Embed presentation

Download as PDF, PPTX

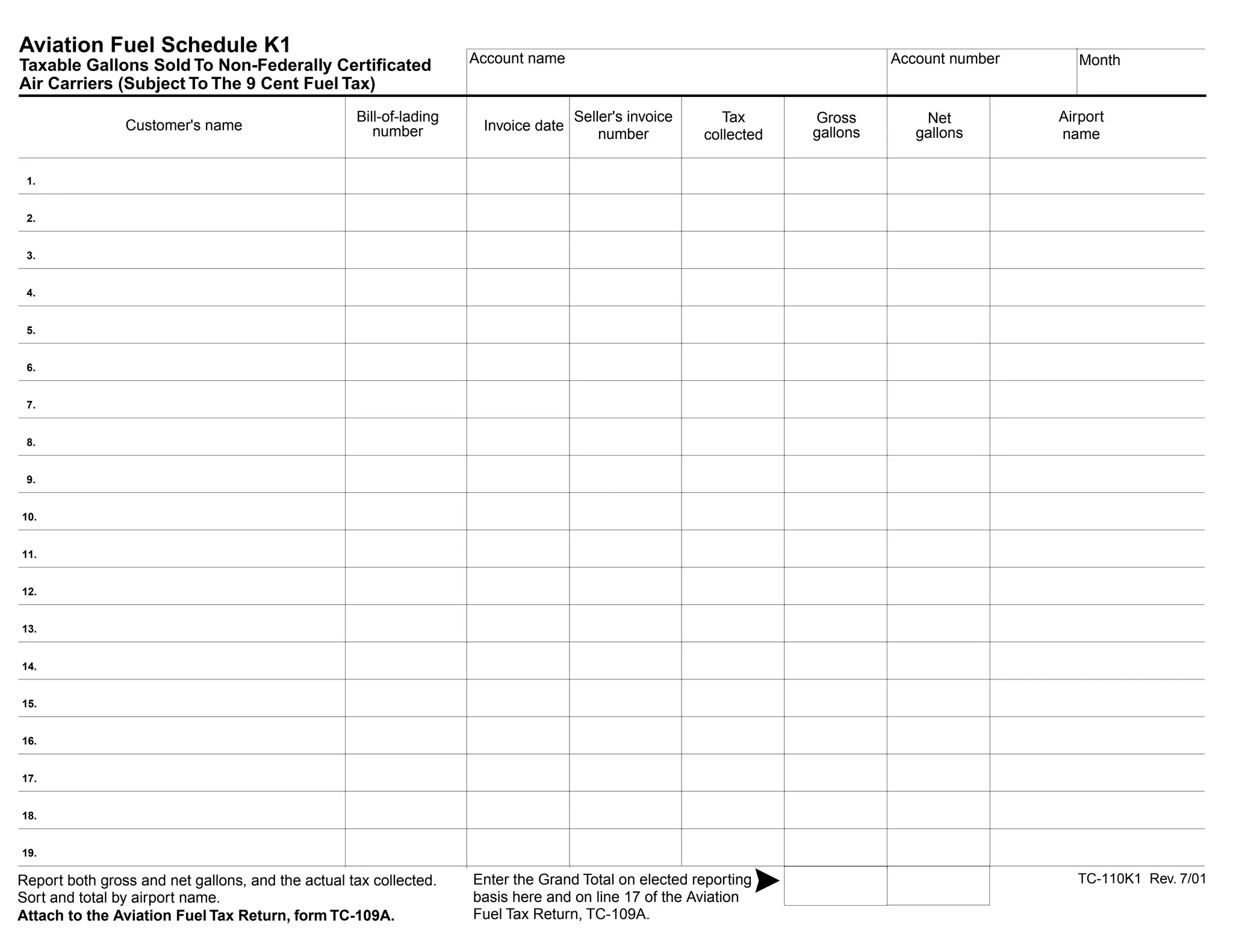

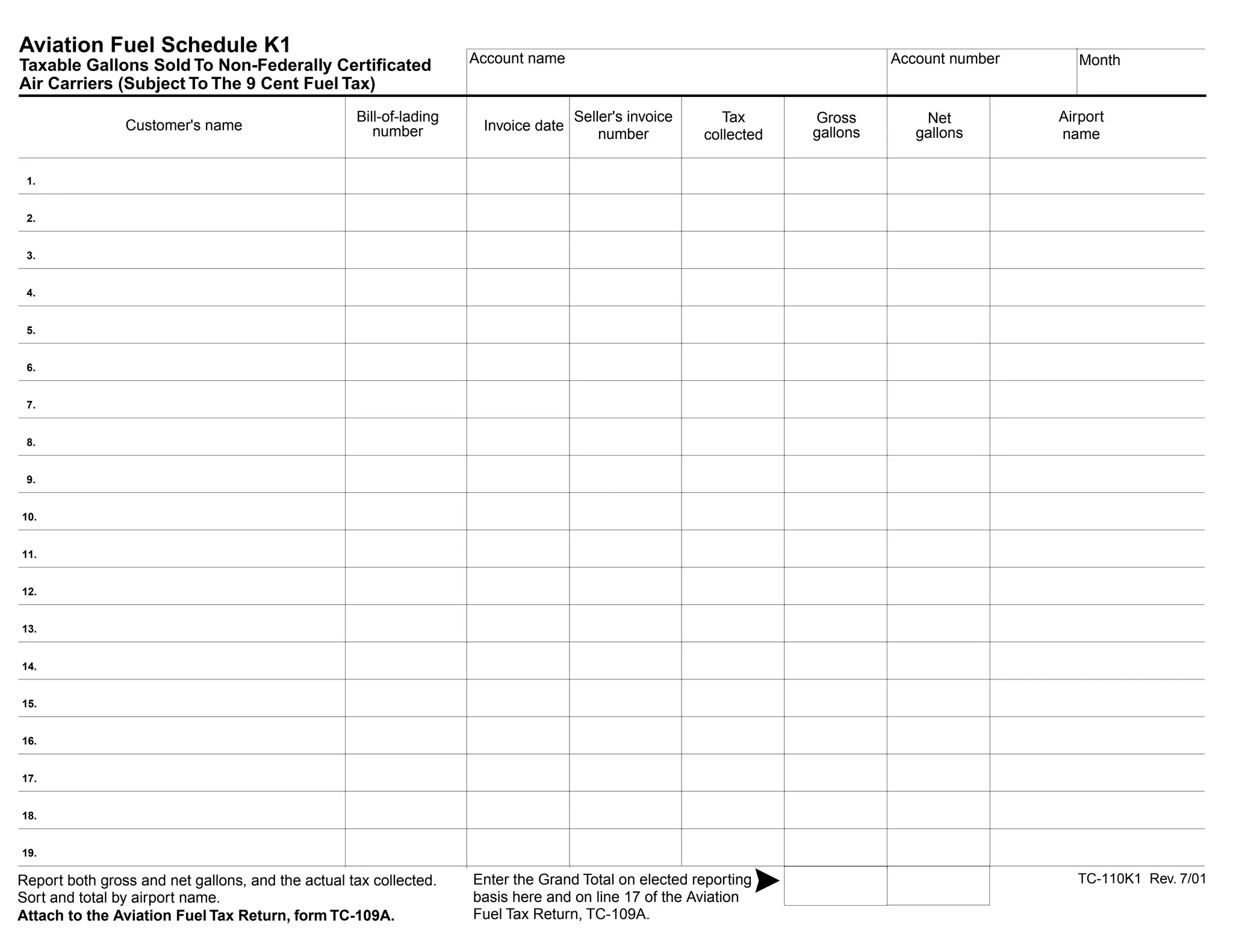

This document appears to be a schedule for reporting aviation fuel sales and taxes in Utah. It provides instructions for licensed Utah airports to report gross and net gallons of fuel sold, as well as taxes collected, on a monthly basis. Aviation fuel sold to certain certificated air carriers is taxed at 4 cents per gallon while all other fuel is taxed at 9 cents per gallon and should be reported on this schedule (TC-110K1) along with the destination airport. Penalties may apply for failing to file complete reporting schedules.