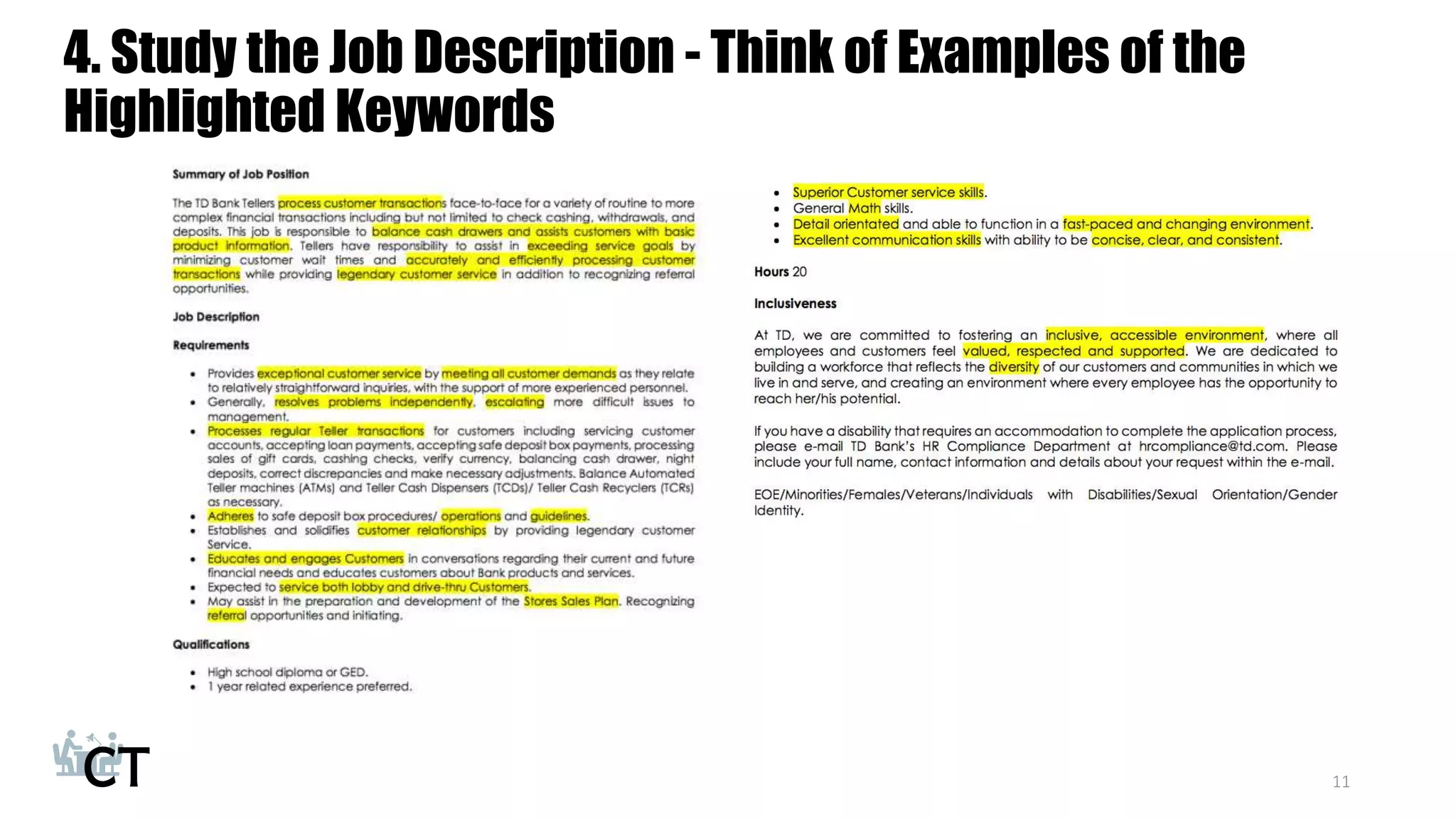

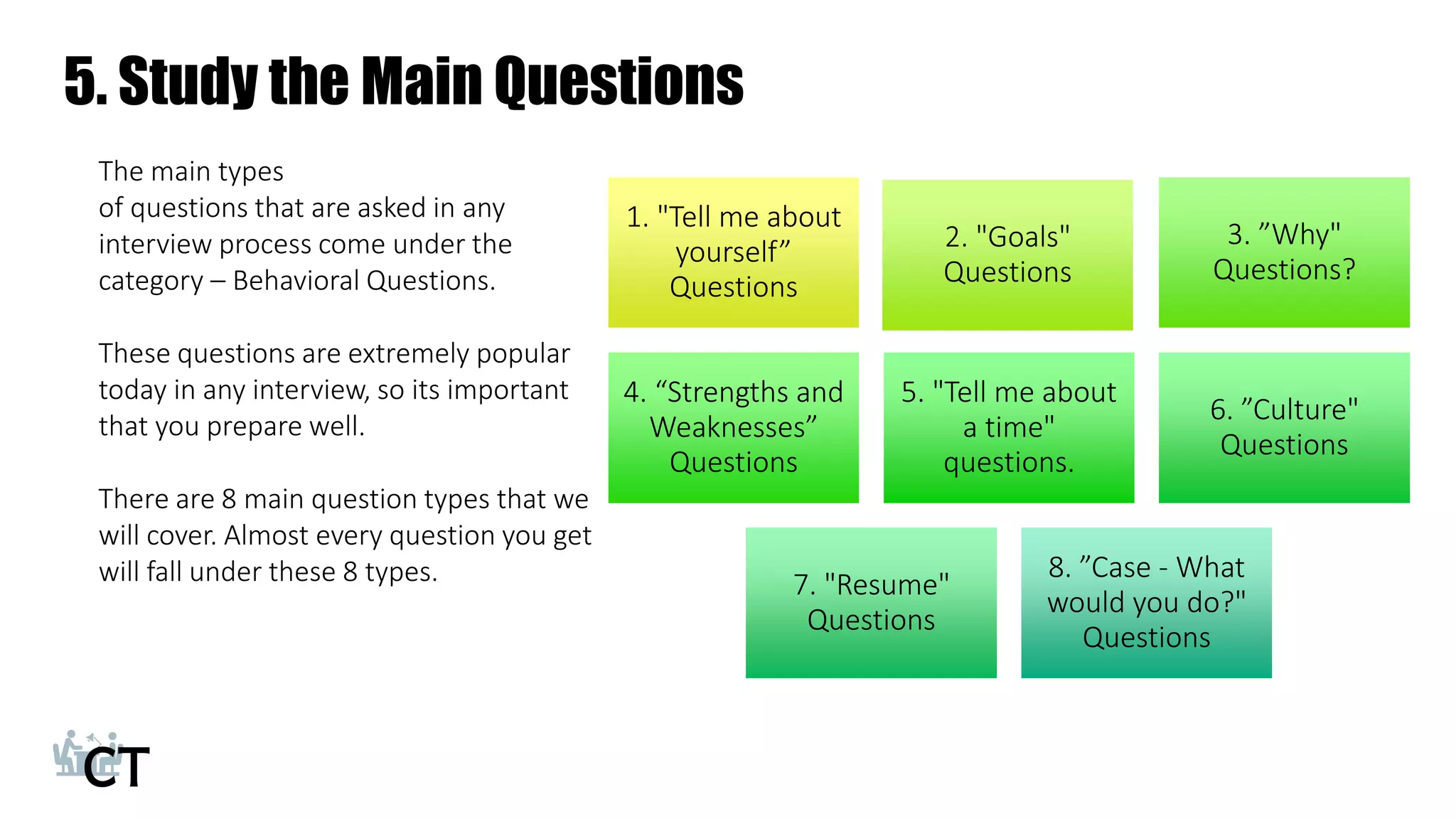

This document outlines a TD Bank teller interview preparation course aimed at boosting candidates' confidence and readiness for the interview process. It details essential steps for preparation, including understanding the industry, researching TD Bank, studying common interview questions, and practicing responses. The course offers structured modules, resources, and support to help candidates excel in their interviews.