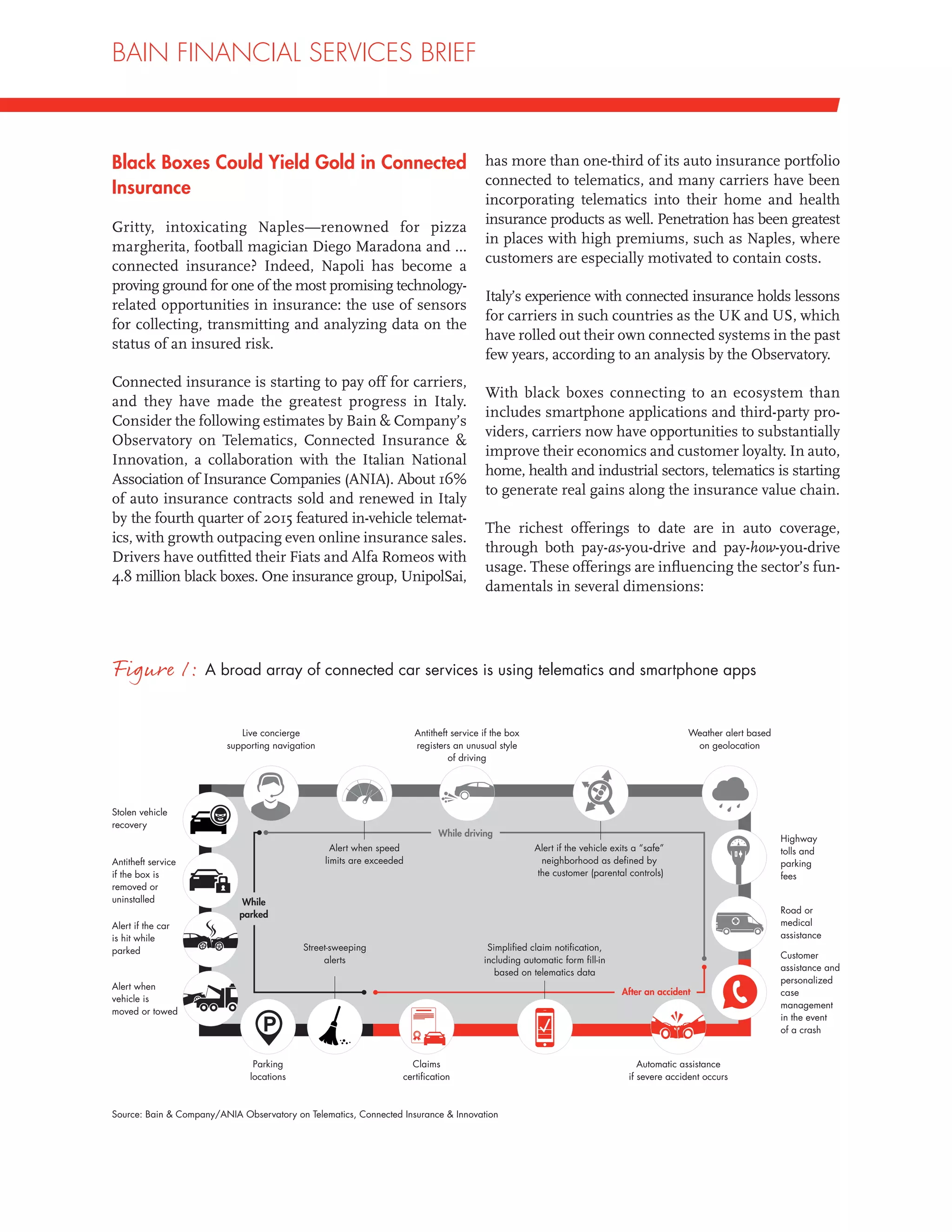

Telematics is increasingly integrated into various insurance sectors, with over a third of auto insurance portfolios in Italy utilizing this technology, particularly in areas with high premiums like Naples. The use of telematics is proving beneficial for carriers by improving customer loyalty, risk assessment, and pricing strategies, and is creating new service offerings. To successfully implement connected insurance, companies must address strategic goals, customer targeting, and data management while exploring partnerships and adapting their internal processes.