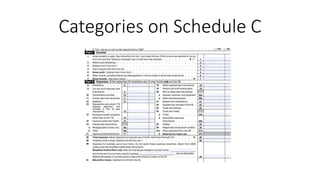

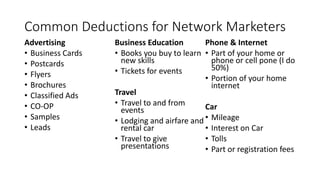

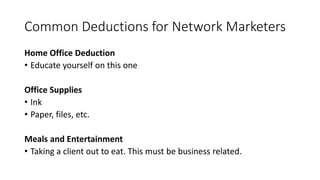

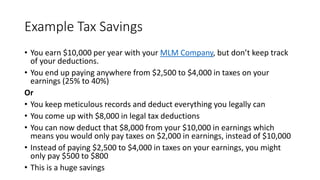

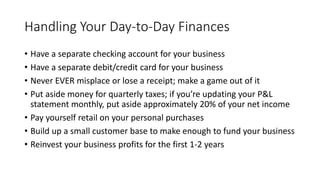

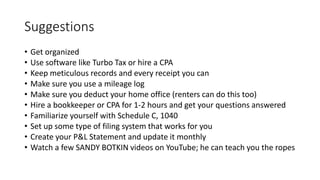

This document provides tips for MLM representatives on organizing their business taxes. It recommends keeping meticulous records of all business expenses and receipts organized by category in a spreadsheet or profit and loss statement. This makes taxes easier at the end of the year. Common deductions include advertising, business education, travel, phone and internet, car expenses, home office, supplies, and meals related to business. Tracking expenses can save thousands in taxes by reducing taxable income. The document provides an example and urges reps to get organized, use tax software, and consult professionals to understand deductions.