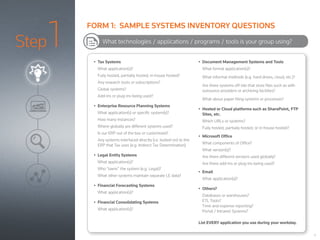

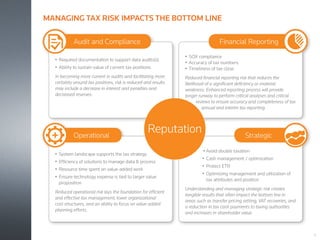

The document outlines a guide for evaluating tax technology, emphasizing the evolving role of tax professionals, termed 'taxologists', who leverage technology to enhance tax operations. It details a four-step approach: assessing processes and technology, mapping relationships, taking a global perspective, and grouping issues to identify patterns. The aim is to empower tax teams to improve efficiency, mitigate risks, and align with broader business objectives by adopting a comprehensive strategy for tax technology management.