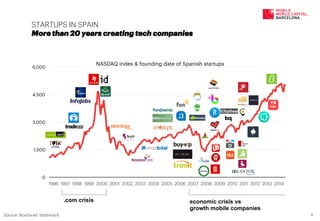

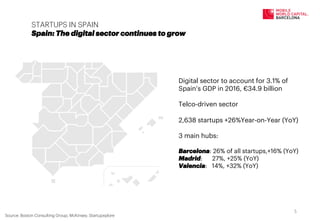

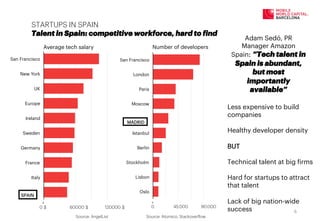

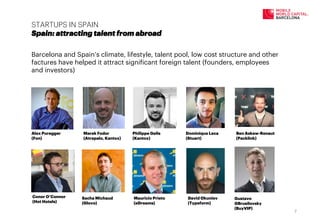

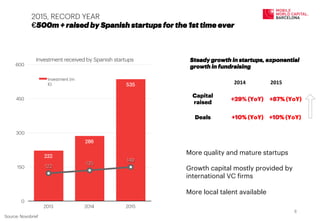

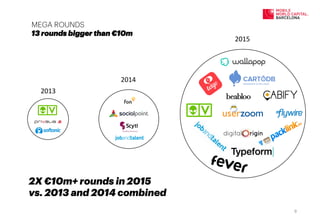

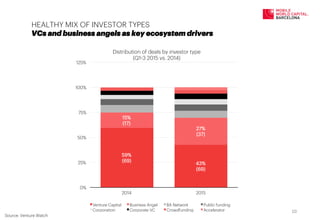

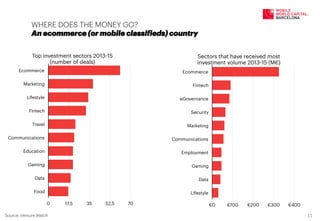

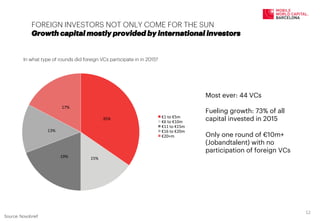

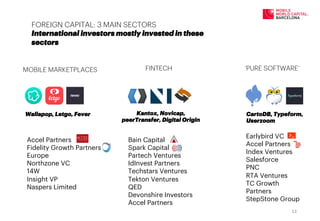

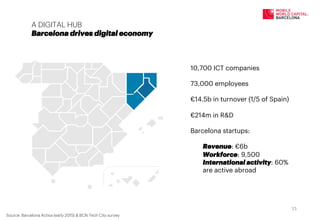

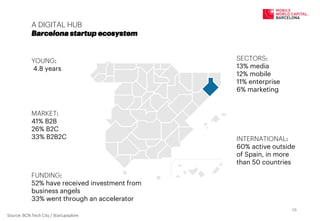

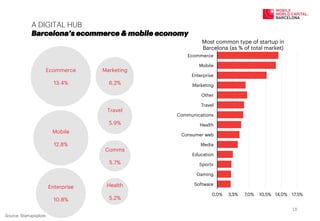

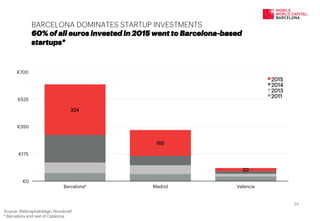

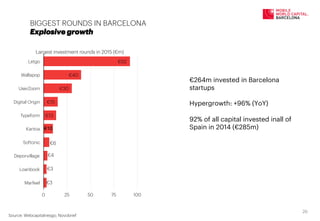

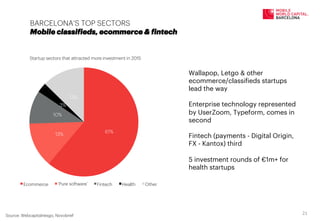

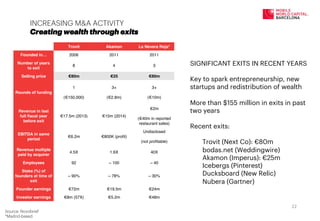

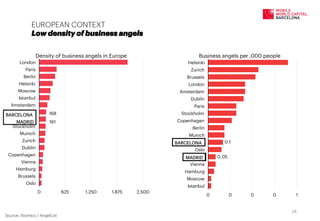

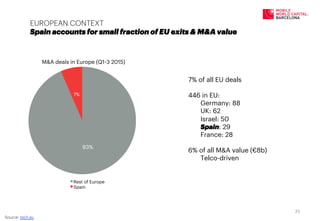

The document provides an overview of the Spanish startup ecosystem in 2015, highlighting significant growth in the digital sector and record investments exceeding €500 million. Barcelona and Madrid emerge as key hubs, with a strong influx of international investors and notable startup exits like trovit and akamon. However, challenges remain, including high taxes and a low density of business angels, which hinder further development of the ecosystem.