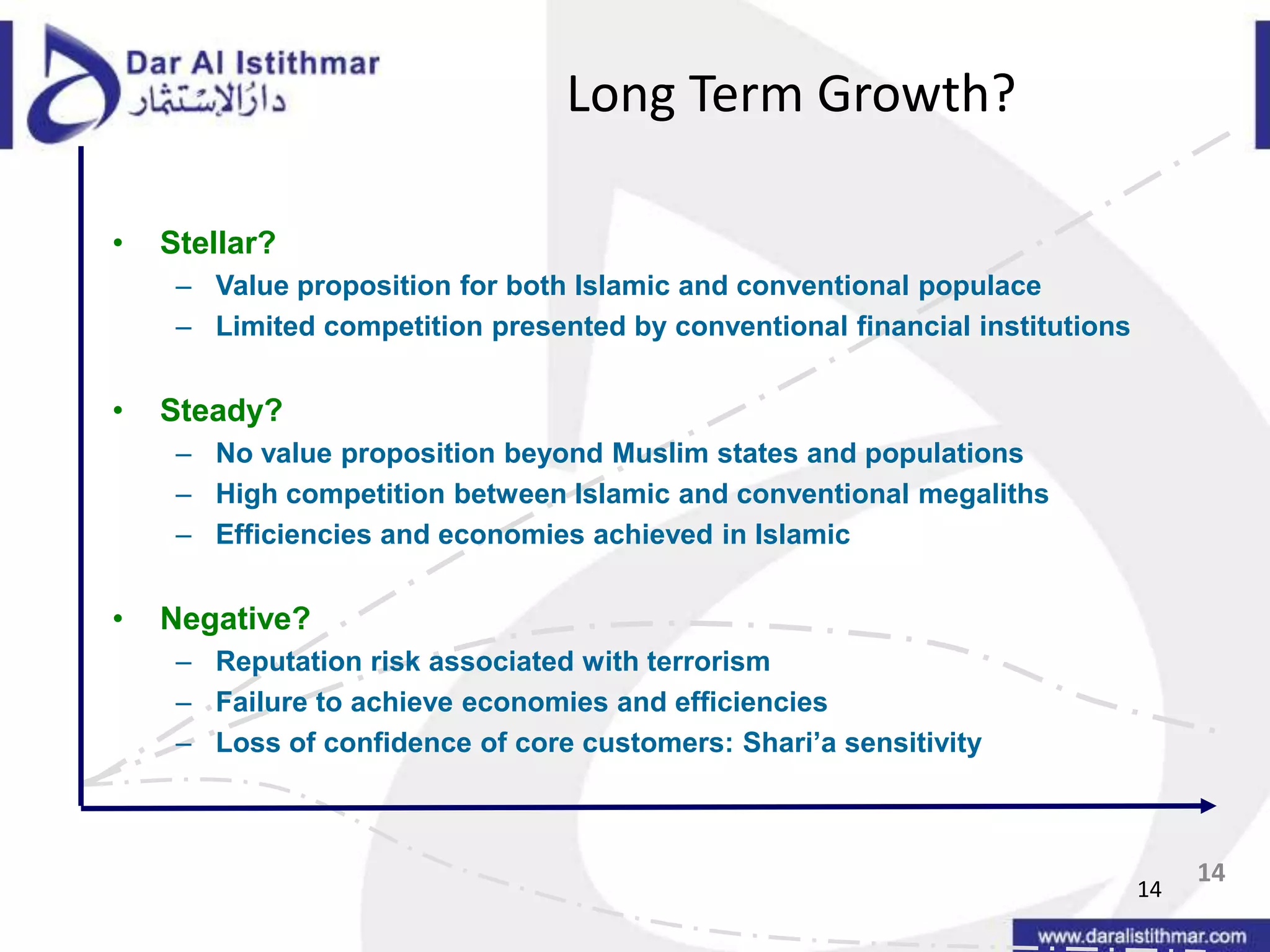

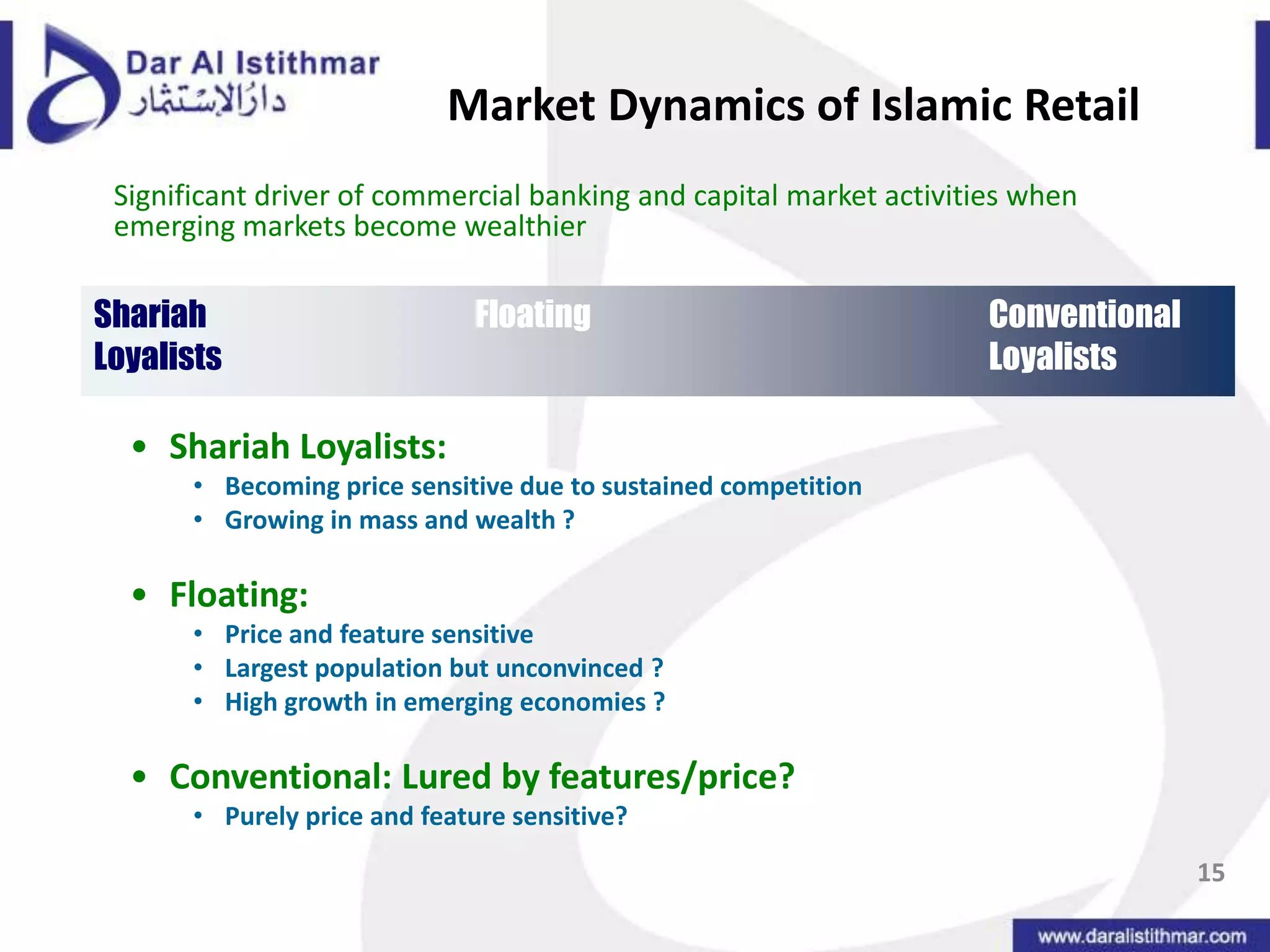

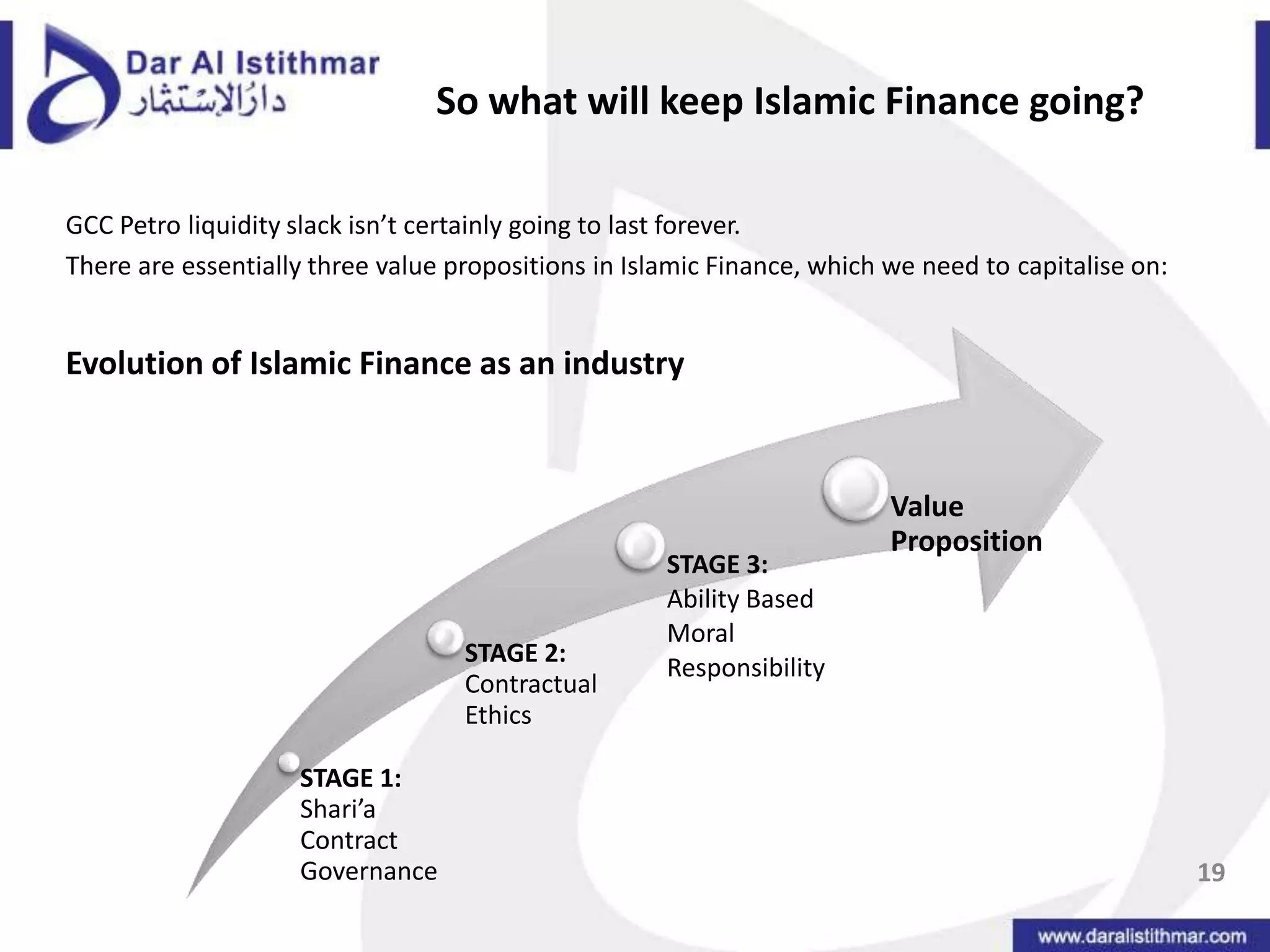

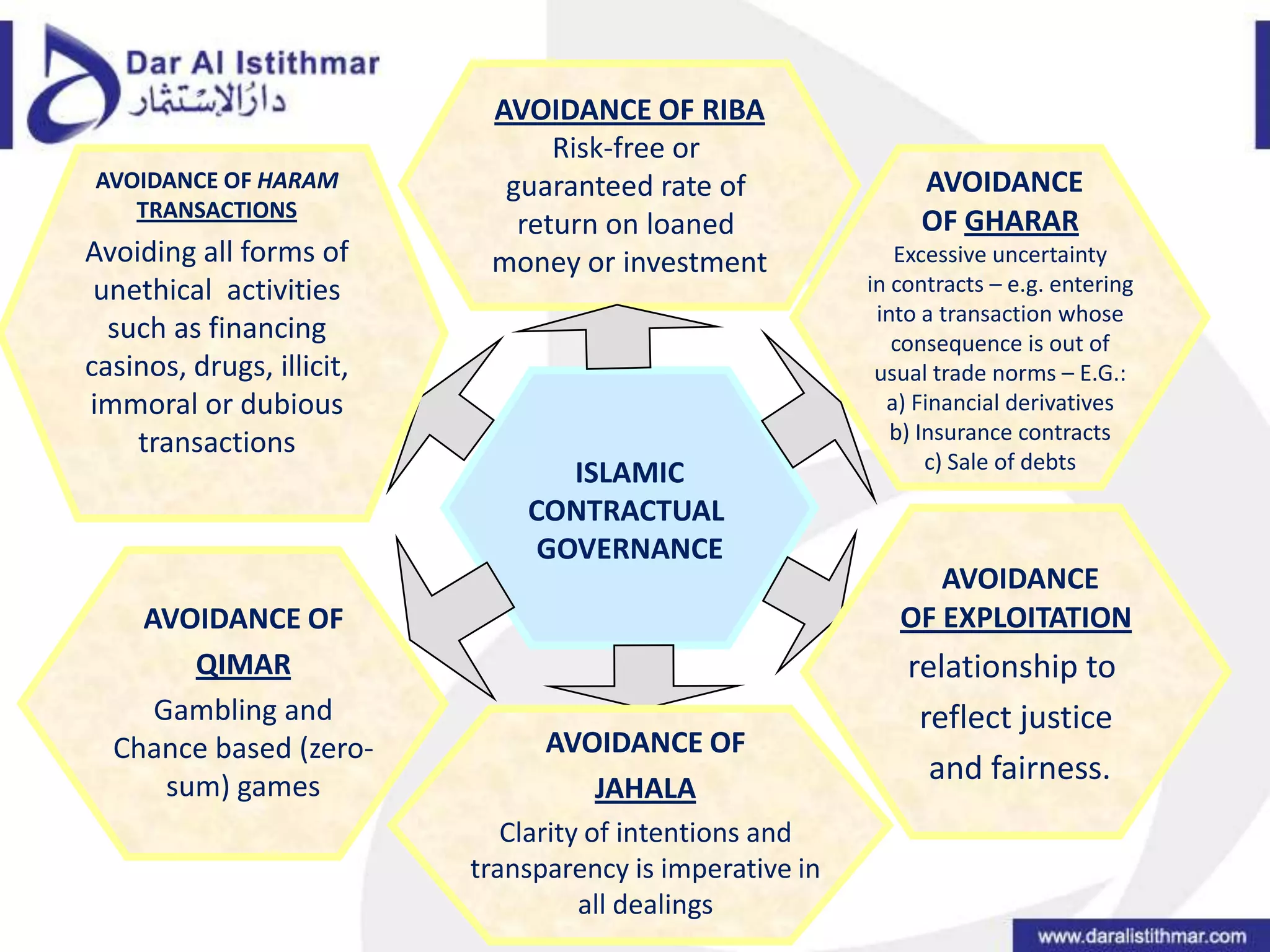

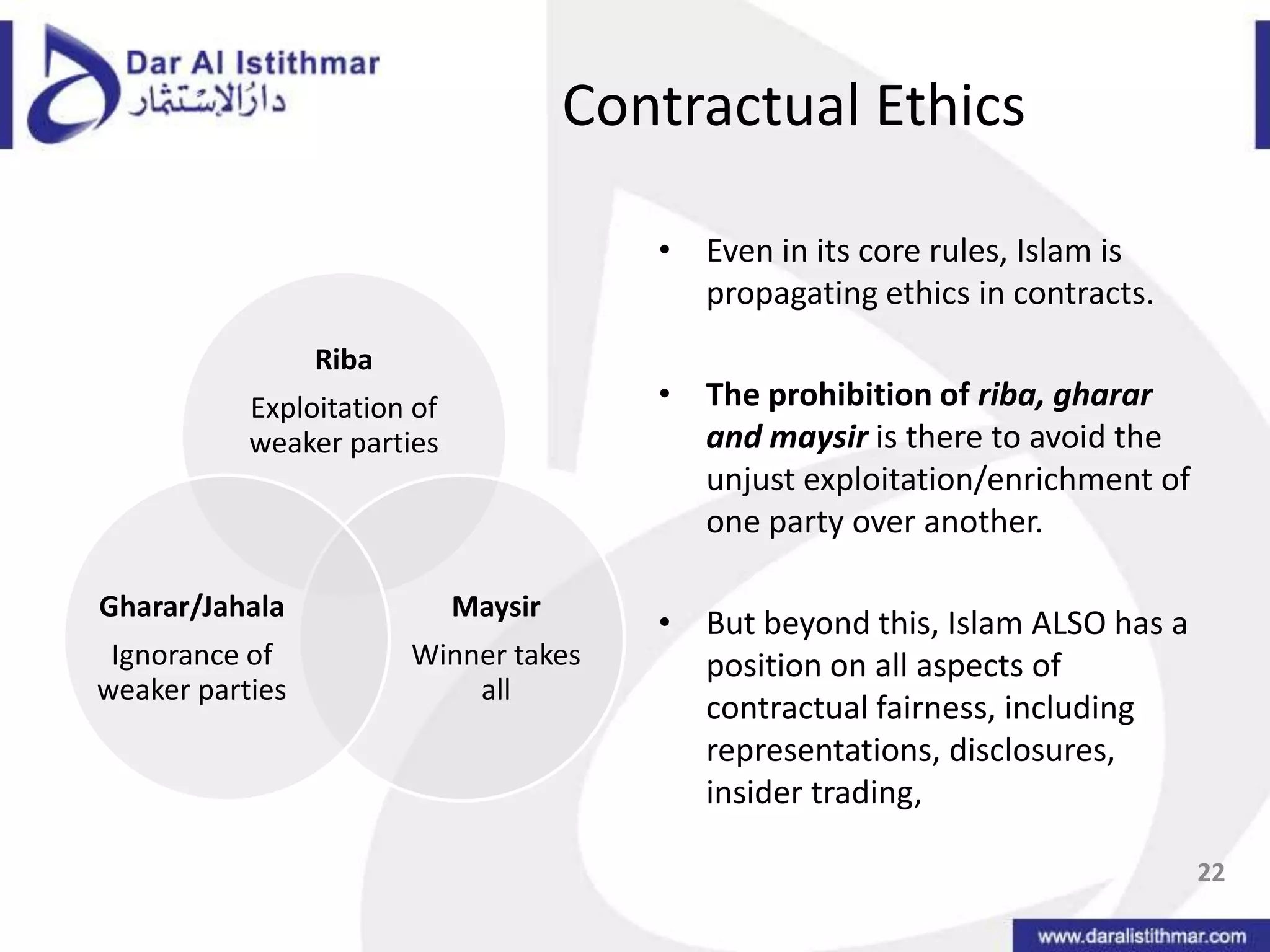

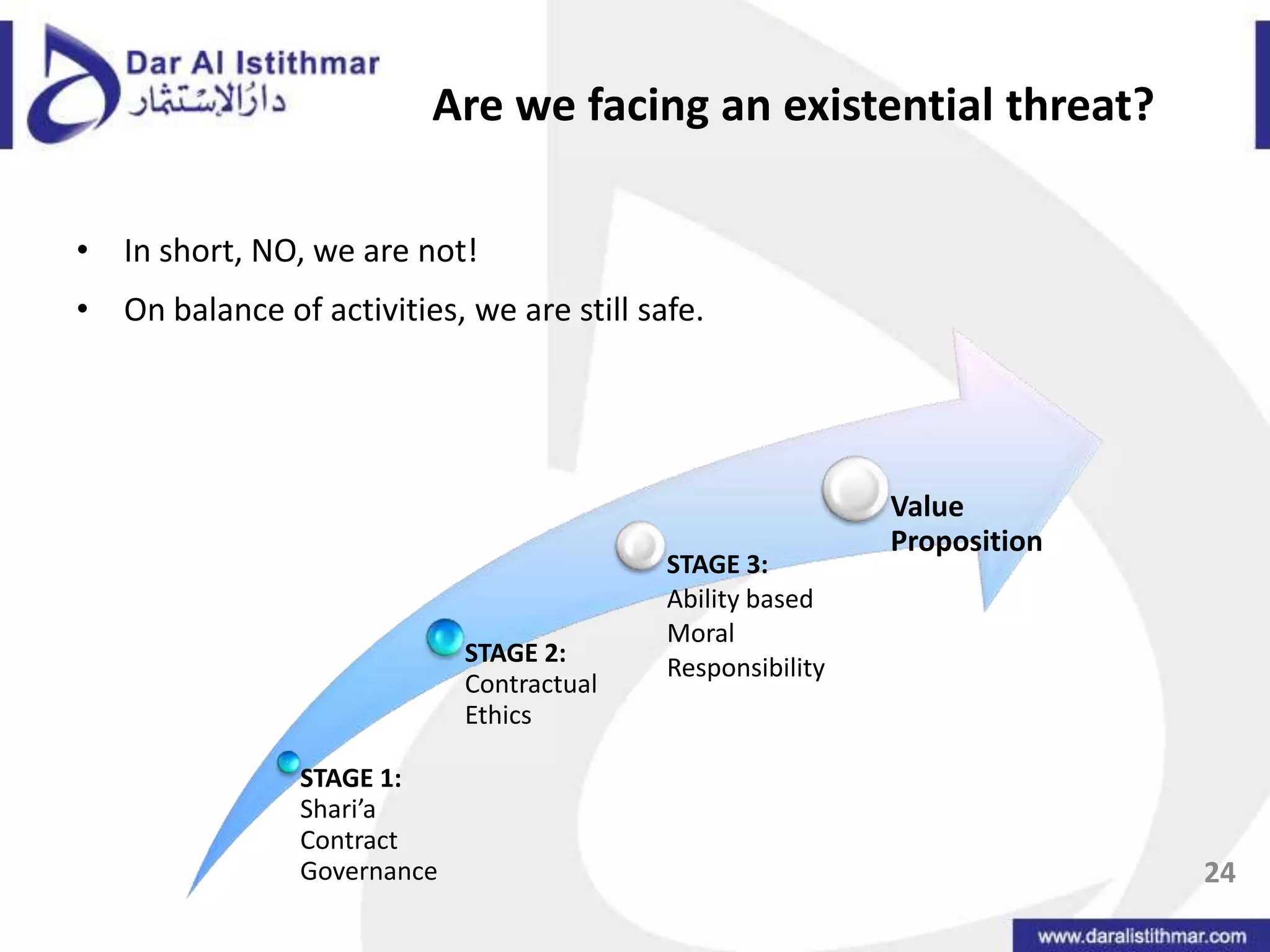

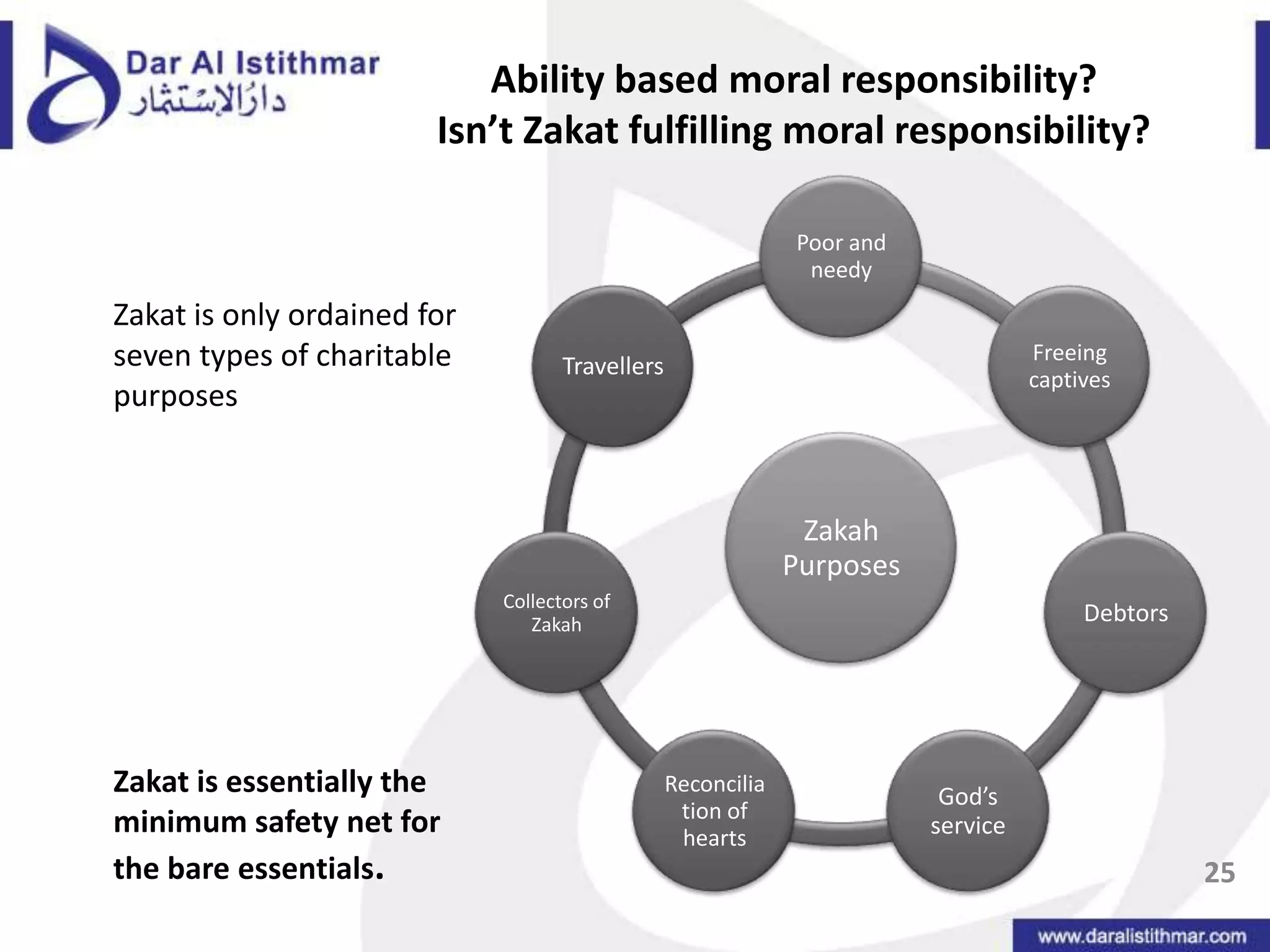

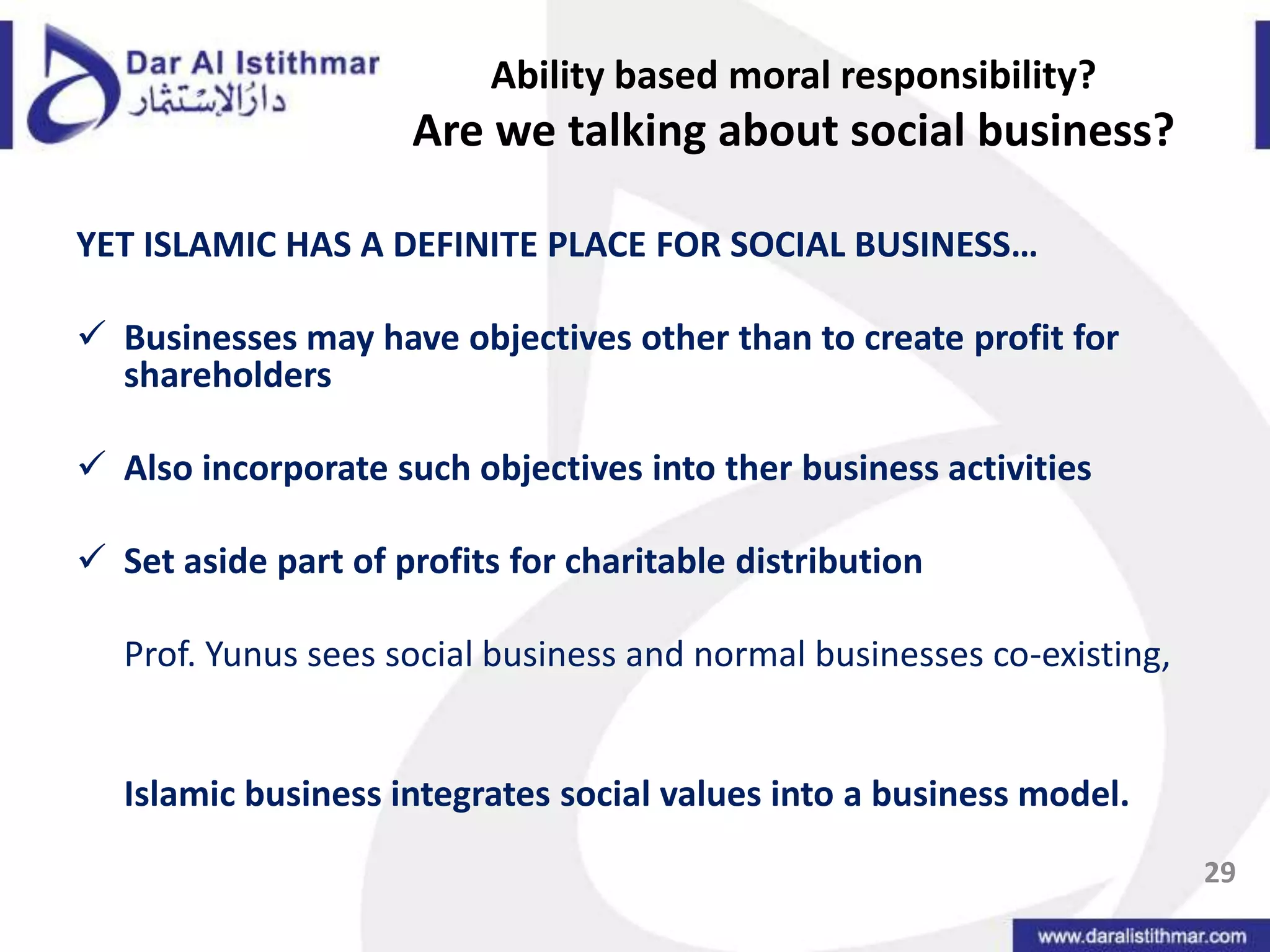

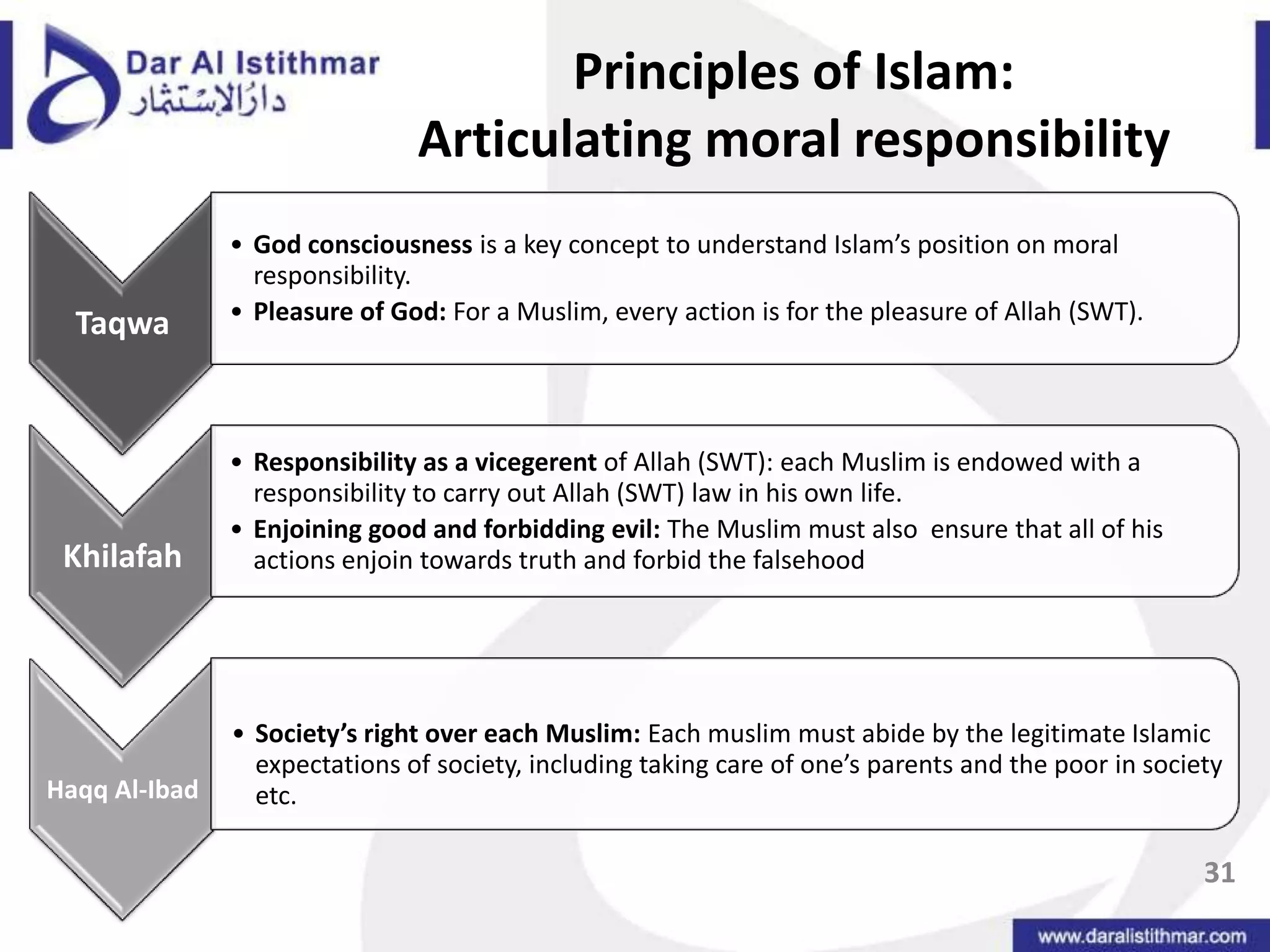

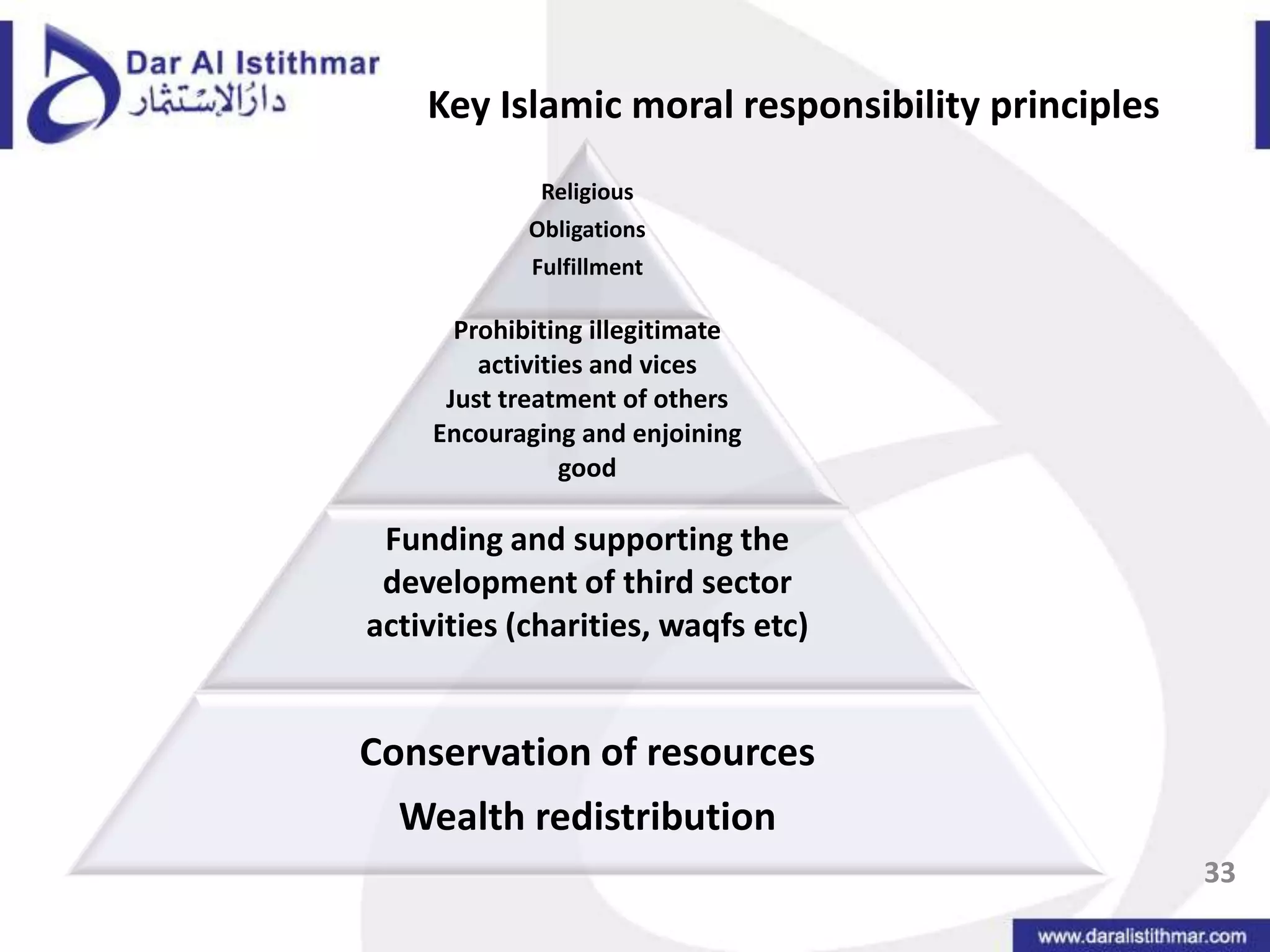

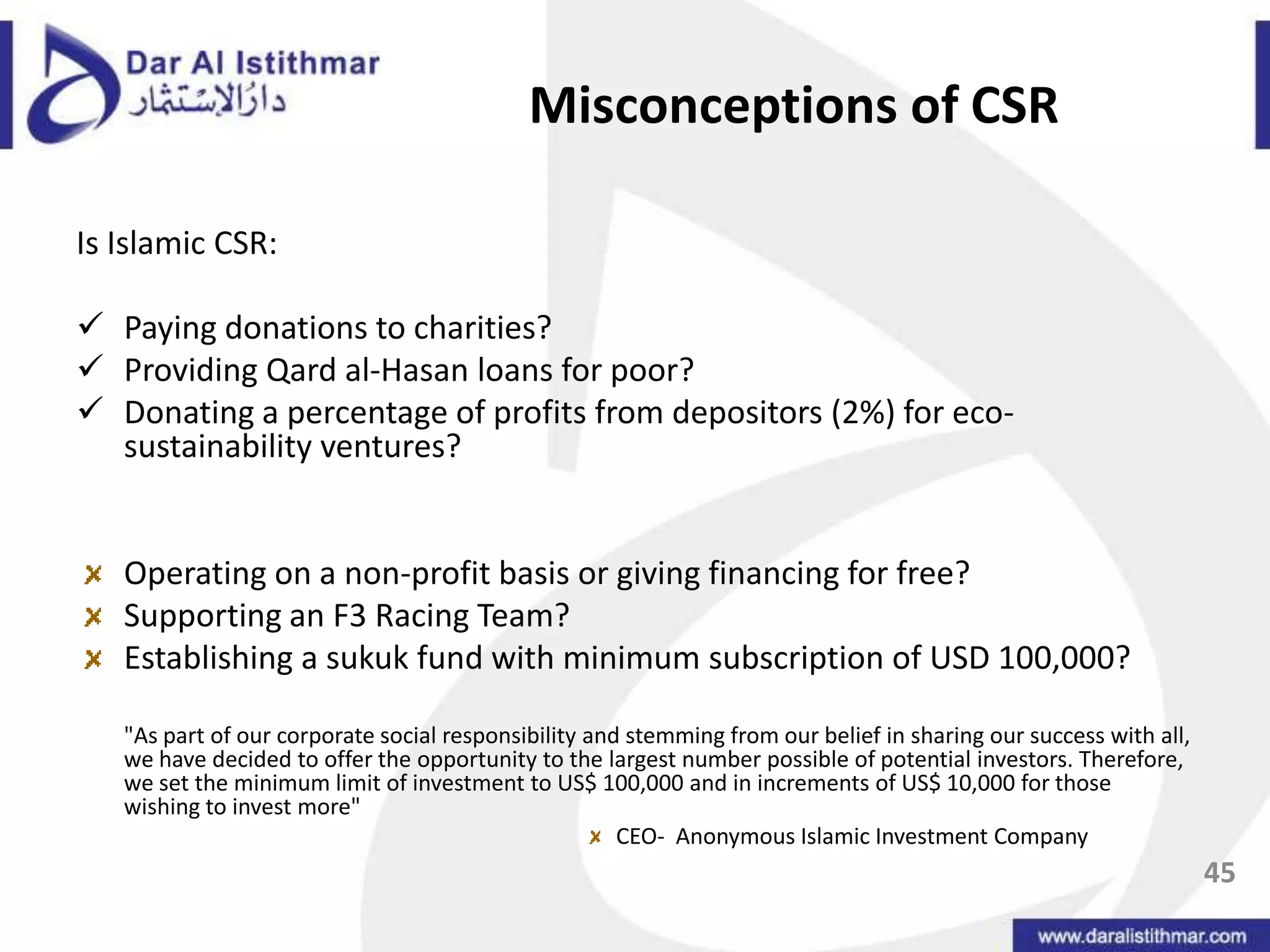

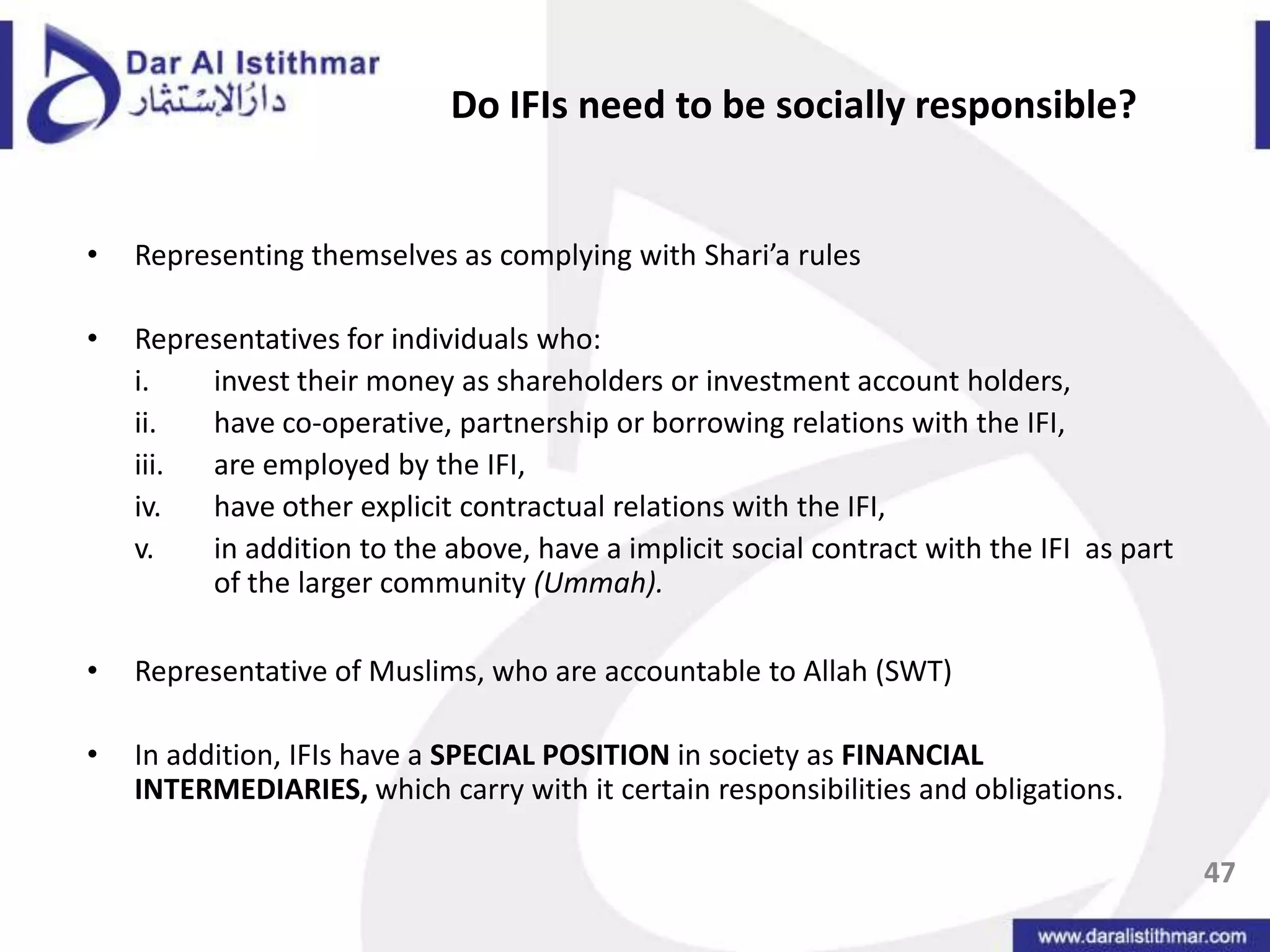

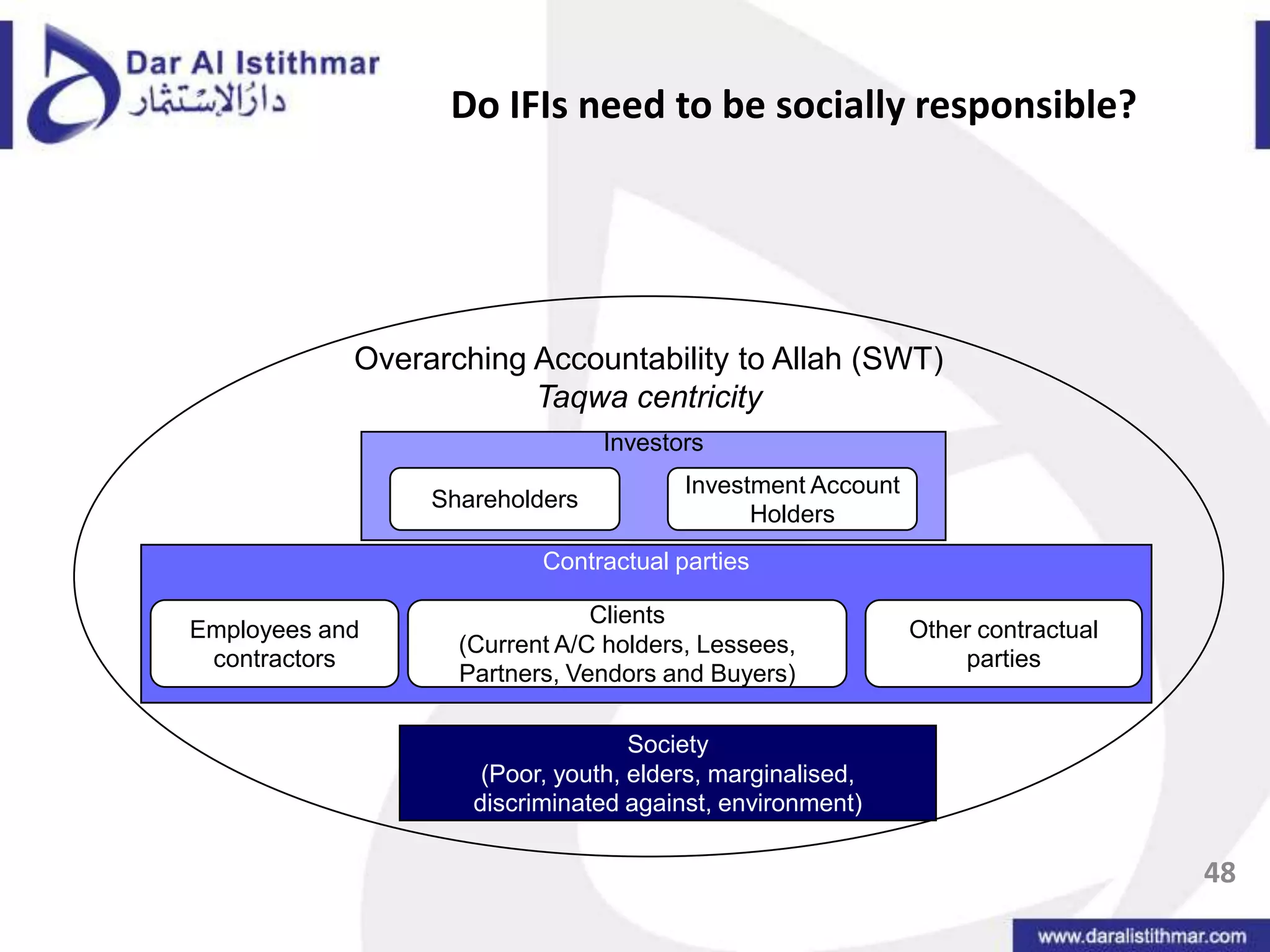

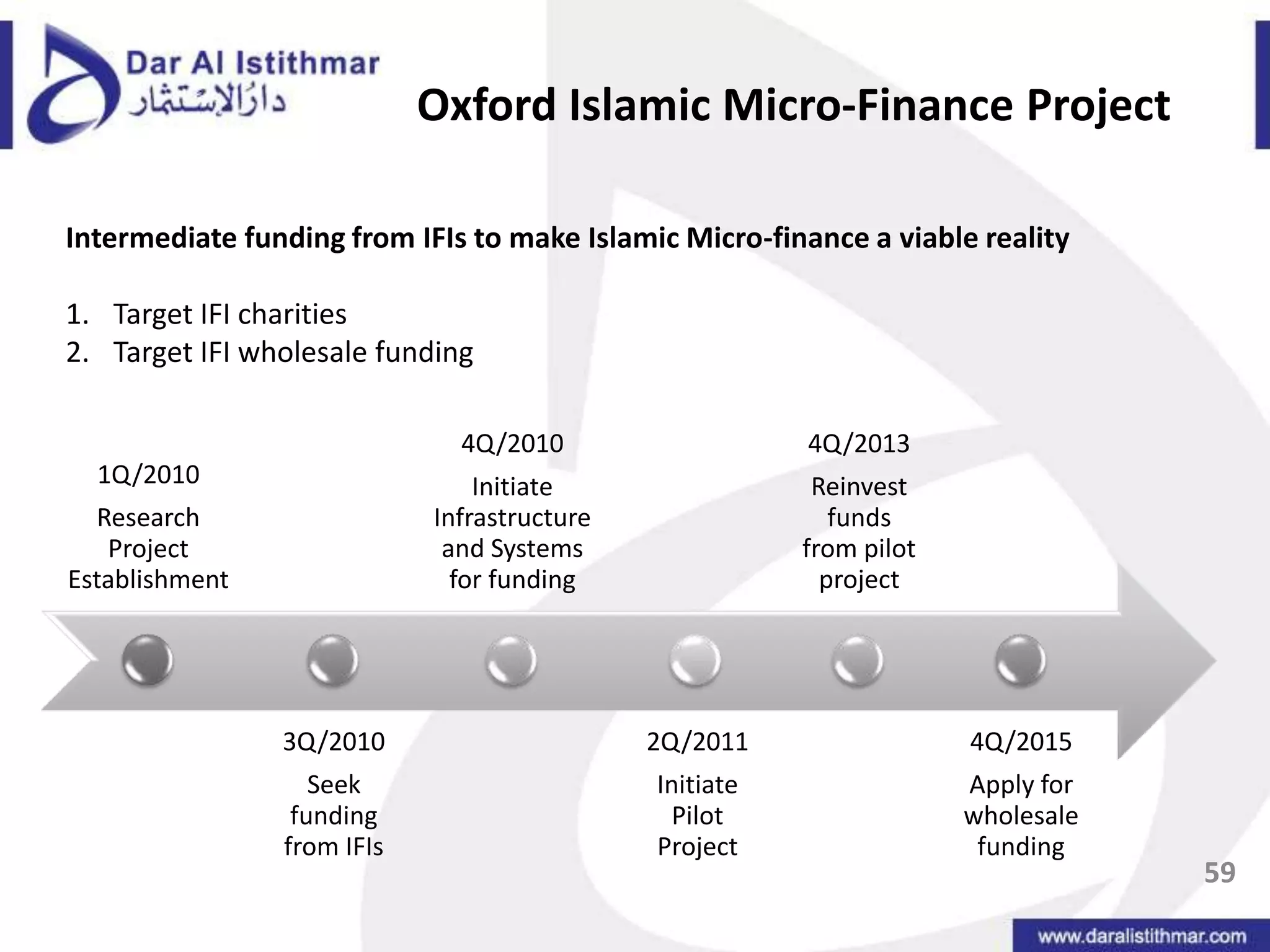

The document assesses the value proposition of Islamic finance, highlighting its growth trajectory, competitive advantages, and the significance of Shari'a compliance and social responsibility. It discusses the challenges and opportunities for the industry, emphasizing the need for innovation and differentiation to attract both Shari'a loyalists and conventional finance customers. The conclusion calls for a strategic response to enhance Islamic finance's appeal in a competitive global landscape.