This document provides a summary of Kenya's economic performance in 2014. Some key points:

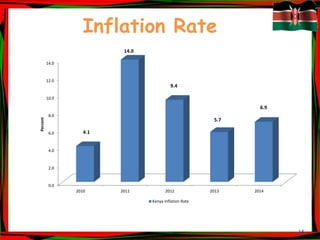

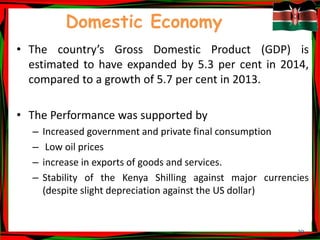

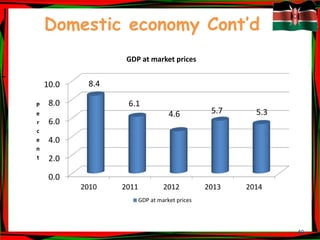

- The economy grew by 5.3% in 2014, down from 5.7% in 2013. Inflation increased slightly to 6.9%.

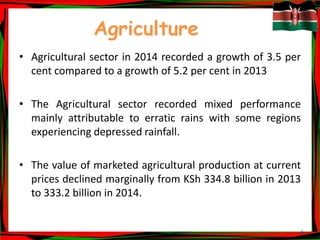

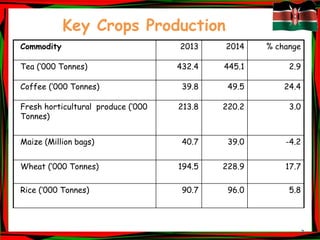

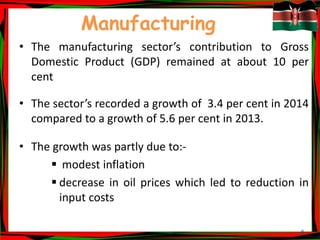

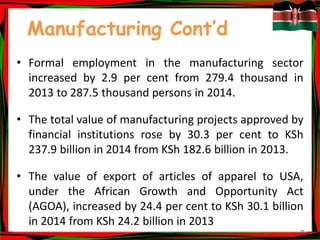

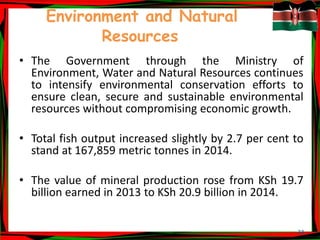

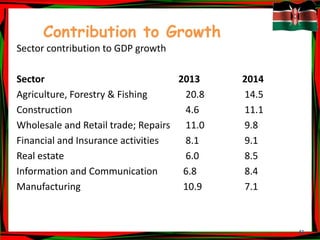

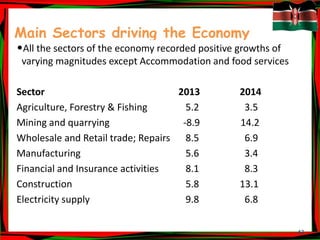

- Agriculture grew by 3.5%, manufacturing by 3.4%, and the building/construction sector grew strongly at 13.1%.

- International trade deficit widened as imports grew faster than exports. Tourism earnings and arrivals declined.

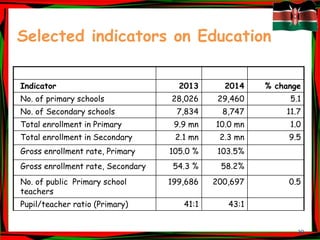

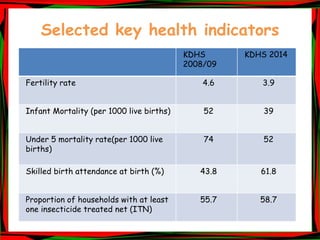

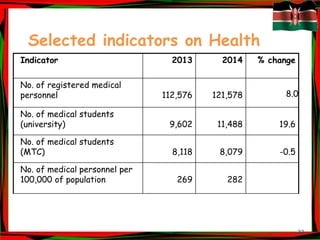

- Social indicators showed improvements, with declines in infant mortality and increases in education enrollment.

![4

International Scene cont’d

GDP Growth Rates and Projections for Selected Countries

Country 2013 2014 2015*

USA 2.2 2.2 3.1

UK 1.7 3.0 2.7

Japan 1.5 0.4 0.8

Euro Area -0.4 0.8 1.1

China 7.7 7.4 7.1

Uganda 5.8 5.9 6.3

Tanzania 7.0 7.2 7.0

Rwanda 4.7 6.0 6.7

Burundi 4.5 4.7 4.8

South Africa 2.0 1.4 2.3

• Source: OECD and World Economic Outlook [IMF]

*Projections](https://image.slidesharecdn.com/technicalpresentationones201524042015-1final2-150429062358-conversion-gate01/85/Technical-presentation-on-es2015-24042015-1-final-2-4-320.jpg)