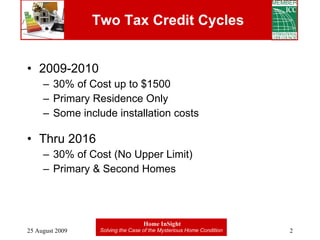

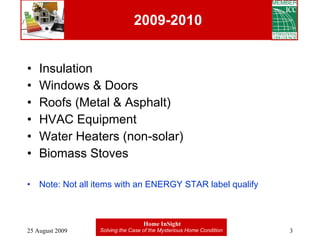

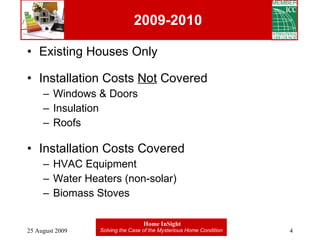

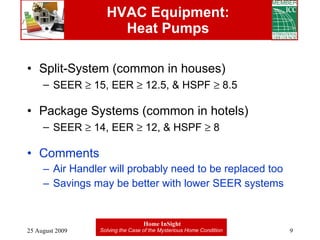

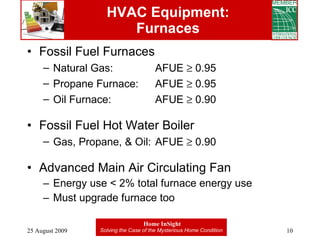

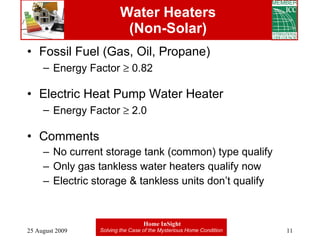

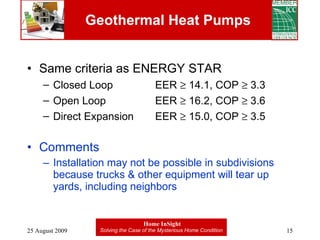

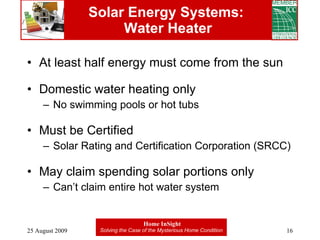

The document summarizes federal tax credits available in the United States for energy efficient home improvements between 2009-2016. It provides details on eligible residential improvements like insulation, windows, doors, HVAC systems, and solar panels. To qualify for tax credits, improvements must meet minimum efficiency standards like SEER ratings and insulation R-values. The tax credits provided 30% of costs up to $1,500 for improvements made from 2009-2010, and 30% of costs with no upper limit for improvements made from 2016 and beyond.