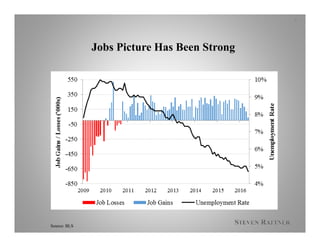

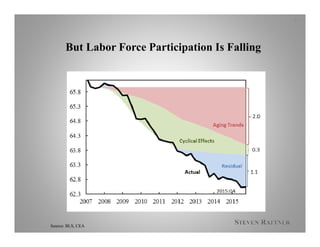

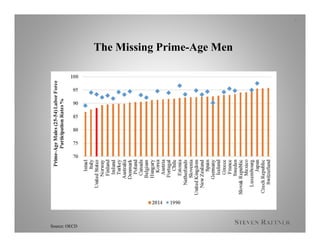

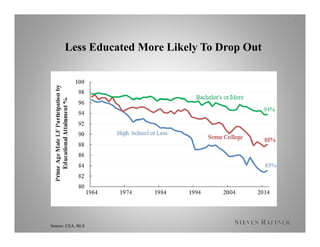

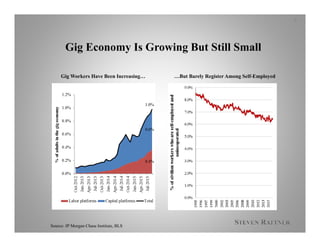

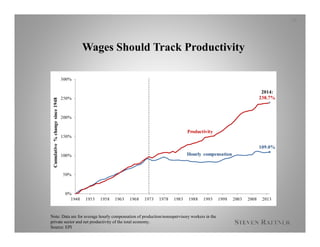

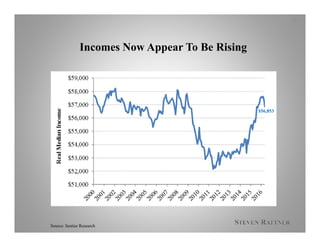

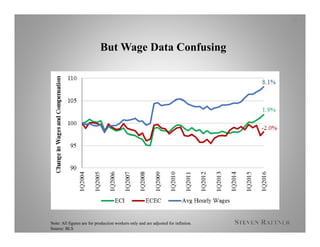

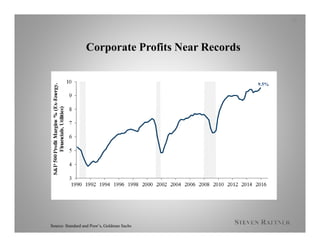

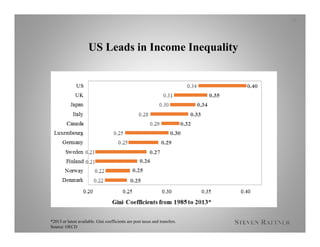

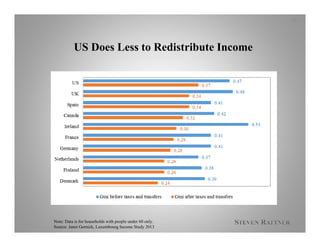

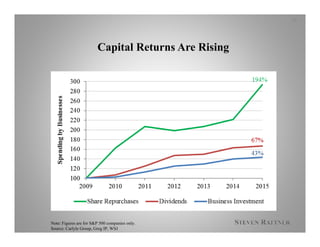

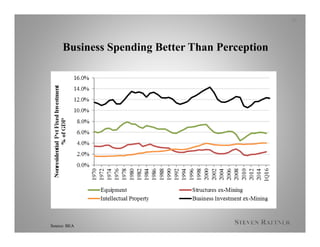

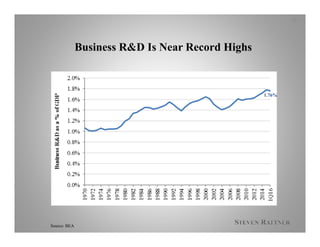

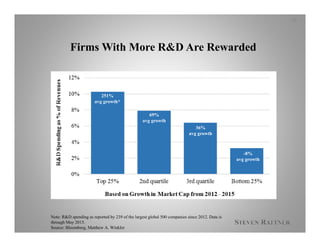

The document summarizes issues facing capitalism today including jobs, wages, income inequality, and corporate short-termism. It finds that while the jobs picture has been strong, labor force participation is falling. Wages have barely risen despite rising productivity and corporate profits reaching near record highs. This is largely due to globalization, technology, tax policy, declining unionization, and "winners-take-all" labor markets. The U.S. also has the highest income inequality among developed nations and does less to redistribute income. However, business spending and R&D are better than perceived and firms that invest more in R&D see higher stock performance, suggesting corporations may not be as short-term as often believed.