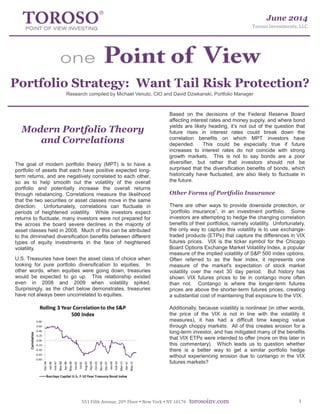

The document discusses portfolio strategy focusing on tail risk protection through diversification using modern portfolio theory (MPT) and correlations. It highlights the challenges in achieving risk mitigation via traditional asset classes, especially during market volatility, and explores alternative strategies like low-volatility investing and the Dow Jones Anti-Beta Index. Additionally, it emphasizes the potential benefits of alternative diversification methods and warns that past performance of asset classes, such as treasuries, may not predict future outcomes.