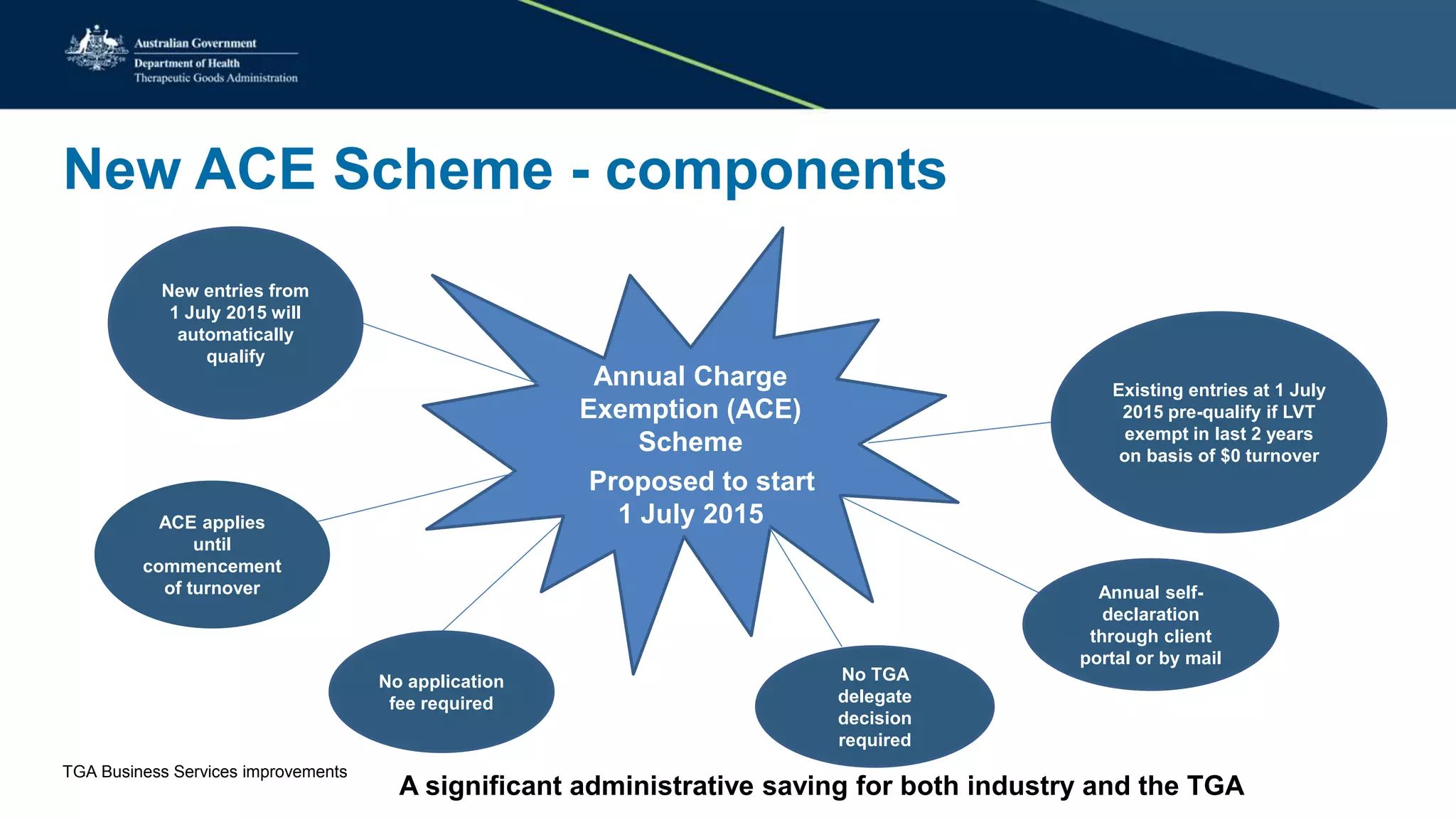

The document proposes changes to the low value turnover (LVT) exemption scheme for annual charges paid to the Therapeutic Goods Administration (TGA) in Australia. Key aspects of the proposed new Annual Charge Exemption (ACE) scheme include:

- Self-declaration of $0 annual turnover to qualify for exemption from annual charges.

- Reduced annual charge rates for some product categories like non-biologic prescription medicines and higher-risk medical devices.

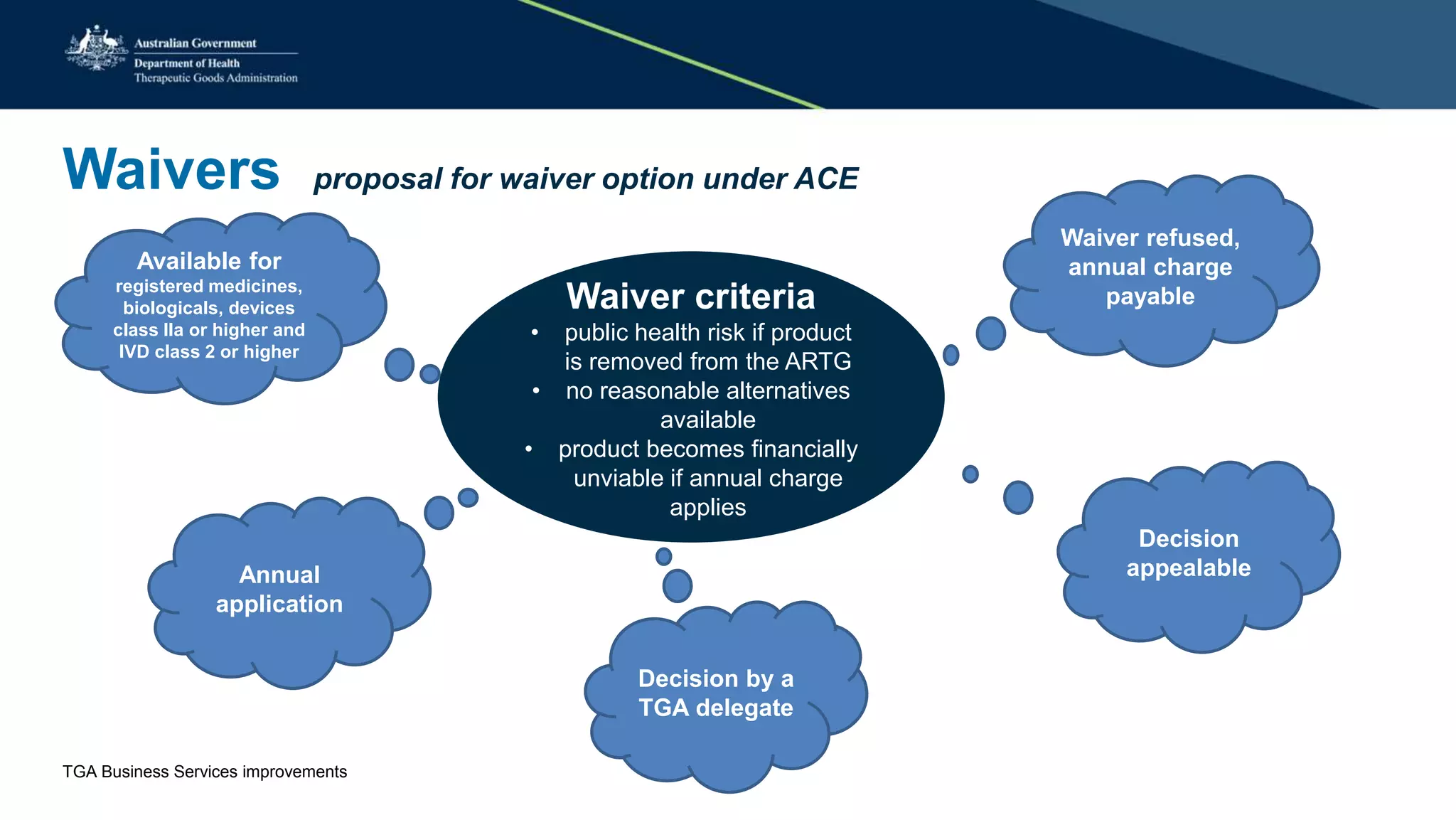

- A waiver option for annual charges on public health or financial viability grounds.

- Reduced administration saving $3 million per year for industry and TGA through streamlined processes like no application fee and online declarations.

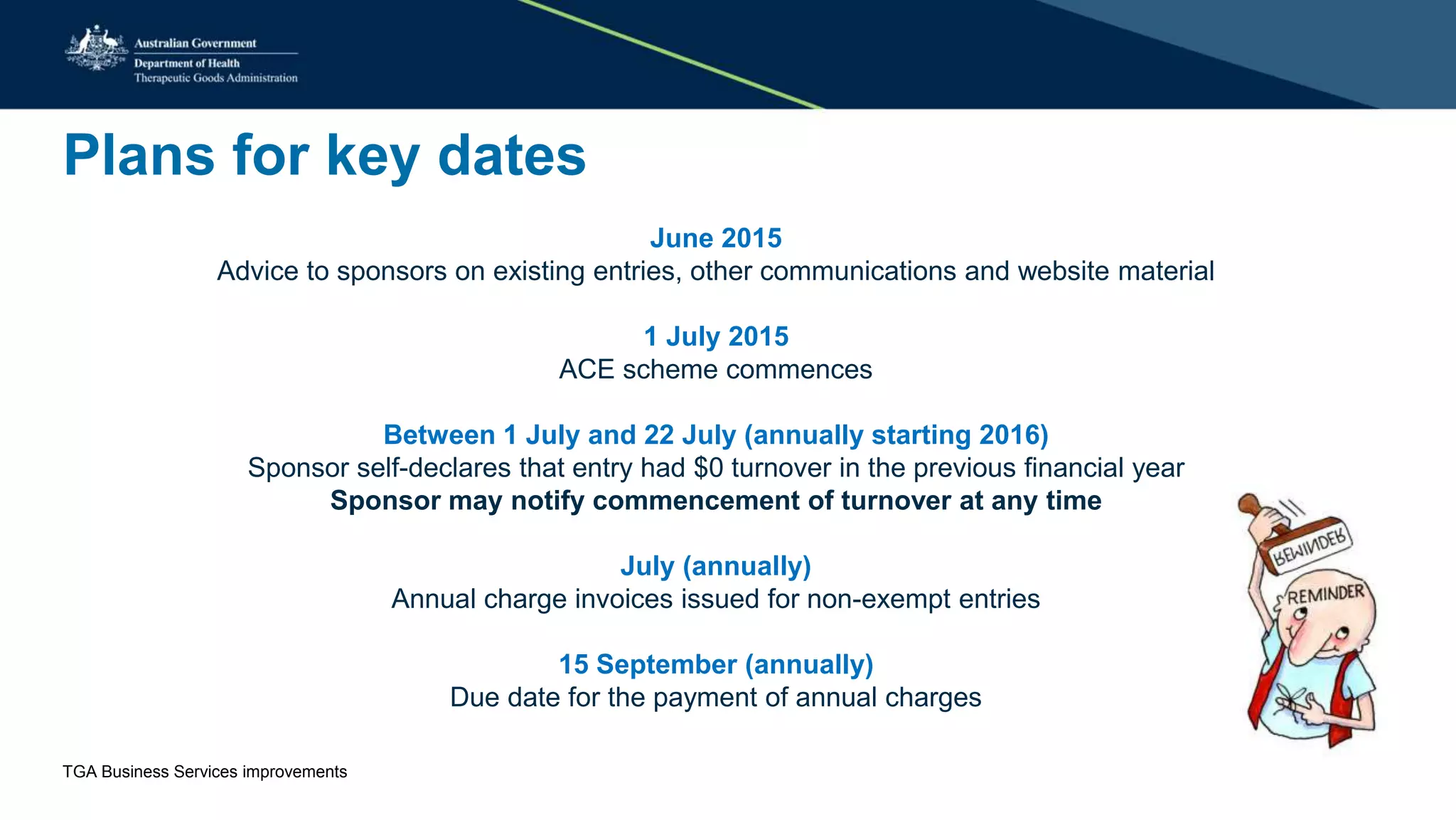

The new ACE