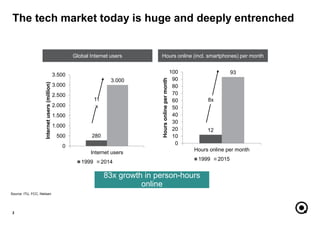

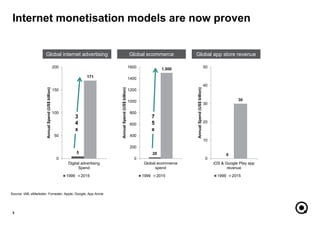

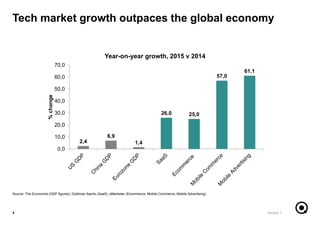

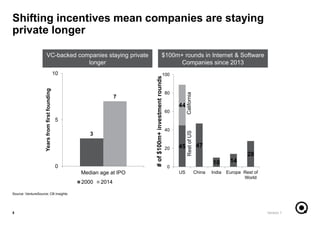

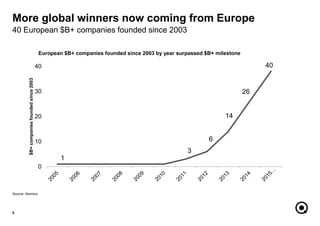

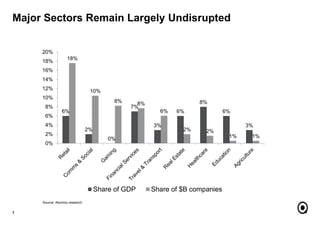

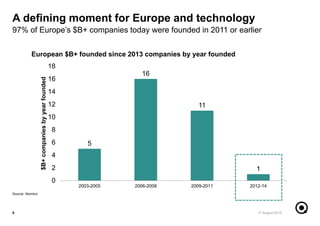

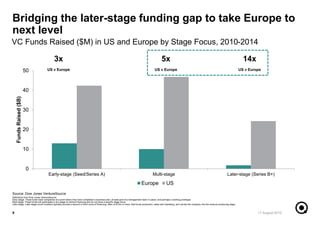

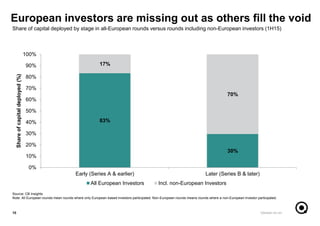

The document discusses the significant growth of the digital economy, highlighting the rise in internet users and spending in digital advertising and e-commerce from 1999 to 2015. It notes that many tech companies are staying private longer, with shifts in funding dynamics favoring later stages, particularly in Europe. Additionally, the report emphasizes the need for bridging funding gaps to enhance European tech market competitiveness and outlines the capabilities of Noah Advisors in facilitating transactions within this sector.