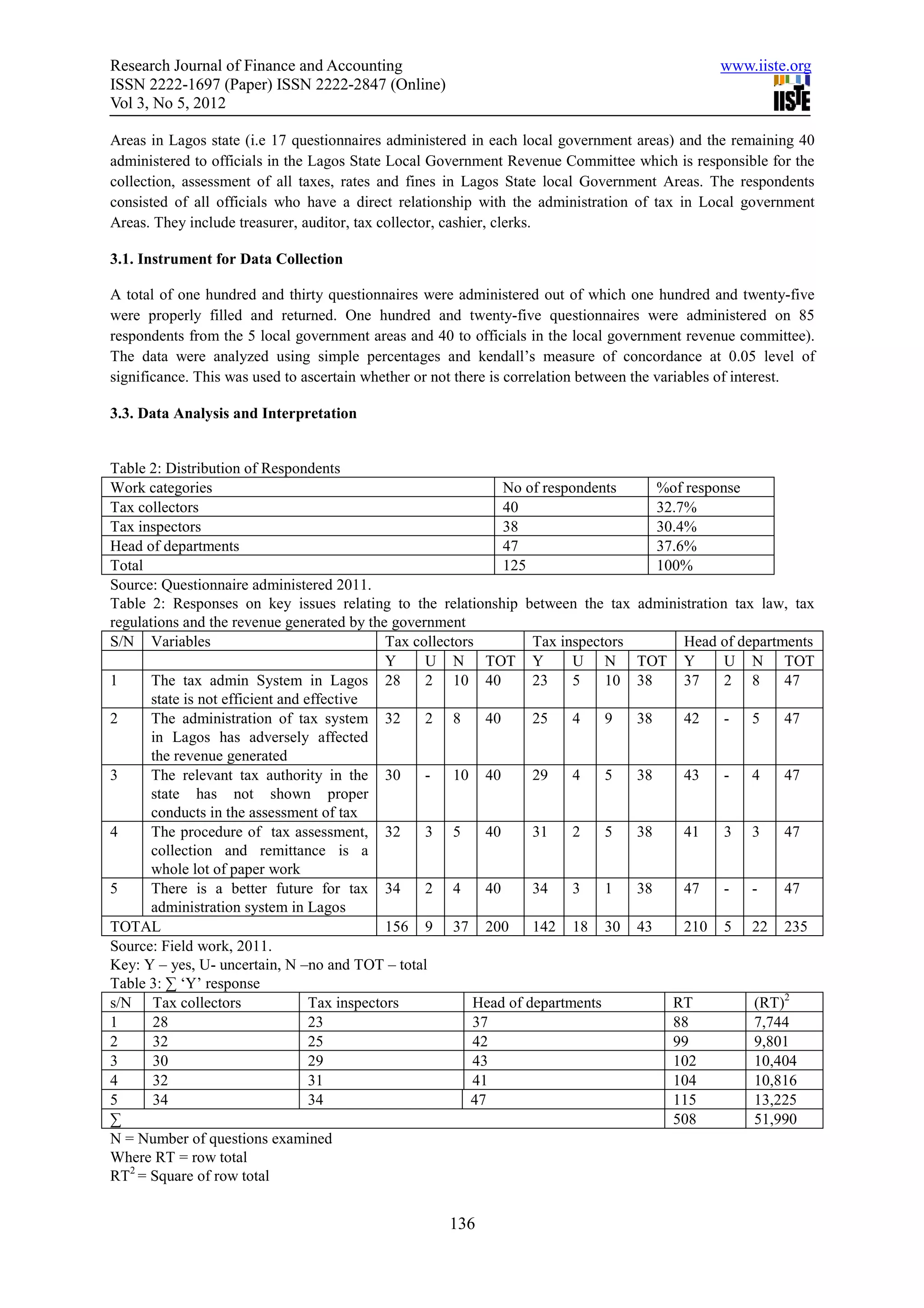

This document summarizes a research study on tax administration and revenue generation in Lagos State, Nigeria. The study examined the effectiveness of tax assessment, collection, and remittance systems. A survey was administered to 130 civil servants involved in tax administration across 5 local government areas. The findings showed that the tax administration system in Lagos State was not totally efficient and that improvements could help boost revenue generation. Specifically, the study found that tax administration impacts the revenue collected by the government and that there is a significant relationship between tax administration policies and laws. The document recommends that Lagos State implement a improved tax system to enhance administration and collections, possibly involving private organizations.