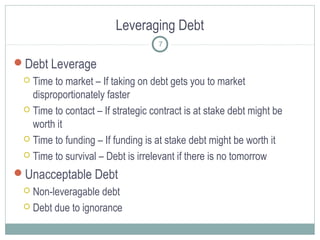

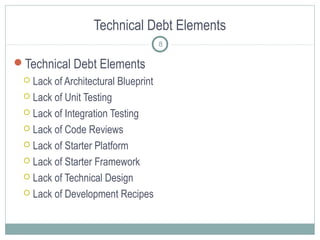

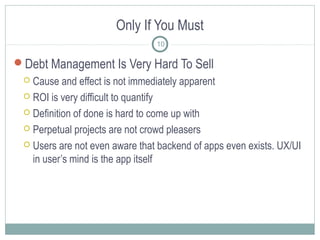

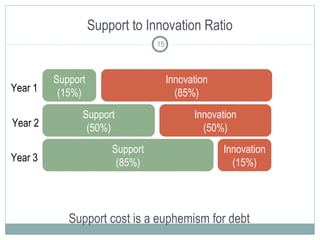

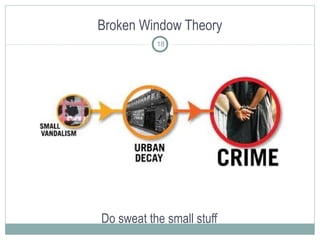

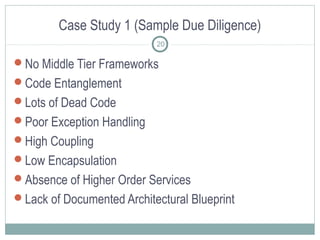

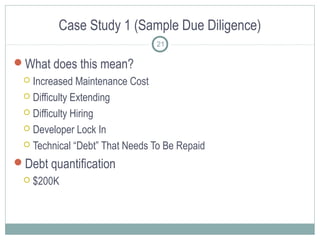

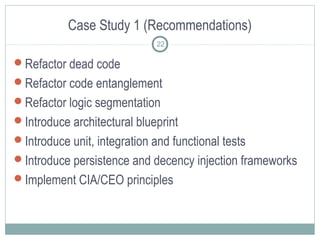

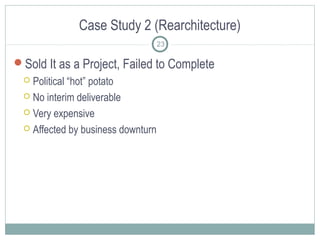

This document discusses technical debt and strategies for managing and selling technical debt rearchitecture projects. It defines technical debt as work that is postponed to a later time, such as lack of testing or architecture planning. While some debt can be useful for time to market goals, ignoring debt accumulation can slow a project over time. The document provides examples of technical debt elements to examine in a codebase and recommends conducting due diligence to understand existing debt. It also presents stories and metaphors to help explain the risks of debt to business stakeholders and the value of rearchitecture projects when needed.