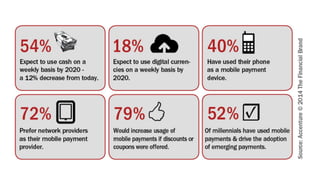

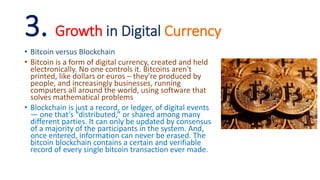

The document discusses technology trends in finance that will emerge by 2020, including the growth of mobile payments and frictionless transactions through expanded acceptance of mobile wallets. It also predicts growth in the use of chip cards and digital currencies like Bitcoin. Financial institutions will need to offer omnichannel services and leverage big data through analytics to gain customer insights. Cybersecurity will also need to be tightened as hackers become more sophisticated. The trends highlighted may lead to growth in e-commerce, increased regulatory scrutiny, and more venture capital investment in financial technology. Financial professionals are advised to help drive technological changes, learn new skills, and act responsibly to take advantage of emerging opportunities.