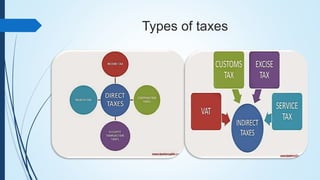

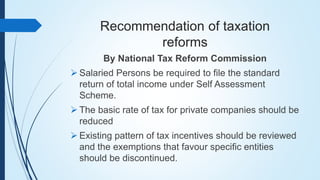

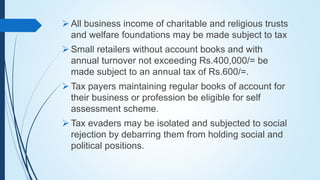

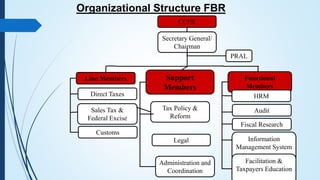

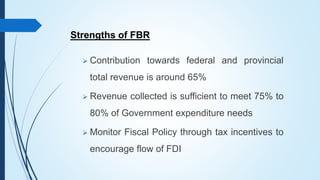

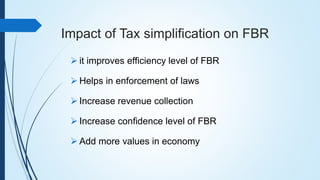

The document discusses tax simplification in Pakistan, outlining its significance, types of taxes, and recommendations for reforming the tax system. It emphasizes the need for clearer rules to combat tax evasion and enhance revenue collection while addressing public perceptions about tax misuse. The Federal Board of Revenue (FBR) is mentioned as the regulatory body focused on improving tax enforcement and efficiency through modern techniques and taxpayer education.